- Canada

- /

- Aerospace & Defense

- /

- TSX:BBD.B

Bombardier (TSX:BBD.B) Valuation in Focus as Global 7500 Hits 150 Speed Records and 200 Deliveries

Reviewed by Kshitija Bhandaru

Bombardier (TSX:BBD.B) has caught investor attention after its Global 7500 business jet was recognized for achieving its 150th speed record, with customer deliveries now topping 200 aircraft. This milestone is a noteworthy signal of sustained demand.

See our latest analysis for Bombardier.

Between the rollout of its new manufacturing facility and anticipation surrounding the Global 8000, Bombardier has given investors plenty to watch. Even so, the share price has only edged slightly higher in 2024, with a modest 1-year total shareholder return of just under 1%. In the longer term, patient investors have seen a cumulative 22% return over five years, suggesting gradual but persistent momentum rather than sudden surges.

If the latest business jet milestones have you rethinking what’s possible, it might be the perfect moment to discover See the full list for free.

With Bombardier’s robust growth and a new wave of innovation on display, the real question for investors is whether shares are still trading below their true worth or if the market has already factored in tomorrow’s potential.

Most Popular Narrative: 11% Overvalued

Bombardier’s most followed narrative points to a fair value that sits notably below the last close, suggesting the market may be pricing in aggressive growth and margin expansion for the years ahead.

Ongoing innovation and introduction of next-generation models (for example, the Global 8000 with higher pricing and margins, plus retrofit upgrades for the 7500 fleet) position Bombardier to capture industry demand for technologically advanced and environmentally progressive aircraft. This enhances margins and supports premium pricing.

What exactly is powering this lofty price? The secret lies in assumptions about recurring revenue streams and the future profit margins that only a handful of aerospace firms aim to achieve. Curious how analysts connect these upgrades to a premium valuation? You might be surprised by the financial calculus at the heart of this case.

Result: Fair Value of $180.73 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent supply chain headwinds or a downturn in business jet demand could quickly challenge the optimism that supports Bombardier’s premium valuation case.

Find out about the key risks to this Bombardier narrative.

Another View: Discounted Cash Flow Tells a Different Story

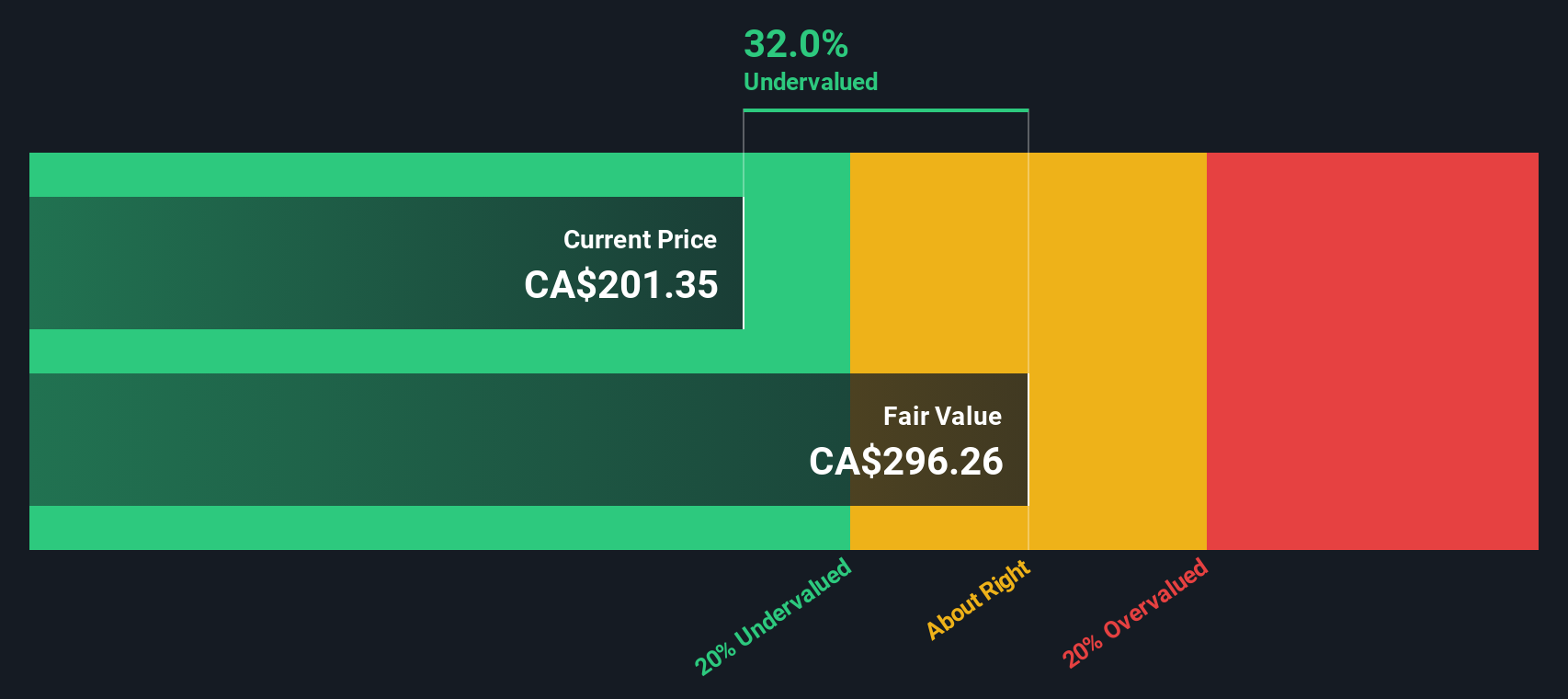

While analyst price targets suggest Bombardier is overvalued based on earnings expectations and industry multiples, our DCF model comes to a much different conclusion. Using future cash flows, the SWS DCF model estimates Bombardier is actually trading about 32% below its fair value. This hints at unrealized potential that analyst consensus might be missing. Could this discrepancy signal an opportunity, or is the market wary for a reason?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Bombardier Narrative

If you see things differently or trust your own analysis more, you can dig into the numbers and shape your own perspective in just a few minutes. Do it your way

A great starting point for your Bombardier research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors know that opportunities often hide in plain sight, waiting to be acted on. Make your next move count by targeting strategies that align with your goals. Don’t let the best stocks slip through your fingers.

- Capitalize on strong cash flow potential by reviewing these 896 undervalued stocks based on cash flows for companies trading below what their fundamentals suggest.

- Secure steady income and growth potential by checking out these 19 dividend stocks with yields > 3% that offer robust yields and a history of reliable payments.

- Lead the way in breakthrough innovation by evaluating these 24 AI penny stocks powering advances in artificial intelligence and automation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bombardier might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:BBD.B

Bombardier

Engages in the design, manufacture, and sale of business aircraft and aircraft structural components worldwide.

Undervalued with proven track record.

Similar Companies

Market Insights

Community Narratives