- Canada

- /

- Construction

- /

- TSX:ARE

Three TSX Dividend Stocks Offering Yields From 3.9% To 5.5%

Reviewed by Simply Wall St

As the global economy navigates through a phase where artificial intelligence and technology sectors show signs of volatility yet promise for long-term growth, investors might consider the stability offered by dividend stocks. In the context of a broadening market leadership and ongoing bull market trends, dividend-paying stocks represent an appealing option for those looking to diversify their portfolios and tap into steady income streams amidst fluctuating market conditions.

Top 10 Dividend Stocks In Canada

| Name | Dividend Yield | Dividend Rating |

| Bank of Nova Scotia (TSX:BNS) | 6.50% | ★★★★★★ |

| Whitecap Resources (TSX:WCP) | 7.05% | ★★★★★★ |

| Power Corporation of Canada (TSX:POW) | 5.59% | ★★★★★☆ |

| Enghouse Systems (TSX:ENGH) | 3.61% | ★★★★★☆ |

| Secure Energy Services (TSX:SES) | 3.51% | ★★★★★☆ |

| Boston Pizza Royalties Income Fund (TSX:BPF.UN) | 8.61% | ★★★★★☆ |

| Russel Metals (TSX:RUS) | 4.32% | ★★★★★☆ |

| Canadian Natural Resources (TSX:CNQ) | 4.01% | ★★★★★☆ |

| Royal Bank of Canada (TSX:RY) | 3.84% | ★★★★★☆ |

| Sun Life Financial (TSX:SLF) | 4.65% | ★★★★★☆ |

Click here to see the full list of 31 stocks from our Top TSX Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

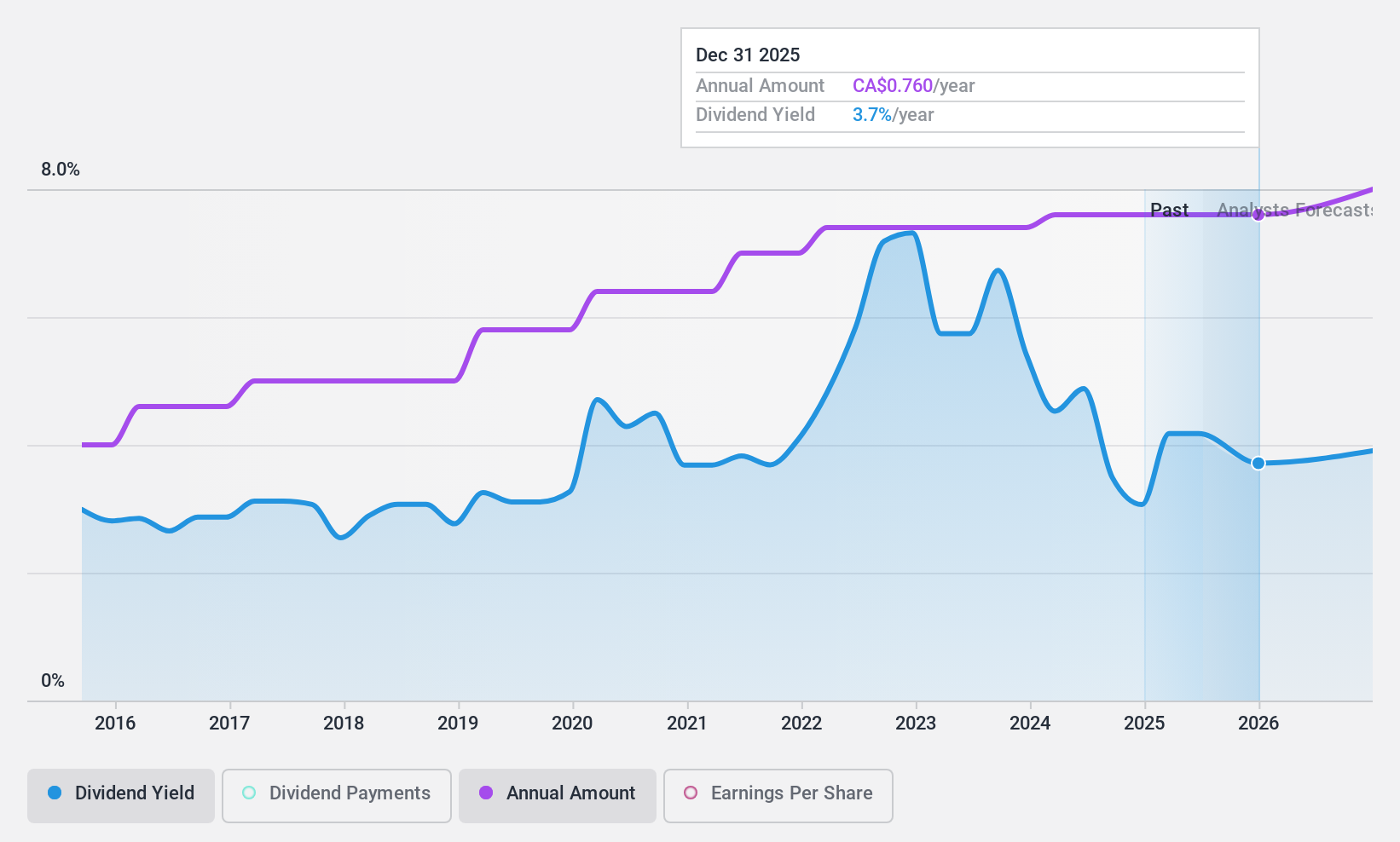

Aecon Group (TSX:ARE)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Aecon Group Inc. operates as a construction and infrastructure development company serving private and public sector clients in Canada, the United States, and internationally, with a market cap of approximately CA$1.05 billion.

Operations: Aecon Group Inc. generates revenue primarily through its Concessions and Construction segments, with CA$59.50 million from Concessions and CA$4.33 billion from Construction.

Dividend Yield: 4.5%

Aecon Group Inc. reported a significant earnings growth of 330.4% last year, showcasing robust financial health despite a challenging market environment. However, its dividend yield at 4.49% remains below the top Canadian payers and is poorly backed by cash flows with a high payout ratio of 4232.8%. While the dividends have been stable over ten years and recently increased to CAD$0.19 per share, future sustainability is questionable as earnings are projected to decline annually by 21.5% over the next three years.

- Get an in-depth perspective on Aecon Group's performance by reading our dividend report here.

- Insights from our recent valuation report point to the potential undervaluation of Aecon Group shares in the market.

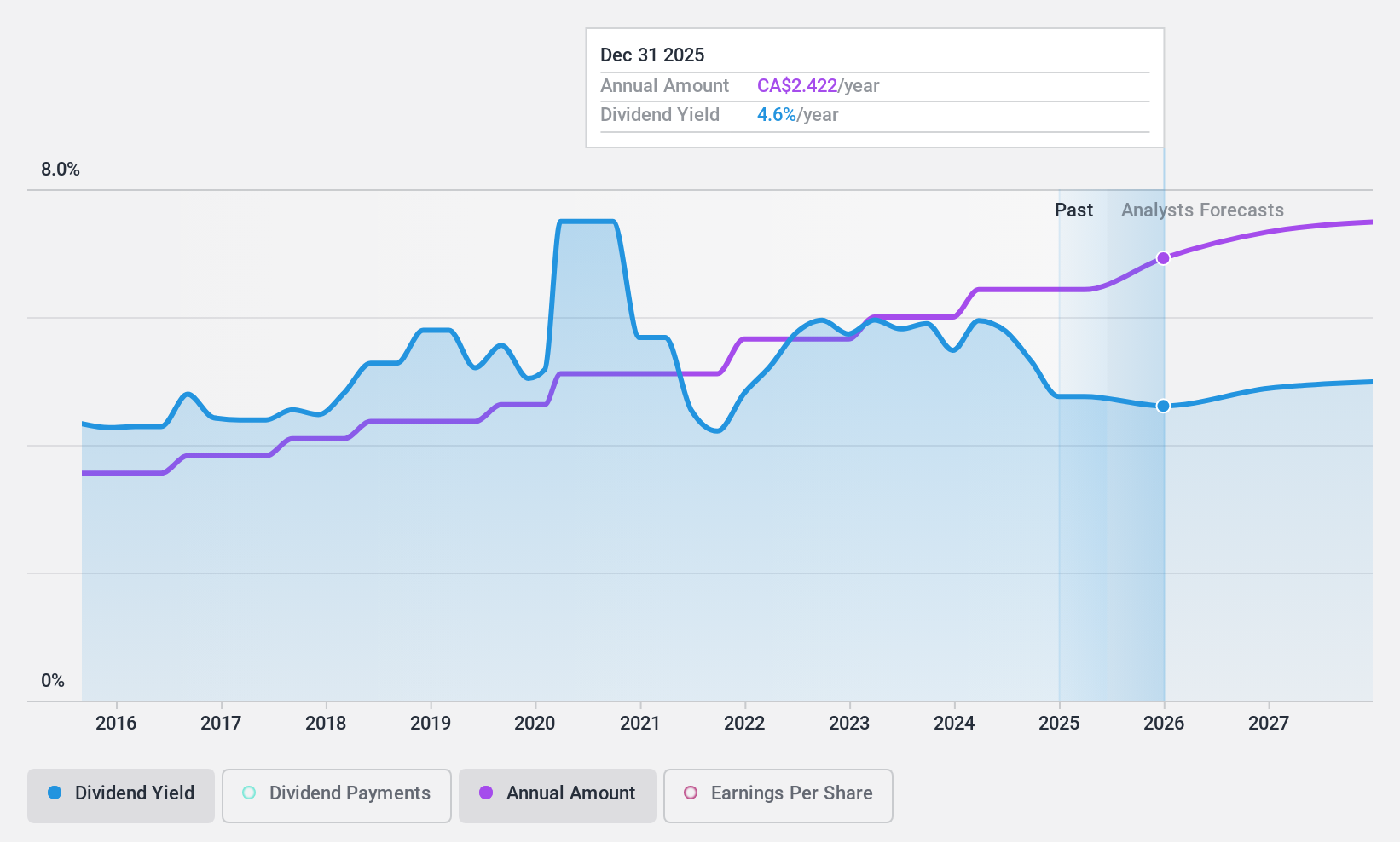

Power Corporation of Canada (TSX:POW)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Power Corporation of Canada, an international management and holding company, operates in the financial services sector across North America, Europe, and Asia with a market capitalization of CA$26.21 billion.

Operations: Power Corporation of Canada generates revenue primarily through its segments: Lifeco with CA$23.51 billion, Power Financial - IGM at CA$3.67 billion, and Alternative Asset Investment Platforms and Other contributing CA$1.59 billion.

Dividend Yield: 5.6%

Power Corporation of Canada has demonstrated a stable dividend history with a 10-year track record of reliable and growing payouts, supported by a payout ratio of 49.9% and cash flow coverage at 28.4%. Despite this, its dividend yield of 5.59% is below the top quartile in the Canadian market. Recent earnings growth was notable, jumping to CAD$722 million in Q1 2024 from CAD$326 million year-over-year, reflecting strong financial performance. However, shareholder proposals on ESG and compensation alignment were rejected at recent meetings, indicating potential governance concerns that could influence investor sentiment.

- Unlock comprehensive insights into our analysis of Power Corporation of Canada stock in this dividend report.

- Our expertly prepared valuation report Power Corporation of Canada implies its share price may be lower than expected.

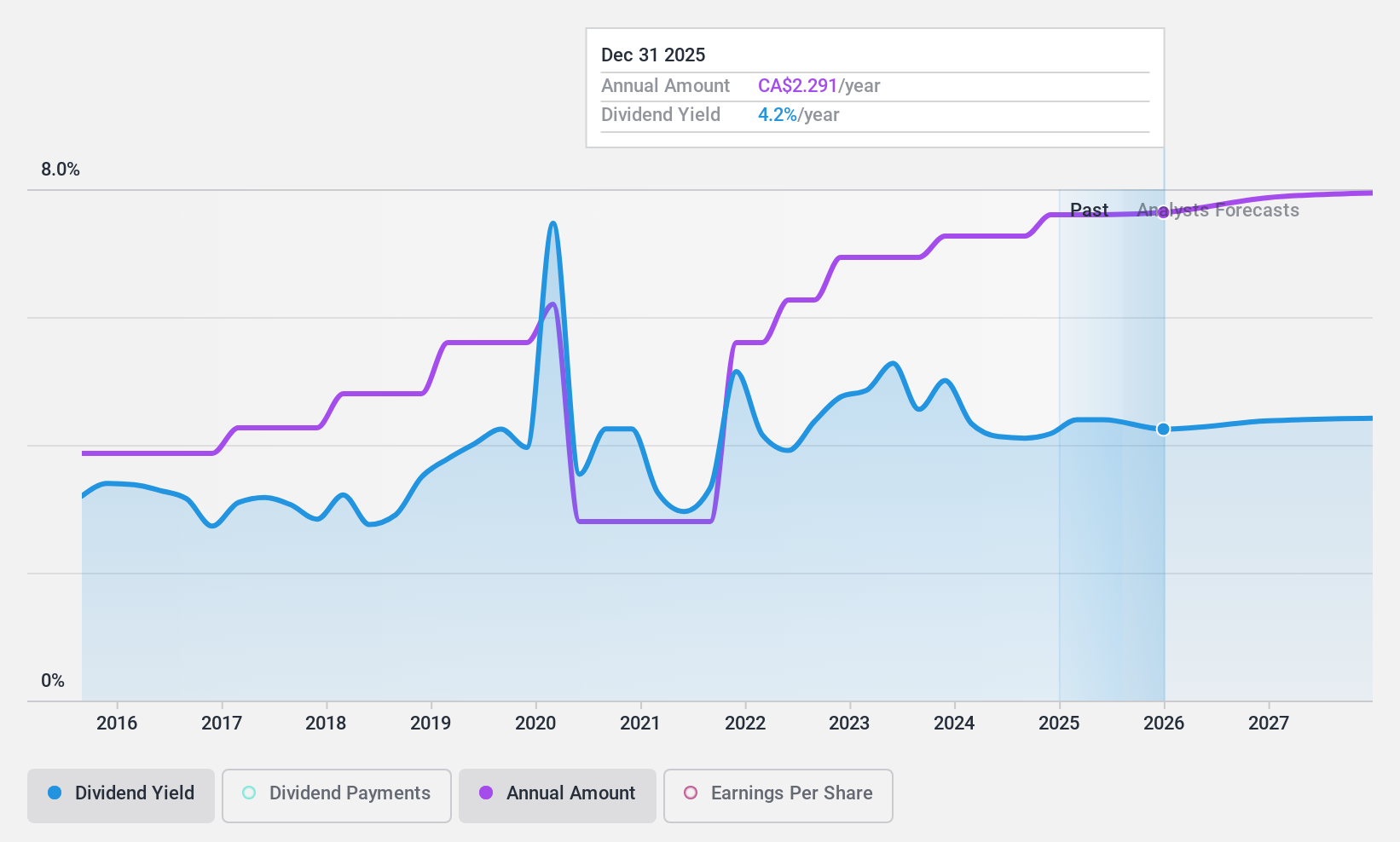

Suncor Energy (TSX:SU)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Suncor Energy Inc. is an integrated energy company with operations in Canada, the United States, and internationally, boasting a market capitalization of approximately CA$70.80 billion.

Operations: Suncor Energy's revenue is primarily derived from its Oil Sands segment, generating CA$23.76 billion, and its Refining and Marketing operations, which produced CA$31.51 billion, alongside a contribution of CA$2.17 billion from Exploration and Production.

Dividend Yield: 4%

Suncor Energy maintains a low payout ratio of 35.2%, ensuring dividends are well-covered by both earnings and cash flows, despite a forecasted average earnings decline of 7.6% over the next three years. Dividend payments have shown volatility over the past decade, reflecting an unstable dividend track record. Recently, Suncor reported increased production and refining volumes in Q1 2024 but faced declining net income year-over-year to CAD$1.61 billion from CAD$2.05 billion, alongside rejected shareholder proposals regarding climate commitments at its annual meeting.

- Dive into the specifics of Suncor Energy here with our thorough dividend report.

- The valuation report we've compiled suggests that Suncor Energy's current price could be quite moderate.

Next Steps

- Access the full spectrum of 31 Top TSX Dividend Stocks by clicking on this link.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:ARE

Aecon Group

Aecon Group Inc., together with its subsidiaries, provide construction and infrastructure development services to private and public sector clients in Canada, the United States, and internationally.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

GOOGL: AI Platform Expansion And Cloud Demand Will Support Durable Performance Amid Competitive Pressures

Trending Discussion