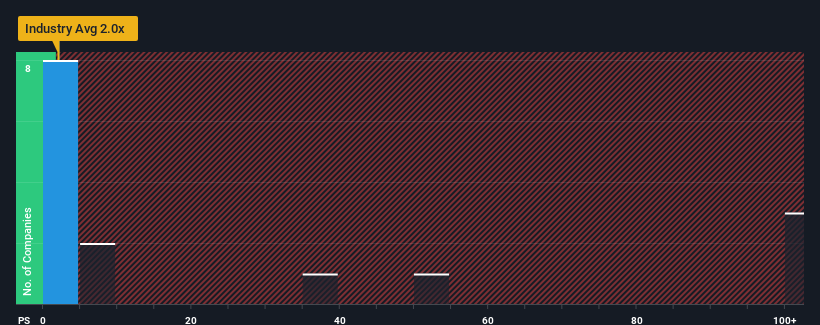

Electrovaya Inc.'s (TSE:ELVA) price-to-sales (or "P/S") ratio of 2.1x might make it look like a strong buy right now compared to the Electrical industry in Canada, where around half of the companies have P/S ratios above 8.9x and even P/S above 101x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/S.

Check out our latest analysis for Electrovaya

What Does Electrovaya's P/S Mean For Shareholders?

With revenue growth that's superior to most other companies of late, Electrovaya has been doing relatively well. It might be that many expect the strong revenue performance to degrade substantially, which has repressed the share price, and thus the P/S ratio. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

Want the full picture on analyst estimates for the company? Then our free report on Electrovaya will help you uncover what's on the horizon.Is There Any Revenue Growth Forecasted For Electrovaya?

The only time you'd be truly comfortable seeing a P/S as depressed as Electrovaya's is when the company's growth is on track to lag the industry decidedly.

If we review the last year of revenue growth, the company posted a terrific increase of 61%. Pleasingly, revenue has also lifted 178% in aggregate from three years ago, thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing revenue over that time.

Turning to the outlook, the next three years should generate growth of 56% per year as estimated by the five analysts watching the company. With the industry only predicted to deliver 47% each year, the company is positioned for a stronger revenue result.

With this information, we find it odd that Electrovaya is trading at a P/S lower than the industry. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Bottom Line On Electrovaya's P/S

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

A look at Electrovaya's revenues reveals that, despite glowing future growth forecasts, its P/S is much lower than we'd expect. There could be some major risk factors that are placing downward pressure on the P/S ratio. While the possibility of the share price plunging seems unlikely due to the high growth forecasted for the company, the market does appear to have some hesitation.

Having said that, be aware Electrovaya is showing 3 warning signs in our investment analysis, you should know about.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Electrovaya might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:ELVA

Electrovaya

Engages in the design, development, manufacture, and sale of lithium-ion batteries, battery management systems, and battery-related products for energy storage, clean electric transportation, and other specialized applications in North America.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives