- Canada

- /

- Aerospace & Defense

- /

- TSX:BBD.B

Bombardier’s Expanding Abu Dhabi Aftermarket Hub Might Change The Case For Investing In Bombardier (TSX:BBD.B)

Reviewed by Sasha Jovanovic

- Bombardier recently reported major construction progress on its new 120,000 sq. ft. service centre at Abu Dhabi’s Al Bateen Executive Airport, part of a broader global expansion that now includes new U.S. capacity in Fort Wayne and an added paint shop at London-Biggin Hill.

- This build-out of maintenance, repair, and overhaul infrastructure is central to Bombardier’s push to grow higher-margin aftermarket revenues and deepen support for its Global, Challenger, and Learjet fleets, including the upcoming Global 8000.

- We’ll now examine how Bombardier’s expanding Abu Dhabi service centre footprint could influence its investment narrative and aftermarket growth outlook.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Bombardier Investment Narrative Recap

To own Bombardier, you generally have to believe that its focus on business jets and higher-margin aftermarket and defense work can offset sector cyclicality and balance sheet pressure. The Abu Dhabi service centre progress supports the key short term catalyst of expanding service capacity, but its financial impact before opening in 2026 appears limited, while exposure to any downturn in business jet demand remains a central risk.

National Bank of Canada’s recent target price increase for Bombardier, tied to its 2027 outlook and demand for business jets and defense aircraft, connects directly to the same themes behind the Abu Dhabi build-out: a larger installed fleet, more service touchpoints, and potential margin uplift from aftermarket and defense programs if current order strength holds.

But while expansion is encouraging, investors should also be aware that Bombardier’s heavy reliance on the cyclical business jet segment...

Read the full narrative on Bombardier (it's free!)

Bombardier's narrative projects $10.2 billion revenue and $980.5 million earnings by 2028. This requires 5.4% yearly revenue growth and a $531.5 million earnings increase from $449.0 million today.

Uncover how Bombardier's forecasts yield a CA$217.12 fair value, a 5% downside to its current price.

Exploring Other Perspectives

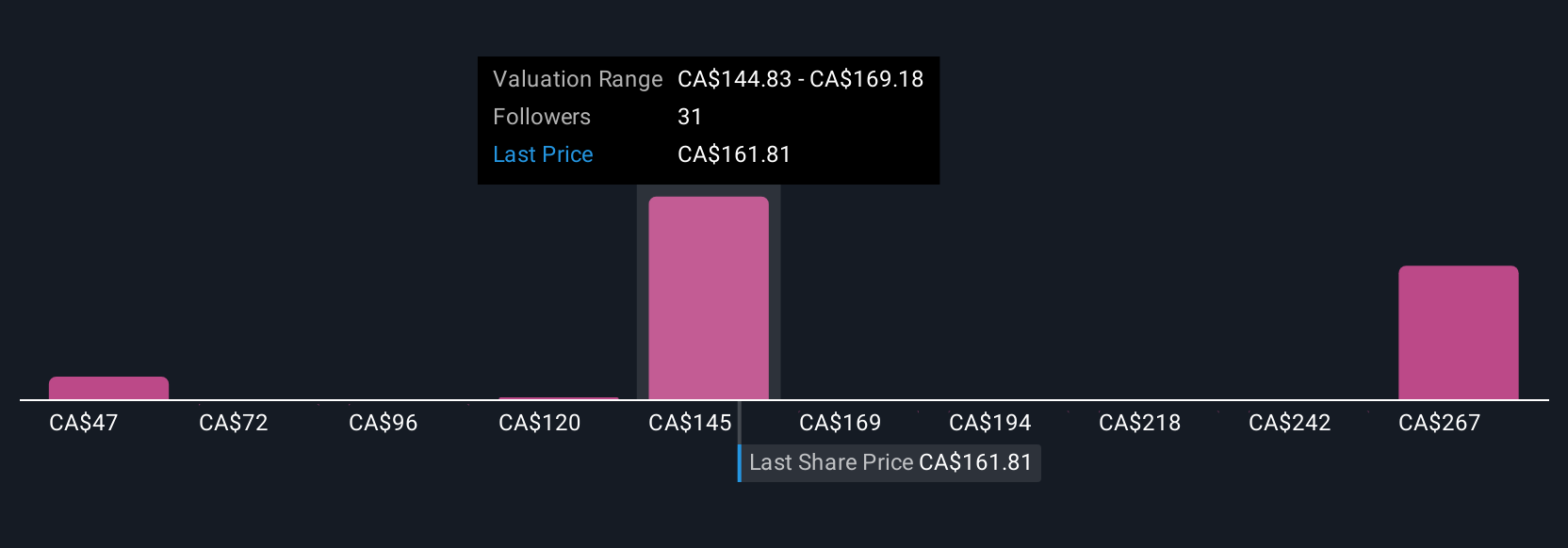

Eleven fair value estimates from the Simply Wall St Community range widely, from about C$47 to C$346 per share, showing sharply different expectations. Set against Bombardier’s push into higher-margin global service centres, this spread underlines why you may want to compare several viewpoints before judging how durable its earnings power could be.

Explore 11 other fair value estimates on Bombardier - why the stock might be worth as much as 52% more than the current price!

Build Your Own Bombardier Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Bombardier research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Bombardier research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Bombardier's overall financial health at a glance.

No Opportunity In Bombardier?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bombardier might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:BBD.B

Bombardier

Engages in the design, manufacture, and sale of business aircraft and aircraft structural components worldwide.

Moderate growth potential with low risk.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026