- Canada

- /

- Construction

- /

- TSX:ARE

Aecon Group (TSX:ARE) Valuation: A Fresh Look as Backlog Hits Record and U.S. Expansion Accelerates

Reviewed by Kshitija Bhandaru

Aecon Group (TSX:ARE) is drawing investor attention as the company overcomes past contract cost overruns and now gears up for growth. The company is backed by a project backlog exceeding $10-billion, especially in utilities and nuclear work.

See our latest analysis for Aecon Group.

Aecon Group's recent momentum is hard to miss, with a 19.8% gain in its 1-month share price return and a 16.9% total shareholder return over the past year. This is a clear signal that optimism is building as the company pivots from previous challenges toward growth, supported by its record backlog and new U.S. acquisitions. Over the long term, Aecon’s total shareholder return is an impressive 199% for three years, highlighting the company’s strong recovery and growing investor confidence.

If Aecon’s turnaround has you curious about what else is gaining traction, now’s an ideal time to broaden your investing horizons and discover fast growing stocks with high insider ownership

Yet with Aecon shares rebounding so sharply, investors face a familiar dilemma: is this renewed optimism already fully reflected in the stock price, or does Aecon’s turnaround present a genuine buying opportunity?

Most Popular Narrative: 0% Overvalued

With Aecon Group’s most popular narrative now placing its fair value right at the last close of CA$24.95, investors have little margin for error since the valuation matches where the shares currently trade. This calls for a closer look at what’s driving recent optimism and what assumptions analysts are making about Aecon’s future.

Significant progress in deleveraging, balance sheet strengthening, and disciplined capital allocation, including successful integration of targeted acquisitions, has created financial headroom for larger project bids and further M&A, providing optionality for earnings and margin expansion.

Curious about the bold financial targets behind such a razor-thin valuation gap? This narrative is modeled on forecasts that expect future profits to increase substantially, margins to do the heavy lifting, and valuations to fully reset. Which specific projections make this achievable, and what are the make-or-break numbers? You'll want to see the core assumptions for yourself before the market moves.

Result: Fair Value of $24.95 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, investors should note ongoing margin pressures and the risk of project delays. Both factors could challenge Aecon’s upbeat growth forecasts.

Find out about the key risks to this Aecon Group narrative.

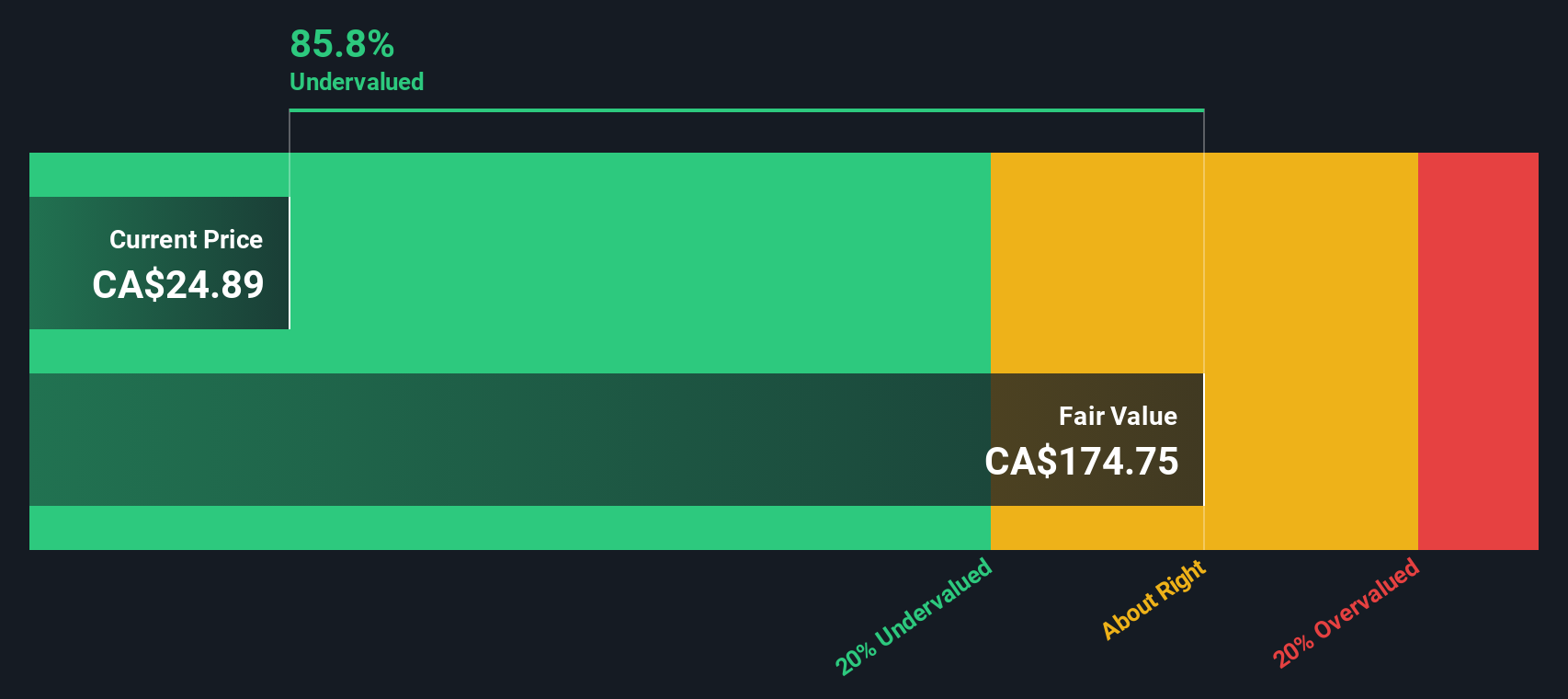

Another View: Discounted Cash Flow Signals Deep Value

Looking at Aecon Group through the lens of our SWS DCF model, the shares appear deeply undervalued. While the most popular narrative places fair value at today's price, our DCF estimate is much higher. This suggests there could be more upside than the market currently credits. What accounts for this striking difference in perspective?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Aecon Group for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Aecon Group Narrative

If you'd rather see the numbers for yourself or want to form your own perspective from scratch, you can craft your own narrative using the same data in under three minutes. Do it your way

A great starting point for your Aecon Group research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t let opportunity pass you by while others snap up tomorrow’s winners. Use the Simply Wall Street Screener and take charge of your portfolio with smart, data-backed picks.

- Capitalize on market inefficiencies by reviewing these 887 undervalued stocks based on cash flows, which analysts believe are trading far below their real worth.

- Maximize your dividends by searching for income-focused options among these 19 dividend stocks with yields > 3%, paying reliable, high yields above 3%.

- Ride the next wave of innovation by checking out these 25 AI penny stocks, which are at the forefront of artificial intelligence breakthroughs and growth potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:ARE

Aecon Group

Aecon Group Inc., together with its subsidiaries, provide construction and infrastructure development services to private and public sector clients in Canada, the United States, and internationally.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives