- Australia

- /

- Retail REITs

- /

- ASX:CQR

Exploring 3 Undervalued Small Caps In Global With Insider Action

Reviewed by Simply Wall St

As global markets react positively to the recent U.S.-China tariff suspension, with major indices like the Nasdaq Composite and S&P 500 showing significant gains, small-cap stocks have also benefited from this improved sentiment. In this environment of easing trade tensions and cooling inflation, identifying promising small-cap stocks involves looking for those with strong fundamentals and potential insider action that may signal confidence in their future growth.

Top 10 Undervalued Small Caps With Insider Buying Globally

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Morgan Advanced Materials | 11.8x | 0.5x | 34.97% | ★★★★★☆ |

| FRP Advisory Group | 11.6x | 2.1x | 20.61% | ★★★★★☆ |

| Tristel | 29.9x | 4.2x | 5.89% | ★★★★☆☆ |

| Cloetta | 15.6x | 1.1x | 45.68% | ★★★★☆☆ |

| Sing Investments & Finance | 7.3x | 3.7x | 39.74% | ★★★★☆☆ |

| Absolent Air Care Group | 23.2x | 1.8x | 47.55% | ★★★☆☆☆ |

| Saturn Oil & Gas | 2.1x | 0.4x | -33.51% | ★★★☆☆☆ |

| DIRTT Environmental Solutions | 11.1x | 0.7x | 1.29% | ★★★☆☆☆ |

| Close Brothers Group | NA | 0.6x | 2.69% | ★★★☆☆☆ |

| Seeing Machines | NA | 2.4x | 44.98% | ★★★☆☆☆ |

Here's a peek at a few of the choices from the screener.

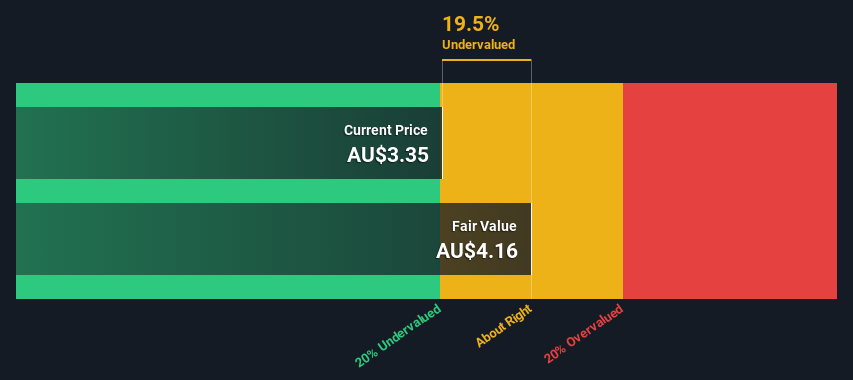

Charter Hall Retail REIT (ASX:CQR)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Charter Hall Retail REIT is a real estate investment trust specializing in the ownership and management of convenience retail properties, with a market capitalization of A$2.52 billion.

Operations: Convenience Shopping Centre Retail is the primary revenue stream, contributing A$223.60 million, while Convenience Net Lease Retail adds A$52 million. The company's gross profit margin has shown variability, with a high of 84.07% and a low of 61.49%. Operating expenses have remained relatively modest compared to gross profit levels over the periods analyzed.

PE: 13.7x

Charter Hall Retail REIT, a smaller player in its sector, has recently shown insider confidence through share purchases over the past six months. While their financial position shows debt not well covered by operating cash flow and reliance on higher-risk external borrowing, they maintain high-quality earnings despite large one-off items. However, with earnings forecasted to decline by an average of 0.1% annually over the next three years, potential investors should weigh these factors carefully.

- Click to explore a detailed breakdown of our findings in Charter Hall Retail REIT's valuation report.

Gain insights into Charter Hall Retail REIT's past trends and performance with our Past report.

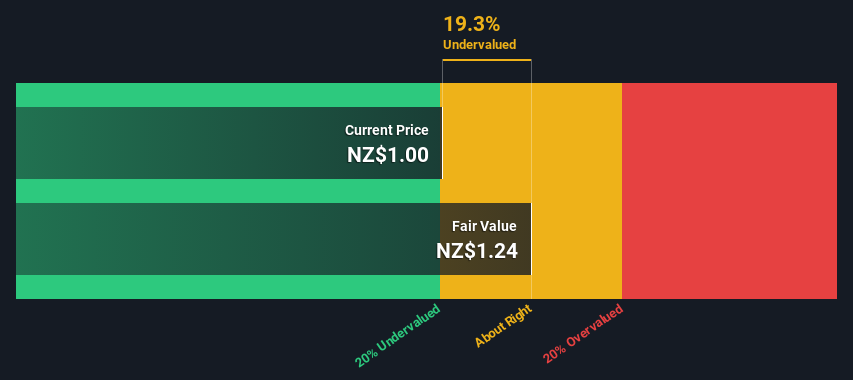

Argosy Property (NZSE:ARG)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Argosy Property is a New Zealand-based property investment company focusing on commercial real estate, with a market capitalization of approximately NZ$1.26 billion.

Operations: Argosy Property's revenue is primarily derived from its operations, with a gross profit margin that has shown variability over time, reaching 75.06% by March 2025. The company incurs costs of goods sold and operating expenses, which have impacted its net income margins significantly, as seen in recent periods where non-operating expenses contributed to negative net income margins before recovering to a positive 80.82% by March 2025.

PE: 7.4x

Argosy Property, a smaller player in the property sector, recently showcased a financial turnaround with net income rising to NZ$125.86 million from a loss of NZ$54.49 million last year. Despite earnings being hit by large one-off items and future declines forecasted at 3.7% annually over three years, insider confidence is evident through recent share purchases. The company's reliance on external borrowing poses risks but highlights potential for those seeking value in underappreciated stocks within this segment.

- Dive into the specifics of Argosy Property here with our thorough valuation report.

Understand Argosy Property's track record by examining our Past report.

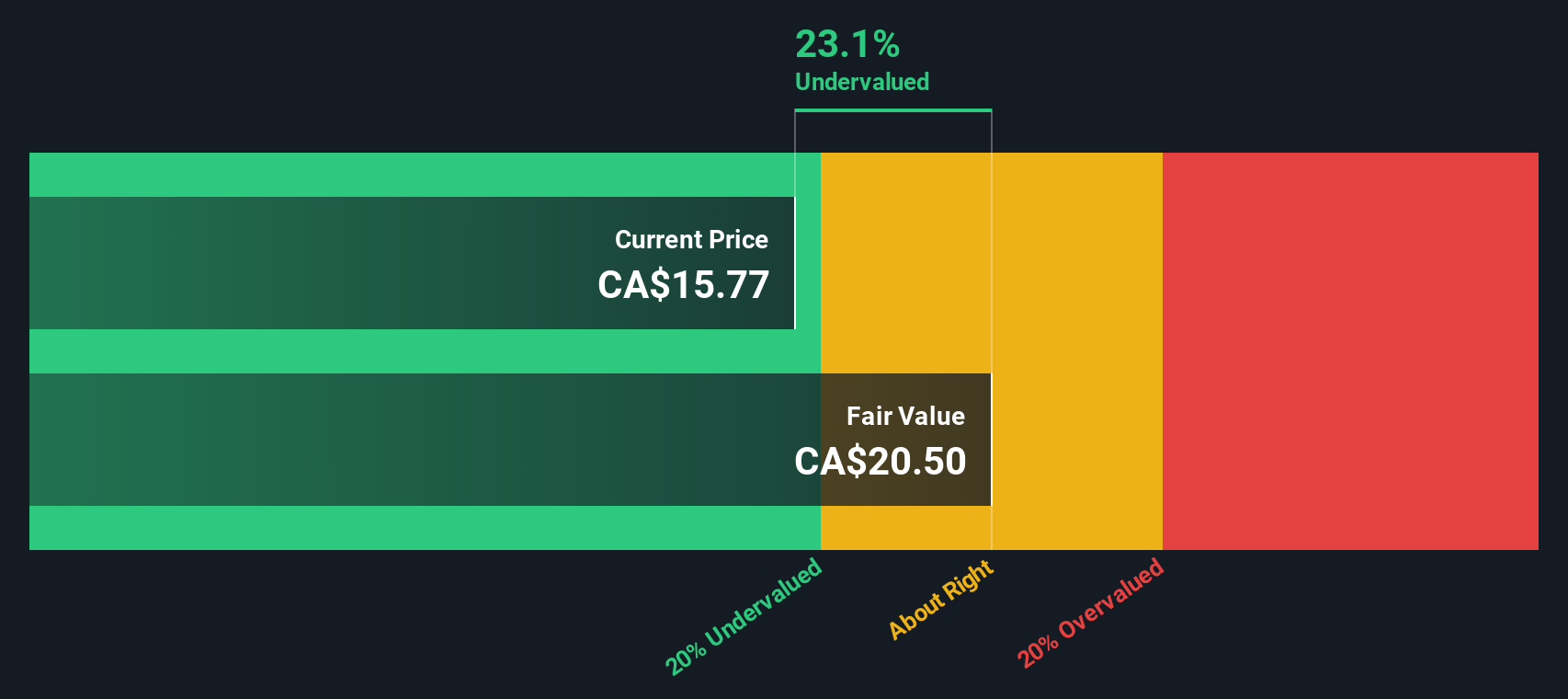

VersaBank (TSX:VBNK)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: VersaBank operates as a digital bank in Canada, providing banking services and financial technology development through its Digital Banking Canada and DRTC segments, with a market capitalization of CA$0.29 billion.

Operations: Digital Banking Canada is the primary revenue stream, contributing CA$98.06 million, while DRTC adds CA$9.71 million. The net income margin shows variability, peaking at 40.54% and dropping to 26.45% over the observed periods. Operating expenses are a significant cost component, with General & Administrative Expenses consistently forming a large portion of these costs across various periods analyzed.

PE: 15.1x

VersaBank, a small cap financial institution, is catching attention with its insider confidence. President David Taylor's purchase of 57,948 shares for approximately CAD 701,172 reflects strong belief in the company's potential. Despite a dip in net income to CAD 8.14 million from CAD 12.7 million last year and steady earnings per share of CAD 0.28, the bank is set to repurchase up to 2 million shares by April 2026 under its buyback program. With earnings projected to grow over time, VersaBank presents an intriguing opportunity for investors seeking value in smaller companies with growth prospects.

Summing It All Up

- Click here to access our complete index of 174 Undervalued Global Small Caps With Insider Buying.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:CQR

Charter Hall Retail REIT

Charter Hall Retail REIT is the leading owner of property for convenience retailers.

Fair value with acceptable track record.

Similar Companies

Market Insights

Community Narratives