- Canada

- /

- Construction

- /

- TSX:BDT

Bird Construction (TSX:BDT) Is Up 5.8% After Landing Ontario Hospital Project Win Has The Bull Case Changed?

Reviewed by Sasha Jovanovic

- Infrastructure Ontario recently announced that Bird Construction has been named the Preferred Proponent to design and build a major hospital project in Ontario, with the project utilizing a collaborative contracting model and target price.

- This selection marks a significant potential contract win for Bird Construction, highlighting the company's growing profile in large-scale infrastructure developments in Canada.

- We'll now examine how this major hospital project win could influence Bird Construction’s investment narrative and future growth prospects.

The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Bird Construction Investment Narrative Recap

To be a Bird Construction shareholder, you need to believe in long-term government infrastructure spending as a driver for backlog growth and margin recovery, even as economic uncertainty creates near-term volatility. The recent hospital project win in Ontario supports backlog and visibility, but project execution delays remain the key short-term risk, especially with higher fixed costs already built into the business. Taken together, the news bolsters confidence in Bird’s pipeline, yet it does not guarantee insulation from sector slowdowns.

Bird’s May 21 announcement of over CA$525 million in new project awards, including the transportation science hub in Ottawa and a seniors housing project in Edmonton, further demonstrates its exposure to large collaborative contracts. This ties directly to Bird’s principal catalysts: the shift toward multi-year, government-backed projects, which underpin future earnings visibility while continuing to expose the company to delays stemming from client decision-making and macro cycles.

However, investors should be aware that if macroeconomic uncertainty continues or is prolonged, large-scale project pushouts or cancellations could…

Read the full narrative on Bird Construction (it's free!)

Bird Construction's outlook projects CA$4.6 billion in revenue and CA$257.8 million in earnings by 2028. This implies a 10.6% annual revenue growth and a CA$159.4 million increase in earnings from the current CA$98.4 million.

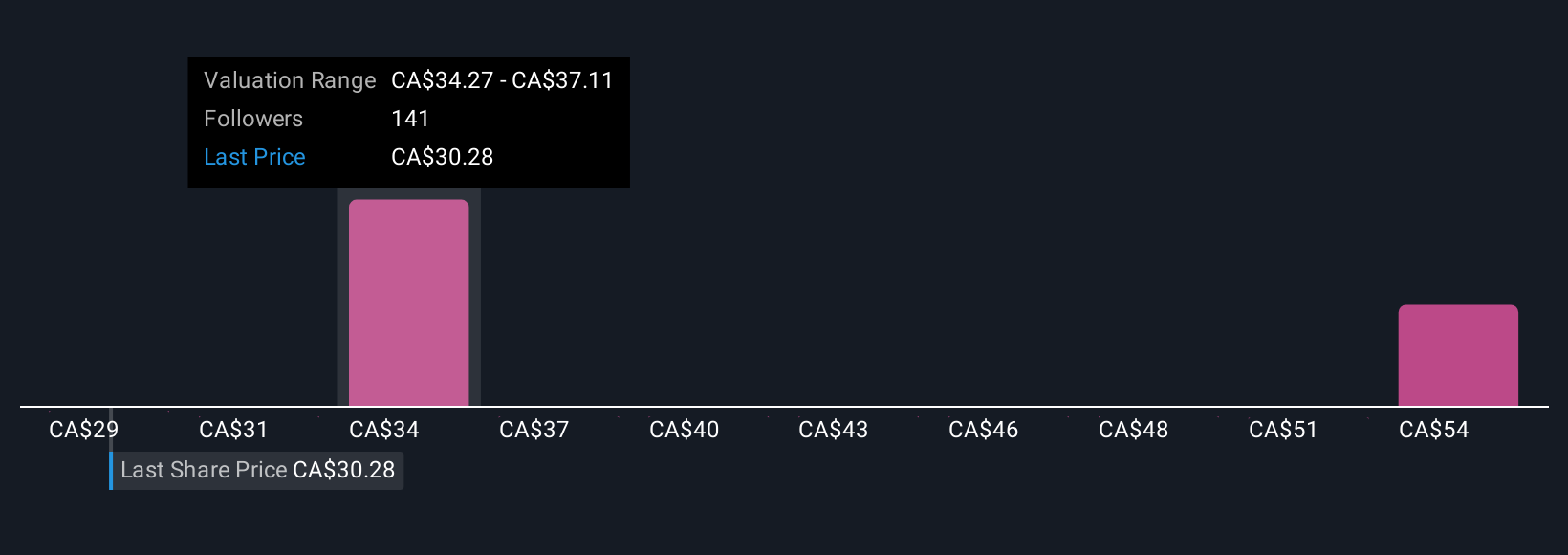

Uncover how Bird Construction's forecasts yield a CA$34.31 fair value, a 10% upside to its current price.

Exploring Other Perspectives

Thirteen members of the Simply Wall St Community put Bird Construction’s fair value between CA$28.60 and CA$56.88. Some focus on multi-year government contracts as a catalyst for steady growth, prompting wide differences in company outlooks.

Explore 13 other fair value estimates on Bird Construction - why the stock might be worth as much as 82% more than the current price!

Build Your Own Bird Construction Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Bird Construction research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Bird Construction research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Bird Construction's overall financial health at a glance.

Looking For Alternative Opportunities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 34 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bird Construction might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:BDT

Flawless balance sheet, undervalued and pays a dividend.

Market Insights

Community Narratives