- Canada

- /

- Electrical

- /

- TSX:ELVA

The one-year returns for Electrovaya's (TSE:ELVA) shareholders have been notable, yet its earnings growth was even better

Electrovaya Inc. (TSE:ELVA) shareholders might be concerned after seeing the share price drop 14% in the last quarter. But looking back over the last year, the returns have actually been rather pleasing! In that time we've seen the stock easily surpass the market return, with a gain of 90%.

After a strong gain in the past week, it's worth seeing if longer term returns have been driven by improving fundamentals.

While Electrovaya made a small profit, in the last year, we think that the market is probably more focussed on the top line growth at the moment. As a general rule, we think this kind of company is more comparable to loss-making stocks, since the actual profit is so low. It would be hard to believe in a more profitable future without growing revenues.

In the last year Electrovaya saw its revenue grow by 11%. That's not a very high growth rate considering it doesn't make profits. In keeping with the revenue growth, the share price gained 90% in that time. That's not a standout result, but it is solid - much like the level of revenue growth. It could be worth keeping an eye on this one, especially if growth accelerates.

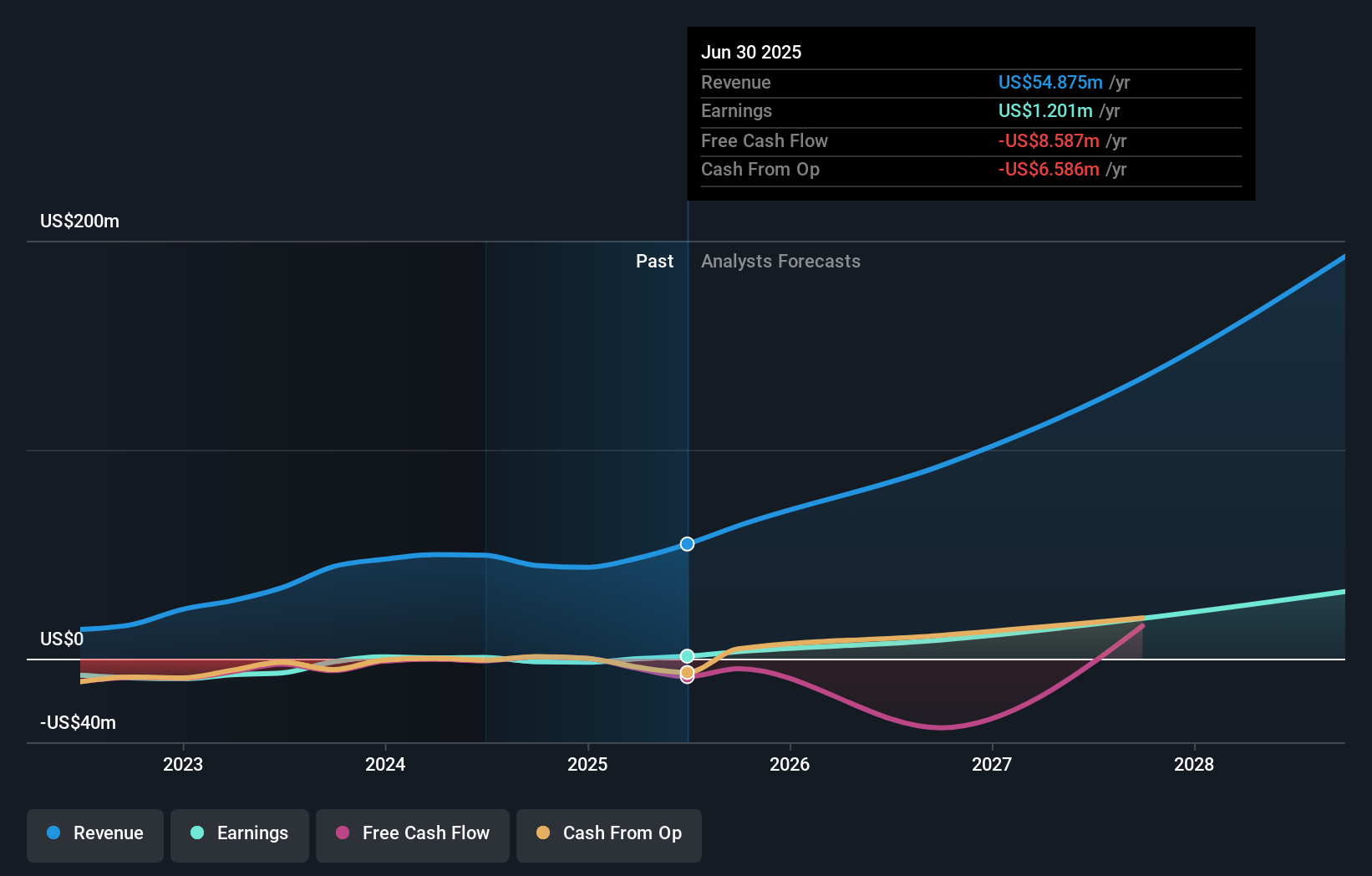

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

We know that Electrovaya has improved its bottom line over the last three years, but what does the future have in store? Take a more thorough look at Electrovaya's financial health with this free report on its balance sheet.

A Different Perspective

It's nice to see that Electrovaya shareholders have received a total shareholder return of 90% over the last year. That's better than the annualised return of 0.7% over half a decade, implying that the company is doing better recently. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. It's always interesting to track share price performance over the longer term. But to understand Electrovaya better, we need to consider many other factors. Take risks, for example - Electrovaya has 3 warning signs we think you should be aware of.

But note: Electrovaya may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Canadian exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Electrovaya might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:ELVA

Electrovaya

Engages in the design, development, manufacture, and sale of lithium-ion batteries, battery management systems, and battery-related products for energy storage, clean electric transportation, and other specialized applications in North America.

High growth potential with proven track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026