The Canadian market is navigating a complex landscape of potential tariffs and trade uncertainties, which could introduce new inflationary pressures and affect economic growth. However, the overall economic backdrop remains positive with above-trend growth and low unemployment rates, suggesting opportunities for strategic diversification. For investors interested in smaller or newer companies, penny stocks—despite their somewhat outdated name—continue to present intriguing prospects. In this article, we explore three penny stocks that demonstrate financial strength and offer potential for long-term growth amidst current market conditions.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Alvopetro Energy (TSXV:ALV) | CA$4.85 | CA$177.31M | ★★★★★★ |

| Silvercorp Metals (TSX:SVM) | CA$4.60 | CA$1B | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$4.68 | CA$439.49M | ★★★★★★ |

| Pulse Seismic (TSX:PSD) | CA$2.37 | CA$120.49M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.40 | CA$236.24M | ★★★★★☆ |

| Findev (TSXV:FDI) | CA$0.50 | CA$14.32M | ★★★★★★ |

| PetroTal (TSX:TAL) | CA$0.69 | CA$628.96M | ★★★★★★ |

| NamSys (TSXV:CTZ) | CA$0.97 | CA$26.06M | ★★★★★★ |

| East West Petroleum (TSXV:EW) | CA$0.04 | CA$3.62M | ★★★★★★ |

| DIRTT Environmental Solutions (TSX:DRT) | CA$1.18 | CA$228.22M | ★★★★☆☆ |

Click here to see the full list of 938 stocks from our TSX Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

DIRTT Environmental Solutions (TSX:DRT)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: DIRTT Environmental Solutions Ltd. is a Canadian interior construction company with a market capitalization of CA$228.22 million.

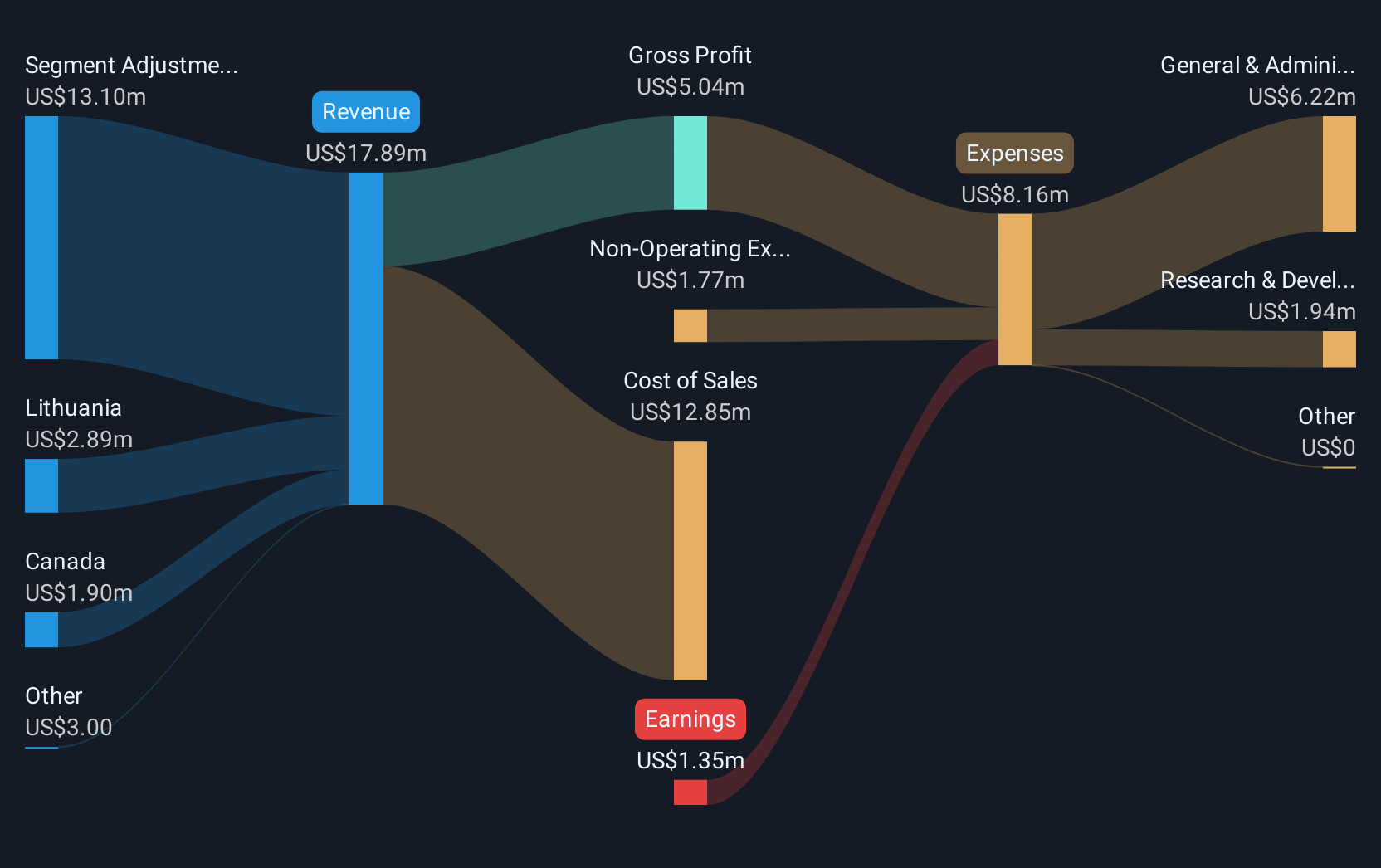

Operations: The company's revenue from the Building Products segment is $176.36 million.

Market Cap: CA$228.22M

DIRTT Environmental Solutions has demonstrated financial resilience by becoming profitable recently, with short-term assets exceeding both long and short-term liabilities, indicating solid liquidity. The company’s debt is well covered by operating cash flow, although its interest coverage remains below optimal levels. A recent share buyback program reflects management's confidence in the company's valuation, aiming to repurchase up to 3.89% of outstanding shares. However, the board's relative inexperience could pose challenges as it navigates future growth strategies. The appointment of Holly Hess Groos brings seasoned financial oversight to the board amidst ongoing organizational changes.

- Jump into the full analysis health report here for a deeper understanding of DIRTT Environmental Solutions.

- Gain insights into DIRTT Environmental Solutions' future direction by reviewing our growth report.

EcoSynthetix (TSX:ECO)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: EcoSynthetix Inc. is a renewable chemicals company that develops and commercializes bio-based technologies as alternatives to synthetic, petrochemical-based adhesives and related products worldwide, with a market cap of CA$277.24 million.

Operations: The company generates revenue of $15.95 million from its Biopolymer Nanosphere Technology Platform.

Market Cap: CA$277.24M

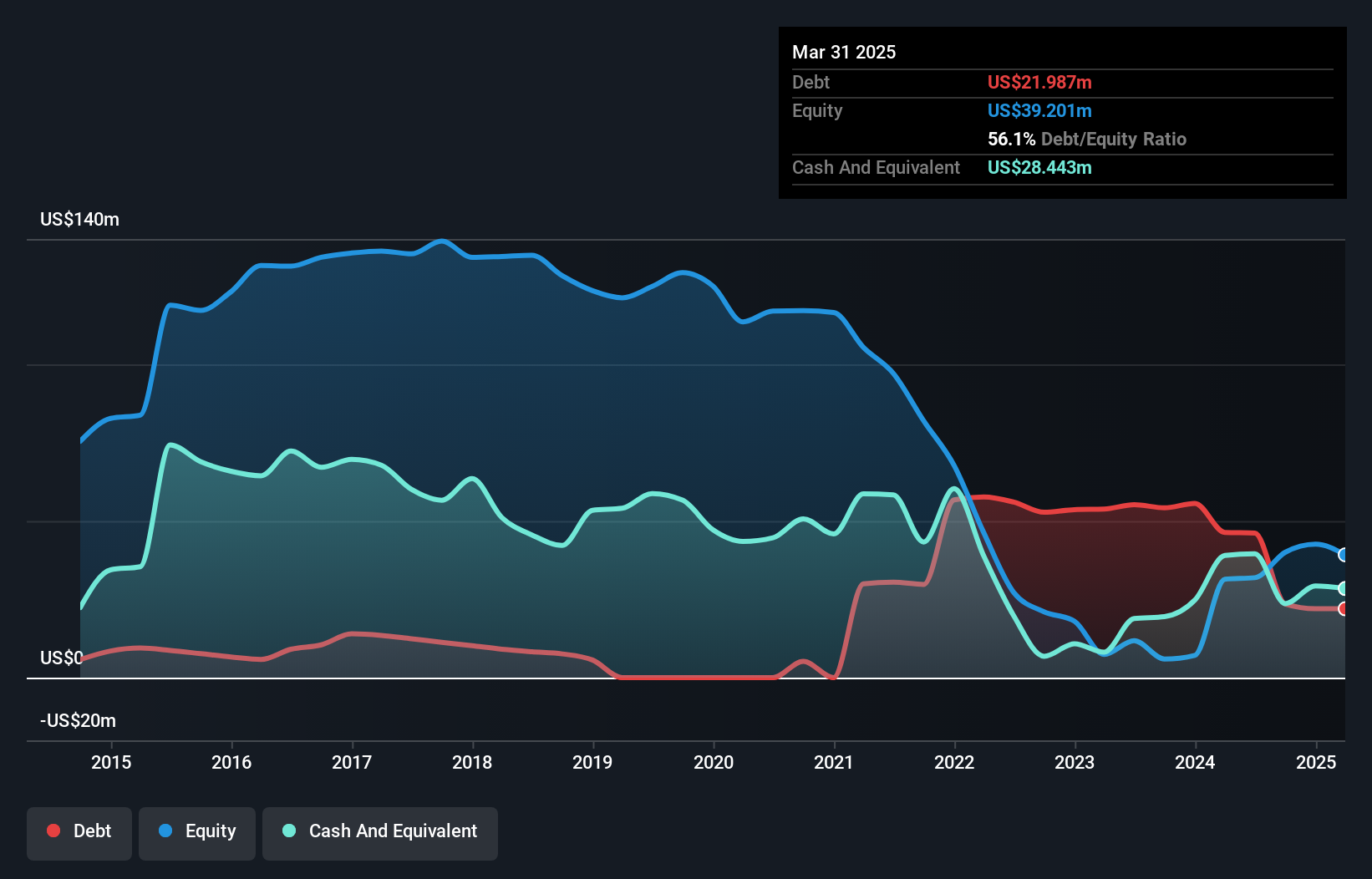

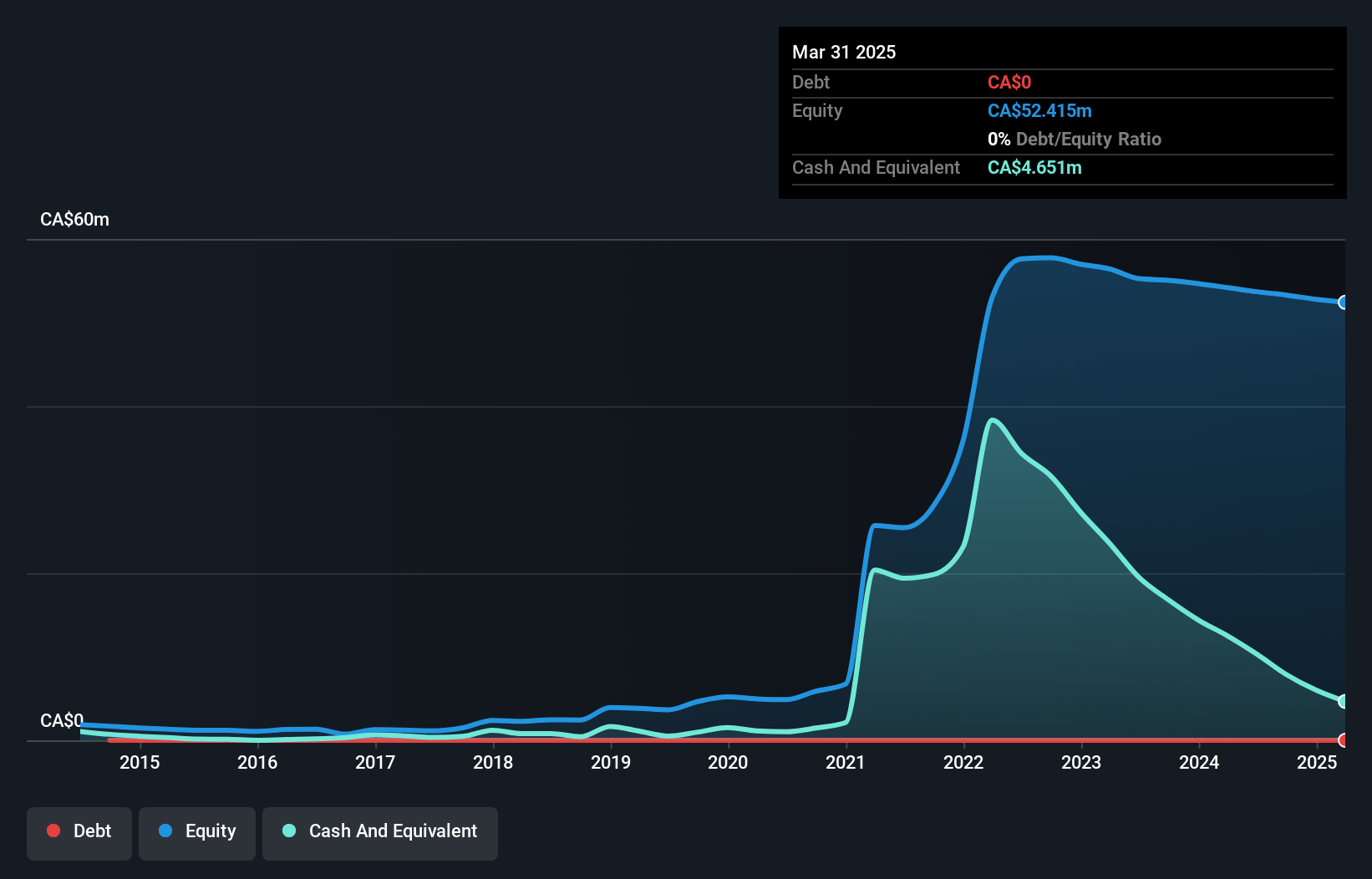

EcoSynthetix Inc., with a market cap of CA$277.24 million, is navigating the challenges typical of penny stocks. Despite generating revenue of $15.95 million from its Biopolymer Nanosphere Technology Platform, the company remains unprofitable, with a negative return on equity (-4.4%) and increasing losses over the past five years at 6.2% annually. Nevertheless, EcoSynthetix benefits from a seasoned management team and board, boasting average tenures of 16.8 and 9.1 years respectively, alongside being debt-free with sufficient cash runway for more than three years based on current free cash flow levels.

- Click here and access our complete financial health analysis report to understand the dynamics of EcoSynthetix.

- Evaluate EcoSynthetix's historical performance by accessing our past performance report.

Century Lithium (TSXV:LCE)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Century Lithium Corp. is an exploration and development stage company focused on acquiring, exploring, evaluating, and developing mineral resource properties in the United States with a market cap of CA$38.87 million.

Operations: Currently, there are no reported revenue segments for the company.

Market Cap: CA$38.87M

Century Lithium Corp., with a market cap of CA$38.87 million, is pre-revenue and currently unprofitable, reflecting the inherent risks of penny stocks. Recent advancements in its Angel Island project include process improvements at its Pilot Plant, shifting focus from R&D to demonstration mode. This strategic move aims to attract potential partners and reduce operational costs. Despite having less than a year of cash runway, Century Lithium remains debt-free with short-term assets exceeding liabilities. The management team and board are experienced, but the company's high share price volatility adds another layer of risk for investors.

- Click to explore a detailed breakdown of our findings in Century Lithium's financial health report.

- Understand Century Lithium's earnings outlook by examining our growth report.

Turning Ideas Into Actions

- Dive into all 938 of the TSX Penny Stocks we have identified here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if EcoSynthetix might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:ECO

EcoSynthetix

A renewable chemicals company, develops and commercializes bio-based technologies that are used as replacement solutions for synthetic, petrochemical-based chemicals, and other related products in the Americas, Europe, the Middle East, Africa, and Asia Pacific.

Flawless balance sheet with weak fundamentals.

Similar Companies

Market Insights

Community Narratives