- Canada

- /

- Aerospace & Defense

- /

- TSX:BBD.B

Investors in Bombardier (TSE:BBD.B) have unfortunately lost 49% over the last three years

For many investors, the main point of stock picking is to generate higher returns than the overall market. But the risk of stock picking is that you will likely buy under-performing companies. Unfortunately, that's been the case for longer term Bombardier Inc. (TSE:BBD.B) shareholders, since the share price is down 49% in the last three years, falling well short of the market return of around 46%. The falls have accelerated recently, with the share price down 20% in the last three months.

So let's have a look and see if the longer term performance of the company has been in line with the underlying business' progress.

View our latest analysis for Bombardier

Bombardier isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. When a company doesn't make profits, we'd generally expect to see good revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

Over the last three years, Bombardier's revenue dropped 35% per year. That's definitely a weaker result than most pre-profit companies report. With revenue in decline, the share price decline of 14% per year is hardly undeserved. The key question now is whether the company has the capacity to fund itself to profitability, without more cash. The company will need to return to revenue growth as quickly as possible, if it wants to see some enthusiasm from investors.

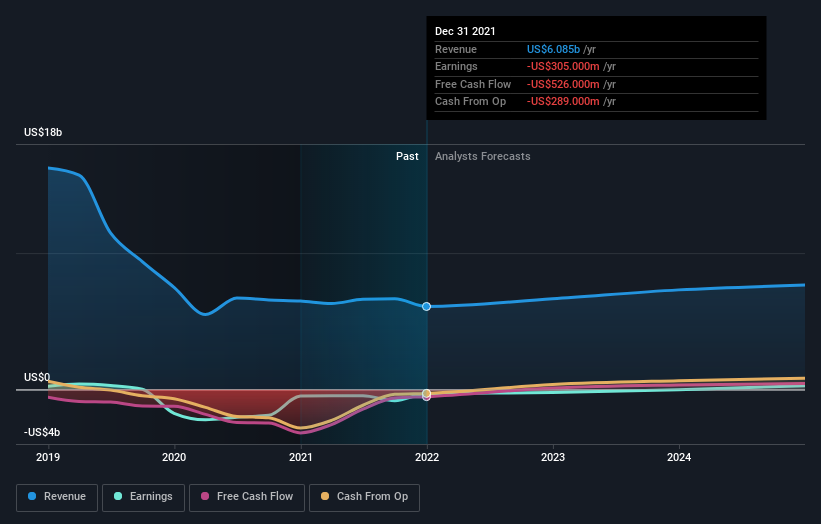

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

We consider it positive that insiders have made significant purchases in the last year. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. If you are thinking of buying or selling Bombardier stock, you should check out this free report showing analyst profit forecasts.

A Different Perspective

We're pleased to report that Bombardier shareholders have received a total shareholder return of 45% over one year. That certainly beats the loss of about 7% per year over the last half decade. This makes us a little wary, but the business might have turned around its fortunes. It's always interesting to track share price performance over the longer term. But to understand Bombardier better, we need to consider many other factors. For example, we've discovered 2 warning signs for Bombardier (1 is potentially serious!) that you should be aware of before investing here.

Bombardier is not the only stock that insiders are buying. For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Bombardier might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:BBD.B

Bombardier

Engages in the design, manufacture, and sale of business aircraft and aircraft structural components worldwide.

Reasonable growth potential slight.

Similar Companies

Market Insights

Community Narratives