Stock Analysis

Exploring Undiscovered Canadian Stocks With Potential In July 2024

Reviewed by Simply Wall St

The Canadian stock market has shown robust performance recently, with a 4.0% increase over the past week and a notable 12% rise over the last year. With earnings expected to grow by 15% annually, investors might find potential in lesser-known stocks that could benefit from these favorable market conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In Canada

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| TWC Enterprises | 7.71% | 8.87% | 30.01% | ★★★★★★ |

| Reconnaissance Energy Africa | NA | 66.35% | -25.78% | ★★★★★★ |

| Taiga Building Products | NA | 7.62% | 15.46% | ★★★★★★ |

| Frontera Energy | 28.78% | -0.59% | 34.36% | ★★★★★☆ |

| Santacruz Silver Mining | 13.08% | 53.09% | 46.68% | ★★★★★☆ |

| Mako Mining | 28.08% | 39.01% | 48.79% | ★★★★★☆ |

| Queen's Road Capital Investment | 7.20% | 22.14% | 22.20% | ★★★★☆☆ |

| Genesis Land Development | 39.50% | 22.73% | 41.36% | ★★★★☆☆ |

| Senvest Capital | 54.38% | 2.12% | -0.88% | ★★★★☆☆ |

| Fairfax India Holdings | 17.90% | 2.65% | 1.15% | ★★★★☆☆ |

We'll examine a selection from our screener results.

VersaBank (TSX:VBNK)

Simply Wall St Value Rating: ★★★★★☆

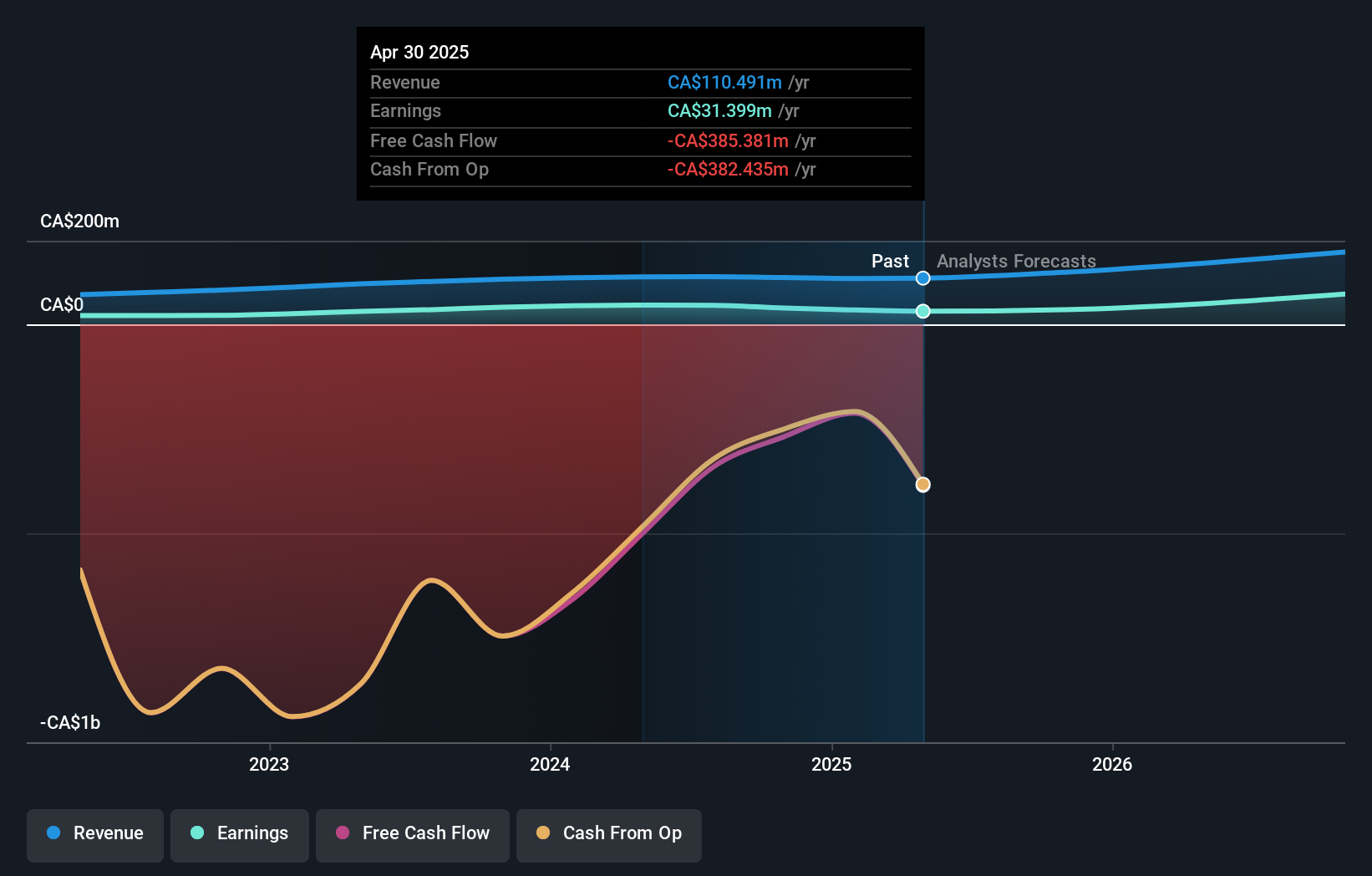

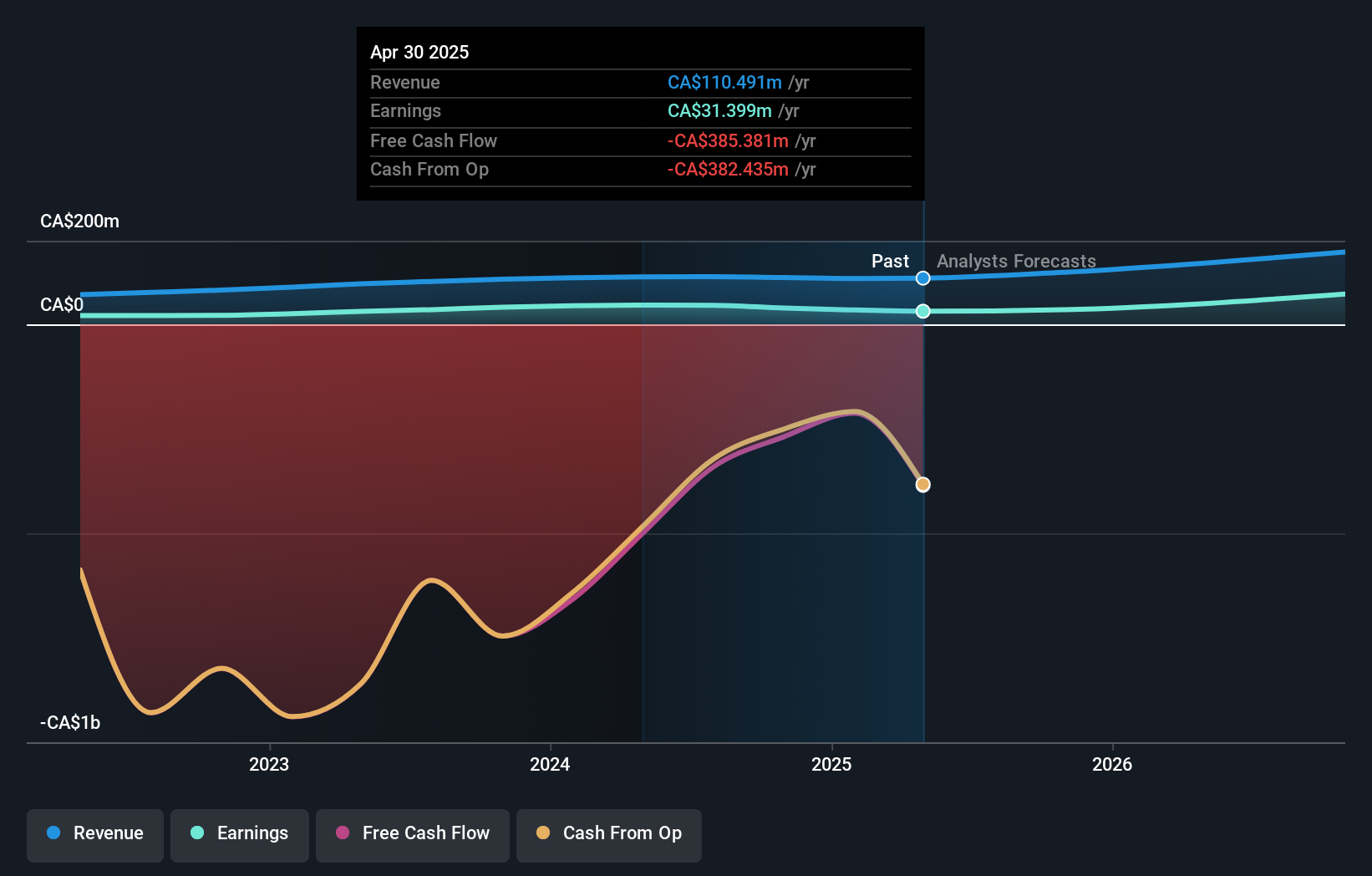

Overview: VersaBank, a Canadian financial institution, offers a range of banking products and services across Canada and the United States, with a market capitalization of CA$398.55 million.

Operations: VersaBank generates its revenue primarily through digital banking services, contributing CA$104.90 million, supplemented by CA$10.56 million from its DRTC division, which focuses on cybersecurity services and banking and financial technology development. The bank has consistently achieved a gross profit margin of 100%, indicating that it operates without the cost of goods sold.

VersaBank, a lesser-known Canadian bank, showcases robust financial health with total assets of CA$4.4B and a strong net interest margin of 2.7%. With total loans at CA$4.0B and deposits at CA$3.7B, its bad loans are well-managed at only 0.4%, reflecting prudent risk control. The bank's earnings surged by 49% last year, outpacing the industry's growth and highlighting its potential as an undiscovered gem in the financial sector.

- Unlock comprehensive insights into our analysis of VersaBank stock in this health report.

Gain insights into VersaBank's historical performance by reviewing our past performance report.

VersaBank (TSX:VBNK)

Simply Wall St Value Rating: ★★★★★☆

Overview: VersaBank, a Canadian financial institution, offers a range of banking products and services across Canada and the United States, with a market capitalization of CA$398.55 million.

Operations: VersaBank generates its revenue primarily through digital banking services, contributing CA$104.90 million, supplemented by CA$10.56 million from its DRTC division, which focuses on cybersecurity services and banking and financial technology development. The bank has consistently achieved a gross profit margin of 100%, indicating that it operates without the cost of goods sold.

VersaBank, a lesser-known Canadian bank, showcases robust financial health with total assets of CA$4.4B and a strong net interest margin of 2.7%. With total loans at CA$4.0B and deposits at CA$3.7B, its bad loans are well-managed at only 0.4%, reflecting prudent risk control. The bank's earnings surged by 49% last year, outpacing the industry's growth and highlighting its potential as an undiscovered gem in the financial sector.

- Unlock comprehensive insights into our analysis of VersaBank stock in this health report.

Gain insights into VersaBank's historical performance by reviewing our past performance report.

Winpak (TSX:WPK)

Simply Wall St Value Rating: ★★★★★★

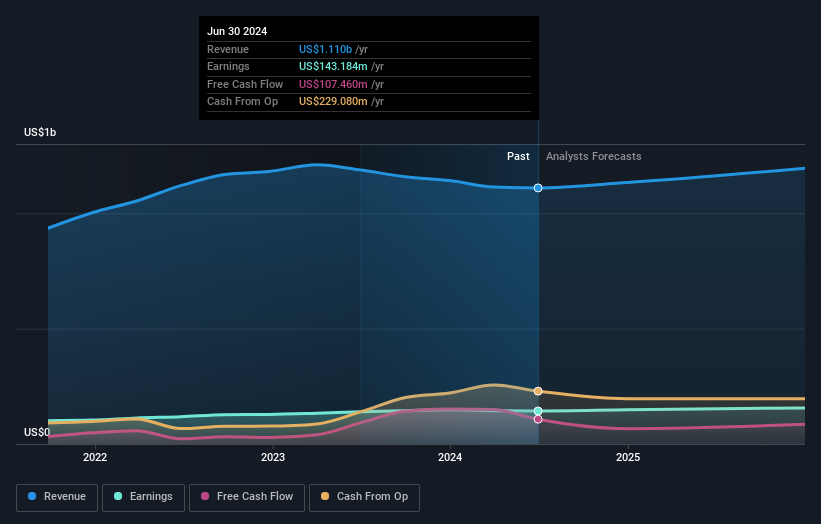

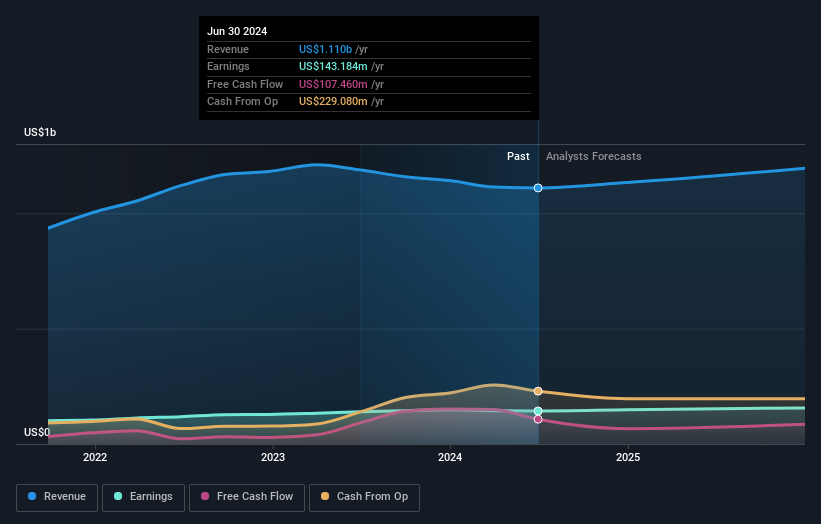

Overview: Winpak Ltd. specializes in the production and distribution of packaging materials and associated machinery, serving markets in the United States, Canada, and Mexico, with a market capitalization of CA$2.72 billion.

Operations: The company generates its revenue primarily through three segments: Flexible Packaging, Rigid Packaging and Flexible Lidding, and Packaging Machinery. With a gross profit margin of 29.28% as of the latest reporting period, it reflects a slight increase compared to earlier margins such as 27.55% in early periods covered by the data.

Winpak, a notable player in the packaging industry, has demonstrated robust financial health with an 8% earnings growth surpassing its industry's decline of 13%. The company is debt-free and maintains high-quality earnings. Recently, Winpak declared a dividend of CAD 0.03 per share and successfully repurchased shares worth CAD 18.95 million, underscoring its commitment to shareholder value. Forecasted to grow earnings by 4.1% annually, Winpak trades at a significant discount to its estimated fair value, presenting an attractive opportunity for discerning investors seeking growth potential in lesser-explored markets.

- Click here and access our complete health analysis report to understand the dynamics of Winpak.

Review our historical performance report to gain insights into Winpak's's past performance.

Winpak (TSX:WPK)

Simply Wall St Value Rating: ★★★★★★

Overview: Winpak Ltd. specializes in the production and distribution of packaging materials and associated machinery, serving markets in the United States, Canada, and Mexico, with a market capitalization of CA$2.72 billion.

Operations: The company generates its revenue primarily through three segments: Flexible Packaging, Rigid Packaging and Flexible Lidding, and Packaging Machinery. With a gross profit margin of 29.28% as of the latest reporting period, it reflects a slight increase compared to earlier margins such as 27.55% in early periods covered by the data.

Winpak, a notable player in the packaging industry, has demonstrated robust financial health with an 8% earnings growth surpassing its industry's decline of 13%. The company is debt-free and maintains high-quality earnings. Recently, Winpak declared a dividend of CAD 0.03 per share and successfully repurchased shares worth CAD 18.95 million, underscoring its commitment to shareholder value. Forecasted to grow earnings by 4.1% annually, Winpak trades at a significant discount to its estimated fair value, presenting an attractive opportunity for discerning investors seeking growth potential in lesser-explored markets.

- Click here and access our complete health analysis report to understand the dynamics of Winpak.

Review our historical performance report to gain insights into Winpak's's past performance.

Westshore Terminals Investment (TSX:WTE)

Simply Wall St Value Rating: ★★★★★☆

Overview: Westshore Terminals Investment Corporation manages a coal handling facility in Roberts Bank, British Columbia, with a market capitalization of CA$1.42 billion.

Operations: This company operates in the transportation infrastructure sector, generating a revenue of CA$366.73 million as of the latest reporting period. It has demonstrated a gross profit margin of 43.40%, reflecting its operational efficiency in managing costs relative to revenue generated from its services.

Westshore Terminals Investment Corporation, a lesser-known yet robust player in the infrastructure sector, has demonstrated significant growth with a 33.7% increase in earnings over the past year, outpacing its industry's average of 11.4%. Despite forecasts suggesting a potential 4.9% annual decline in earnings over the next three years, the company remains debt-free and maintains high-quality earnings. Trading just 0.5% below its estimated fair value and with positive free cash flow, Westshore presents an intriguing opportunity for investors seeking hidden gems within Canada's market landscape.

- Click here to discover the nuances of Westshore Terminals Investment with our detailed analytical health report.

Understand Westshore Terminals Investment's track record by examining our Past report.

Westshore Terminals Investment (TSX:WTE)

Simply Wall St Value Rating: ★★★★★☆

Overview: Westshore Terminals Investment Corporation manages a coal handling facility in Roberts Bank, British Columbia, with a market capitalization of CA$1.42 billion.

Operations: This company operates in the transportation infrastructure sector, generating a revenue of CA$366.73 million as of the latest reporting period. It has demonstrated a gross profit margin of 43.40%, reflecting its operational efficiency in managing costs relative to revenue generated from its services.

Westshore Terminals Investment Corporation, a lesser-known yet robust player in the infrastructure sector, has demonstrated significant growth with a 33.7% increase in earnings over the past year, outpacing its industry's average of 11.4%. Despite forecasts suggesting a potential 4.9% annual decline in earnings over the next three years, the company remains debt-free and maintains high-quality earnings. Trading just 0.5% below its estimated fair value and with positive free cash flow, Westshore presents an intriguing opportunity for investors seeking hidden gems within Canada's market landscape.

- Click here to discover the nuances of Westshore Terminals Investment with our detailed analytical health report.

Understand Westshore Terminals Investment's track record by examining our Past report.

Where To Now?

- Embark on your investment journey to our 43 TSX Undiscovered Gems With Strong Fundamentals selection here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether Winpak is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:WPK

Winpak

Manufactures and distributes packaging materials and related packaging machines in the United States, Canada, and Mexico.

Flawless balance sheet with solid track record.