Here's Why We Think ATS (TSE:ATS) Might Deserve Your Attention Today

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like ATS (TSE:ATS). While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

View our latest analysis for ATS

How Quickly Is ATS Increasing Earnings Per Share?

The market is a voting machine in the short term, but a weighing machine in the long term, so you'd expect share price to follow earnings per share (EPS) outcomes eventually. That means EPS growth is considered a real positive by most successful long-term investors. To the delight of shareholders, ATS has achieved impressive annual EPS growth of 42%, compound, over the last three years. That sort of growth rarely ever lasts long, but it is well worth paying attention to when it happens.

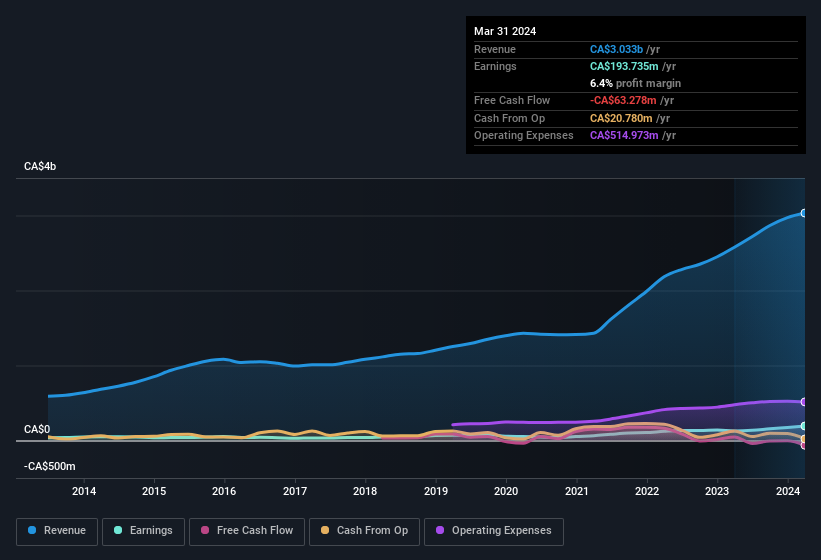

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. EBIT margins for ATS remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 18% to CA$3.0b. That's encouraging news for the company!

In the chart below, you can see how the company has grown earnings and revenue, over time. To see the actual numbers, click on the chart.

The trick, as an investor, is to find companies that are going to perform well in the future, not just in the past. While crystal balls don't exist, you can check our visualization of consensus analyst forecasts for ATS' future EPS 100% free.

Are ATS Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

We note that ATS insiders spent CA$174k on stock, over the last year; in contrast, we didn't see any selling. This is a good look for the company as it paints an optimistic picture for the future. We also note that it was the company insider, Cleland Fiona, who made the biggest single acquisition, paying CA$139k for shares at about CA$63.79 each.

The good news, alongside the insider buying, for ATS bulls is that insiders (collectively) have a meaningful investment in the stock. Indeed, they hold CA$27m worth of its stock. That shows significant buy-in, and may indicate conviction in the business strategy. While their ownership only accounts for 0.6%, this is still a considerable amount at stake to encourage the business to maintain a strategy that will deliver value to shareholders.

Is ATS Worth Keeping An Eye On?

ATS' earnings per share have been soaring, with growth rates sky high. Just as heartening; insiders both own and are buying more stock. This quick rundown suggests that the business may be of good quality, and also at an inflection point, so maybe ATS deserves timely attention. It is worth noting though that we have found 1 warning sign for ATS that you need to take into consideration.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of ATS, you'll probably love this curated collection of companies in CA that have an attractive valuation alongside insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:ATS

Undervalued with reasonable growth potential.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.