We Discuss Why Sharc International Systems Inc.'s (CSE:SHRC) CEO Will Find It Hard To Get A Pay Rise From Shareholders This Year

CEO Lynn Mueller has done a decent job of delivering relatively good performance at Sharc International Systems Inc. (CSE:SHRC) recently. This is something shareholders will keep in mind as they cast their votes on company resolutions such as executive remuneration in the upcoming AGM on 20 July 2021. Here is our take on why we think the CEO compensation looks appropriate.

Check out our latest analysis for Sharc International Systems

Comparing Sharc International Systems Inc.'s CEO Compensation With the industry

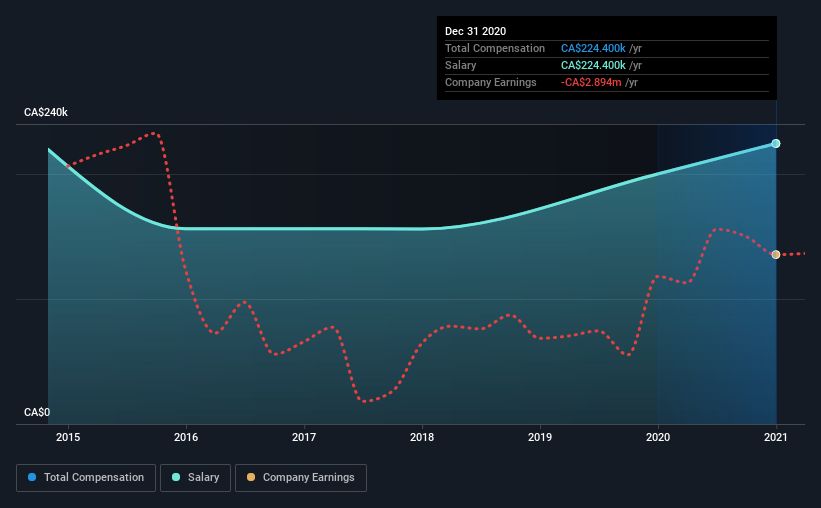

Our data indicates that Sharc International Systems Inc. has a market capitalization of CA$39m, and total annual CEO compensation was reported as CA$224k for the year to December 2020. Notably, that's an increase of 12% over the year before. Notably, the salary of CA$224k is the entirety of the CEO compensation.

On comparing similar-sized companies in the industry with market capitalizations below CA$250m, we found that the median total CEO compensation was CA$266k. This suggests that Sharc International Systems remunerates its CEO largely in line with the industry average.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | CA$224k | CA$200k | 100% |

| Other | - | - | - |

| Total Compensation | CA$224k | CA$200k | 100% |

Speaking on an industry level, nearly 69% of total compensation represents salary, while the remainder of 31% is other remuneration. On a company level, Sharc International Systems prefers to reward its CEO through a salary, opting not to pay Lynn Mueller through non-salary benefits. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

A Look at Sharc International Systems Inc.'s Growth Numbers

Sharc International Systems Inc. has seen its earnings per share (EPS) increase by 40% a year over the past three years. Its revenue is up 351% over the last year.

Shareholders would be glad to know that the company has improved itself over the last few years. It's great to see that revenue growth is strong, too. These metrics suggest the business is growing strongly. While we don't have analyst forecasts for the company, shareholders might want to examine this detailed historical graph of earnings, revenue and cash flow.

Has Sharc International Systems Inc. Been A Good Investment?

Sharc International Systems Inc. has generated a total shareholder return of 5.0% over three years, so most shareholders wouldn't be too disappointed. Although, there's always room to improve. Accordingly, a proposal to increase CEO remuneration without seeing an improvement in shareholder returns might not be met favorably by most shareholders.

In Summary...

Sharc International Systems pays CEO compensation exclusively through a salary, with non-salary compensation completely ignored. The company's decent performance might have made most shareholders happy, possibly making CEO remuneration the least of the concerns to be discussed in the upcoming AGM. Despite the pleasing results, we still think that any proposed increases to CEO compensation will be examined based on a case by case basis and linked to performance outcomes.

CEO pay is simply one of the many factors that need to be considered while examining business performance. In our study, we found 4 warning signs for Sharc International Systems you should be aware of, and 2 of them are potentially serious.

Important note: Sharc International Systems is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

If you're looking for stocks to buy, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About CNSX:SHRC

Sharc International Systems

Together with its subsidiary, provides wastewater energy transfer products and services for commercial, industrial, public utilities, and residential development projects in Canada and the United States.

Medium-low risk with weak fundamentals.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Growing between 25-50% for the next 3-5 years

SLI is share to watch next 5 years

The "Molecular Pencil": Why Beam's Technology is Built to Win

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026