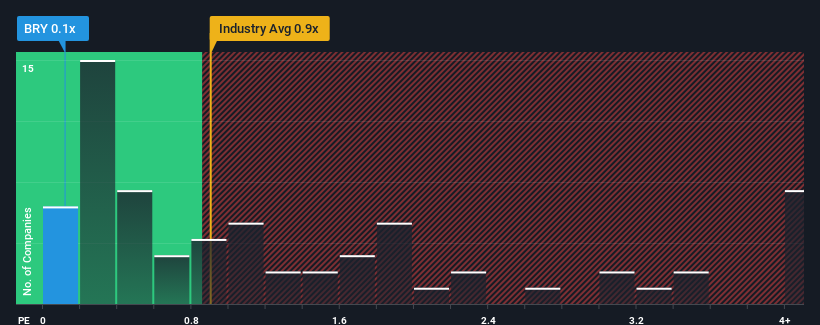

There wouldn't be many who think Bri-Chem Corp.'s (TSE:BRY) price-to-sales (or "P/S") ratio of 0.1x is worth a mention when the median P/S for the Trade Distributors industry in Canada is similar at about 0.6x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

See our latest analysis for Bri-Chem

What Does Bri-Chem's Recent Performance Look Like?

Revenue has risen firmly for Bri-Chem recently, which is pleasing to see. One possibility is that the P/S is moderate because investors think this respectable revenue growth might not be enough to outperform the broader industry in the near future. Those who are bullish on Bri-Chem will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Bri-Chem's earnings, revenue and cash flow.Do Revenue Forecasts Match The P/S Ratio?

Bri-Chem's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 28%. The strong recent performance means it was also able to grow revenue by 51% in total over the last three years. So we can start by confirming that the company has done a great job of growing revenue over that time.

Weighing the recent medium-term upward revenue trajectory against the broader industry's one-year forecast for contraction of 0.8% shows it's a great look while it lasts.

In light of this, it's peculiar that Bri-Chem's P/S sits in line with the majority of other companies. Apparently some shareholders believe the recent performance is at its limits and have been accepting lower selling prices.

What Does Bri-Chem's P/S Mean For Investors?

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

As mentioned previously, Bri-Chem currently trades on a P/S on par with the wider industry, but this is lower than expected considering its recent three-year revenue growth is beating forecasts for a struggling industry. When we see a history of positive growth in a struggling industry, but only an average P/S, we assume potential risks are what might be placing pressure on the P/S ratio. One major risk is whether its revenue trajectory can keep outperforming under these tough industry conditions. It appears some are indeed anticipating revenue instability, because this relative performance should normally provide a boost to the share price.

It is also worth noting that we have found 5 warning signs for Bri-Chem (2 are a bit unpleasant!) that you need to take into consideration.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Bri-Chem might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:BRY

Bri-Chem

Engages in the wholesale distribution of oilfield chemicals for the oil and gas industry in North America.

Excellent balance sheet and good value.