As the Canadian market continues to navigate its third year of a robust bull run, the TSX has shown a 67% gain since its October 2022 low, buoyed by easing inflation and supportive monetary policies. In this environment, growth stocks with significant insider ownership can be particularly appealing as they often indicate strong confidence from those closest to the company's operations and strategic direction.

Top 10 Growth Companies With High Insider Ownership In Canada

| Name | Insider Ownership | Earnings Growth |

| West Red Lake Gold Mines (TSXV:WRLG) | 11.2% | 78% |

| Robex Resources (TSXV:RBX) | 22.3% | 90.3% |

| Propel Holdings (TSX:PRL) | 30.6% | 29.8% |

| NTG Clarity Networks (TSXV:NCI) | 36.4% | 29.9% |

| Enterprise Group (TSX:E) | 32.2% | 30.4% |

| Colliers International Group (TSX:CIGI) | 14.0% | 27.2% |

| CEMATRIX (TSX:CEMX) | 10.5% | 77.8% |

| California Nanotechnologies (TSXV:CNO) | 17.8% | 153% |

| Almonty Industries (TSX:AII) | 12.5% | 65% |

| Allied Gold (TSX:AAUC) | 15% | 83.6% |

We're going to check out a few of the best picks from our screener tool.

Knight Therapeutics (TSX:GUD)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Knight Therapeutics Inc. is engaged in acquiring, in-licensing, out-licensing, marketing, and commercializing prescription pharmaceutical products in Canada and Latin America with a market cap of CA$581.12 million.

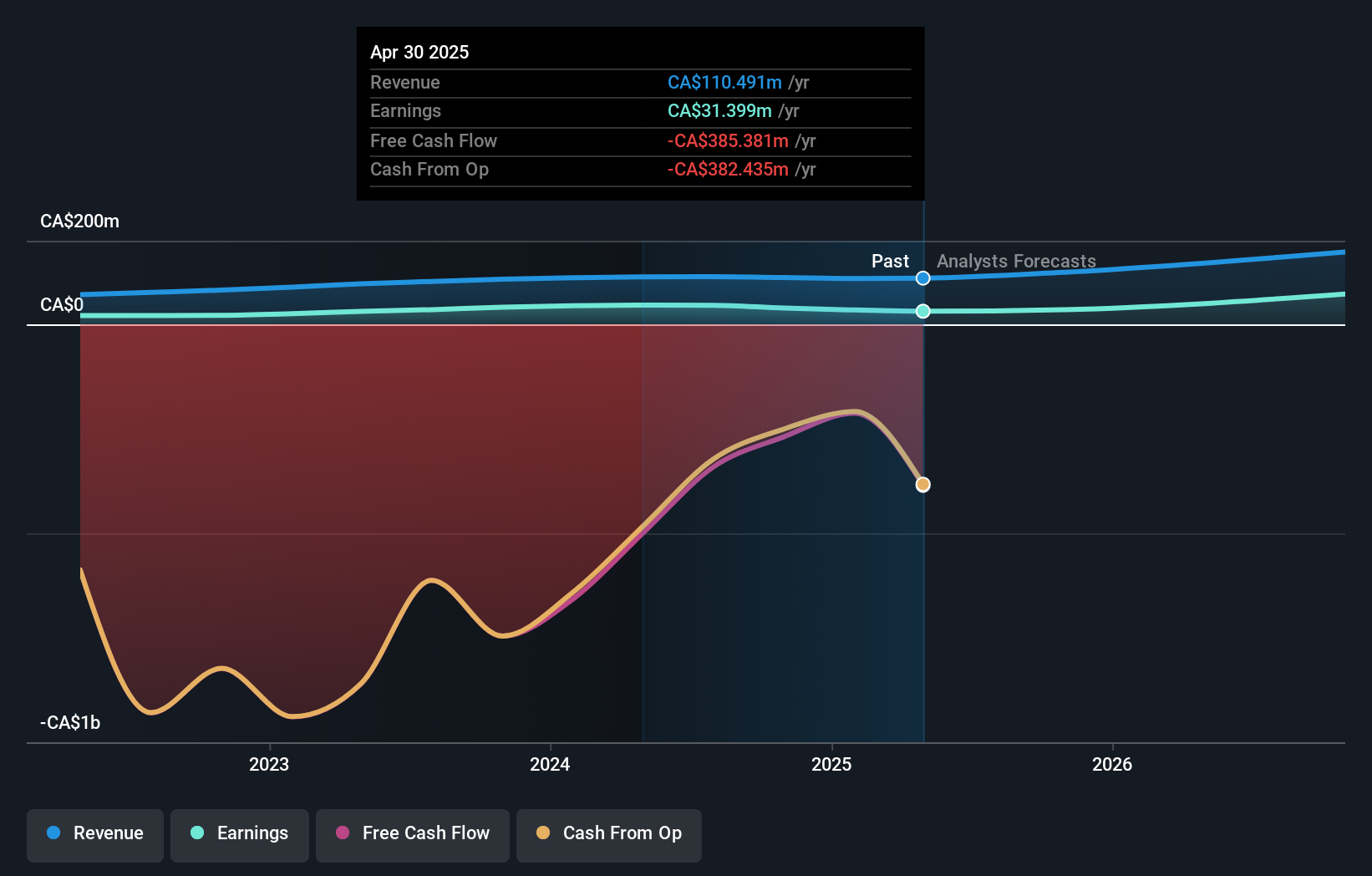

Operations: The company's revenue primarily comes from its Pharmaceuticals segment, which generated CA$384.56 million.

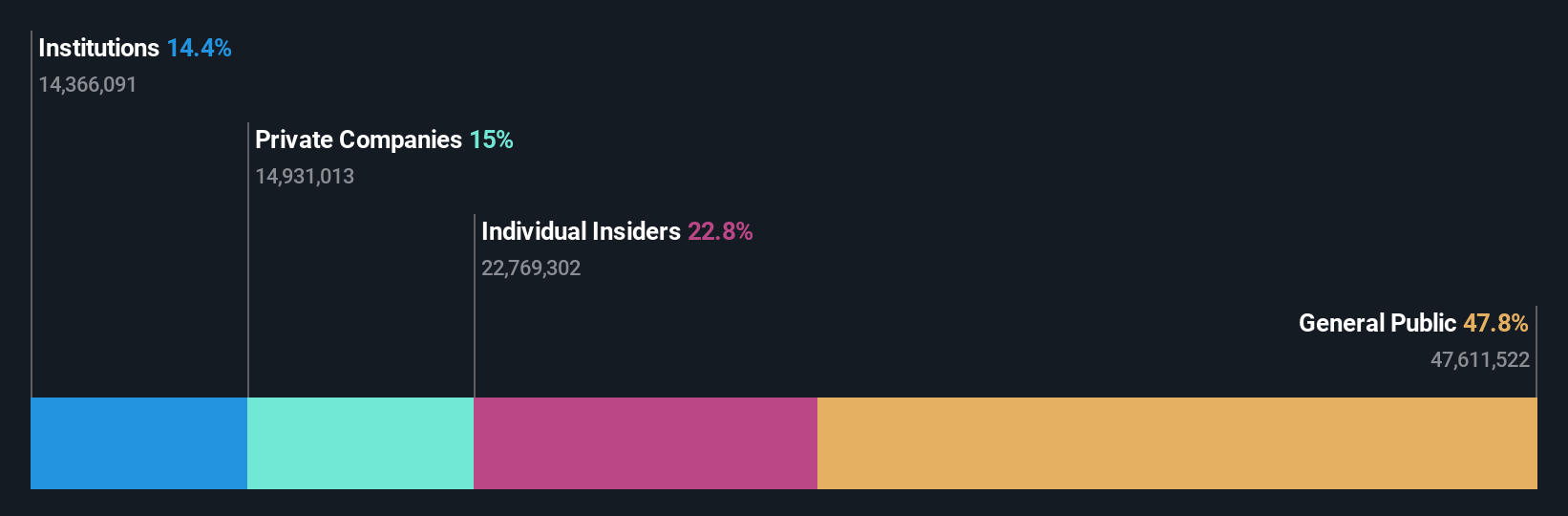

Insider Ownership: 22.8%

Knight Therapeutics shows potential as a growth company with high insider ownership, bolstered by significant earnings growth forecasts of 57.14% annually, outpacing the Canadian market. Despite recent net losses, the company is expanding its product portfolio through strategic agreements and has increased revenue guidance for 2025 to CAD 410-420 million. The relaunch of ORGOVYX® in Canada and a share repurchase program highlight management's confidence in future prospects amidst competitive market dynamics.

- Click to explore a detailed breakdown of our findings in Knight Therapeutics' earnings growth report.

- The analysis detailed in our Knight Therapeutics valuation report hints at an deflated share price compared to its estimated value.

Savaria (TSX:SIS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Savaria Corporation offers accessibility solutions for the elderly and physically challenged across Canada, the United States, Europe, and internationally, with a market cap of CA$1.58 billion.

Operations: The company's revenue segments include Patient Care at CA$197.05 million and Segment Adjustment at CA$686.90 million.

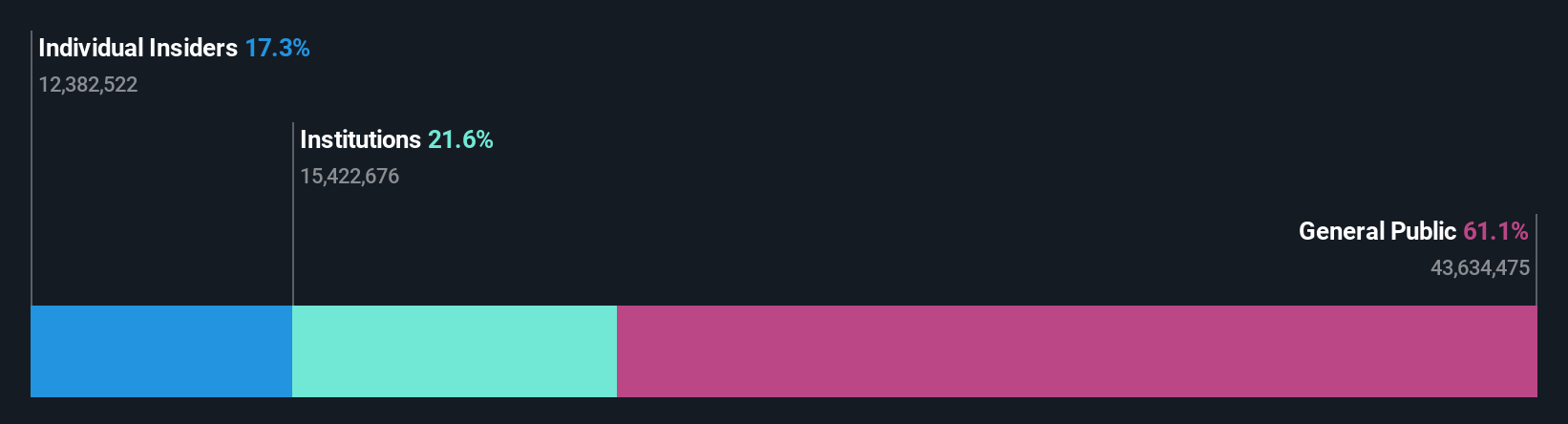

Insider Ownership: 17.3%

Savaria demonstrates potential with forecasted earnings growth of 31.3% annually, surpassing the Canadian market's average. Despite significant insider selling recently, its stock trades at a notable discount to estimated fair value. Recent financial results show an increase in net income and sales, supporting growth prospects. The company also affirmed and increased its monthly dividend to CAD 0.0467 per share, indicating stable cash flow management amidst evolving market conditions.

- Get an in-depth perspective on Savaria's performance by reading our analyst estimates report here.

- Our valuation report here indicates Savaria may be undervalued.

VersaBank (TSX:VBNK)

Simply Wall St Growth Rating: ★★★★★☆

Overview: VersaBank offers a range of banking products and services in Canada and the United States, with a market cap of CA$532.70 million.

Operations: VersaBank's revenue segments include CA$96.56 million from Digital Banking Canada and CA$8.83 million from its DRTC division, which focuses on cybersecurity services and financial technology development.

Insider Ownership: 11.1%

VersaBank's insider ownership aligns with its growth trajectory, shown by substantial insider buying and no significant selling recently. The bank is trading below estimated fair value and anticipates robust revenue growth of 26.5% annually, outpacing the Canadian market. However, profit margins have decreased from last year. Recent initiatives like expanding its Receivable Purchase Program in North America signal strategic positioning for future expansion amidst a challenging interest rate environment.

- Delve into the full analysis future growth report here for a deeper understanding of VersaBank.

- Upon reviewing our latest valuation report, VersaBank's share price might be too optimistic.

Where To Now?

- Dive into all 37 of the Fast Growing TSX Companies With High Insider Ownership we have identified here.

- Ready To Venture Into Other Investment Styles? Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:SIS

Savaria

Provides accessibility solutions for the elderly and physically challenged people in Canada, the United States, Europe, and internationally.

Established dividend payer with reasonable growth potential.

Market Insights

Community Narratives