Should You Reconsider TD Bank After Its 51.6% Surge in 2025?

Reviewed by Bailey Pemberton

Thinking about what to do with Toronto-Dominion Bank stock today? You are definitely not alone. Whether you are a long-time shareholder or considering your first buy, the journey of this stock has been anything but dull. Over the past year, Toronto-Dominion Bank has soared an impressive 51.6%, with a whopping 48.2% return year-to-date. In just the last week, shares moved up another 2.1%, and over the last month, they are up 4.4%. That kind of consistent growth is catching everyone’s attention and is a big reason why it has outperformed much of the broader financial sector recently.

A big part of this momentum comes from improving sentiment around Canadian banks in general. Investors are latching on to news about stabilizing interest rates and a positive outlook for North American economic growth, which has translated into renewed appetite for established financial institutions like Toronto-Dominion Bank. There is also the sense that the risk profile for big banks is looking more predictable, which helps explain why the shares have gained so much ground not just this year but in the longer term, jumping 140.4% over the last five years.

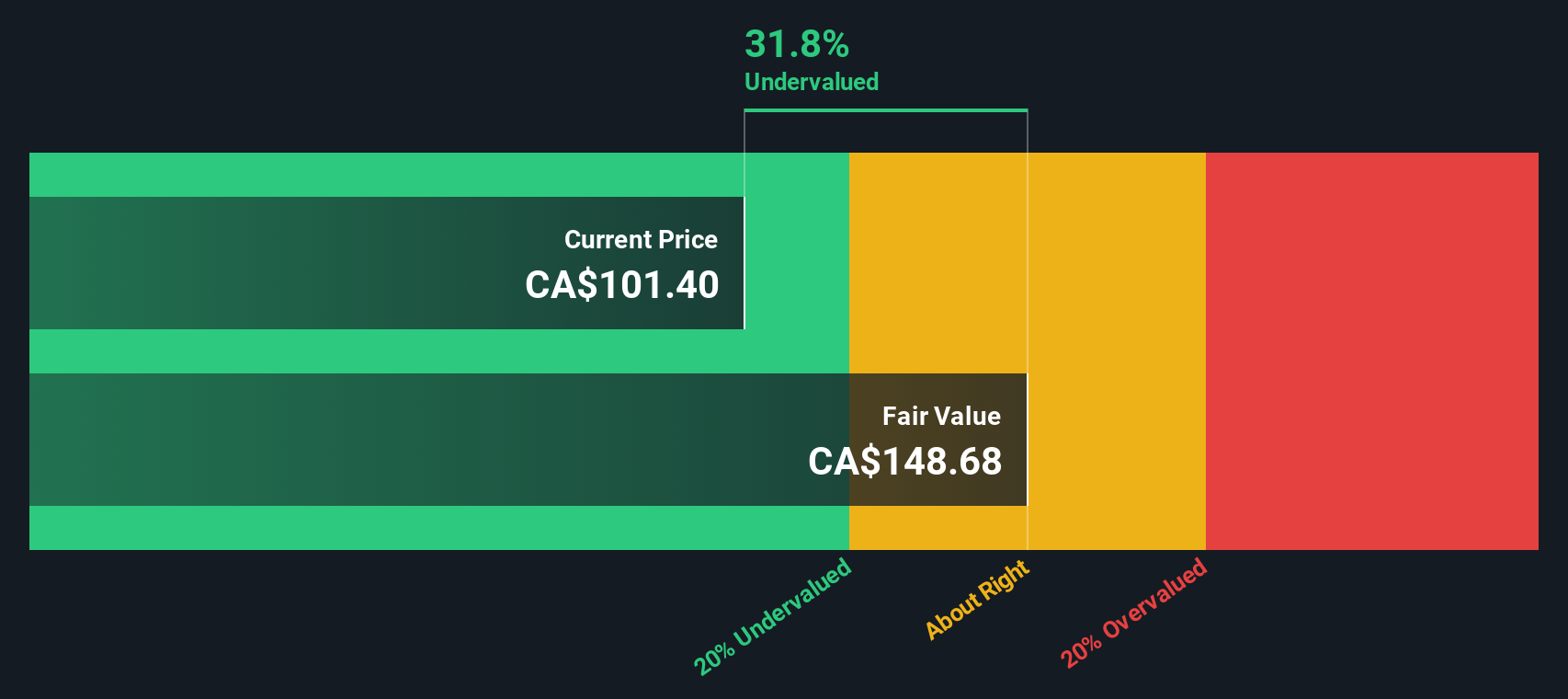

But is the current price still a bargain, or has the stock run too far ahead of itself? A quick look at the value score shows Toronto-Dominion Bank comes in at 5 out of 6, meaning it is considered undervalued by several key measures. Of course, how a stock is valued can vary a lot depending on the approach you use, so let’s walk through the main valuation methods and stick around to the end for a smarter, more comprehensive way to look at what this stock might actually be worth.

Approach 1: Toronto-Dominion Bank Excess Returns Analysis

The Excess Returns valuation method gauges a company’s value by looking at how much profit it generates above the minimum required by its investors. For banks like Toronto-Dominion Bank, this approach highlights the difference between the returns it earns on its equity and the cost of that equity, then factors in growth expectations from analyst forecasts.

Key figures for Toronto-Dominion Bank include a Book Value of CA$71.48 per share and a Stable Earnings Per Share (EPS) of CA$9.01. The EPS is calculated from future Return on Equity estimates from 7 analysts. The company’s cost of equity stands at CA$5.18 per share, leaving an annual Excess Return of CA$3.83 per share. The average Return on Equity is 12.65 percent, while stable book value projections are CA$71.23 per share based on consensus from 8 analysts.

This model estimates an intrinsic value that is 26.0 percent higher than the current share price, indicating the stock is trading at a significant discount to its fair value. According to the Excess Returns approach, Toronto-Dominion Bank appears undervalued for investors seeking long-term upside potential.

Result: UNDERVALUED

Our Excess Returns analysis suggests Toronto-Dominion Bank is undervalued by 26.0%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Toronto-Dominion Bank Price vs Earnings

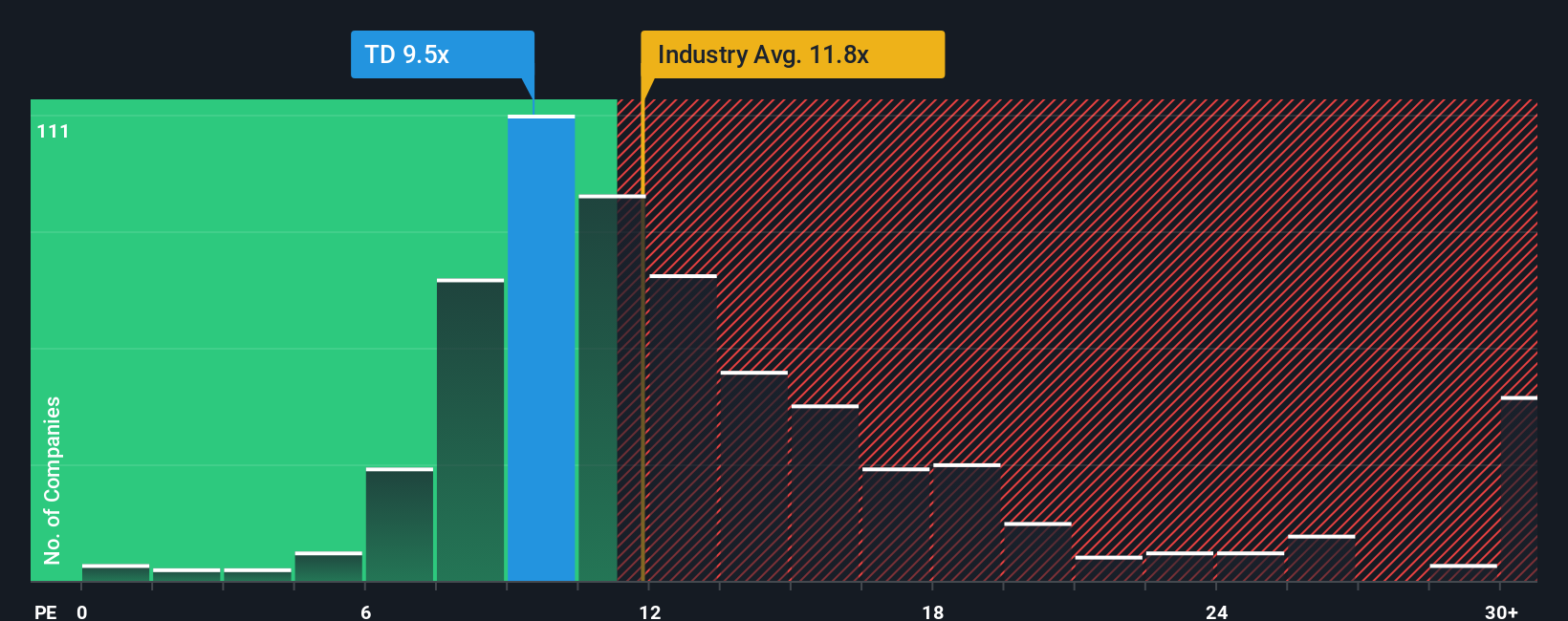

The Price-to-Earnings (PE) ratio is the preferred valuation metric for profitable companies, as it measures how much investors are willing to pay for each dollar of earnings. Since Toronto-Dominion Bank is consistently profitable, the PE ratio gives a clear sense of its current market expectations versus its actual earnings performance.

Growth expectations play a significant role in shaping what is considered a "normal" or "fair" PE ratio. A company expected to grow faster or with a lower risk profile generally warrants a higher PE multiple. Comparatively, Toronto-Dominion Bank trades at a PE of 9.56x, which is below both the industry average of 10.25x and the peer average of 15.36x. This suggests the market is being somewhat cautious about Toronto-Dominion relative to other major banks.

To get a more customized view, Simply Wall St calculates a proprietary “Fair Ratio,” which considers Toronto-Dominion Bank’s earnings growth prospects, industry trends, profit margins, risk factors, and its market capitalization. Unlike a simple comparison to industry averages that may not reflect unique company strengths or challenges, the Fair Ratio provides a more holistic benchmark. For Toronto-Dominion Bank, the Fair Ratio is 11.41x, notably above its current PE. This supports the case that the stock is undervalued based on its outlook and characteristics, signaling opportunity for value-focused investors.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Toronto-Dominion Bank Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is your story about a company; the perspective you bring to the numbers behind the valuation, such as your own views on Toronto-Dominion Bank’s fair value, future revenue, earnings, and profit margins. Narratives link a company’s business story directly to a set of financial forecasts and then to a fair value, making it far easier to connect what you believe about a company’s future with a clear estimate of what it’s really worth.

Narratives are available directly on Simply Wall St’s Community page, used by millions of investors around the world. This tool lets you see how your perspective converts into a target price and allows you to compare your fair value to the current market price to decide if you want to buy, sell, or hold. Because Narratives update automatically when new financial results or news are released, your outlook keeps pace with what matters most.

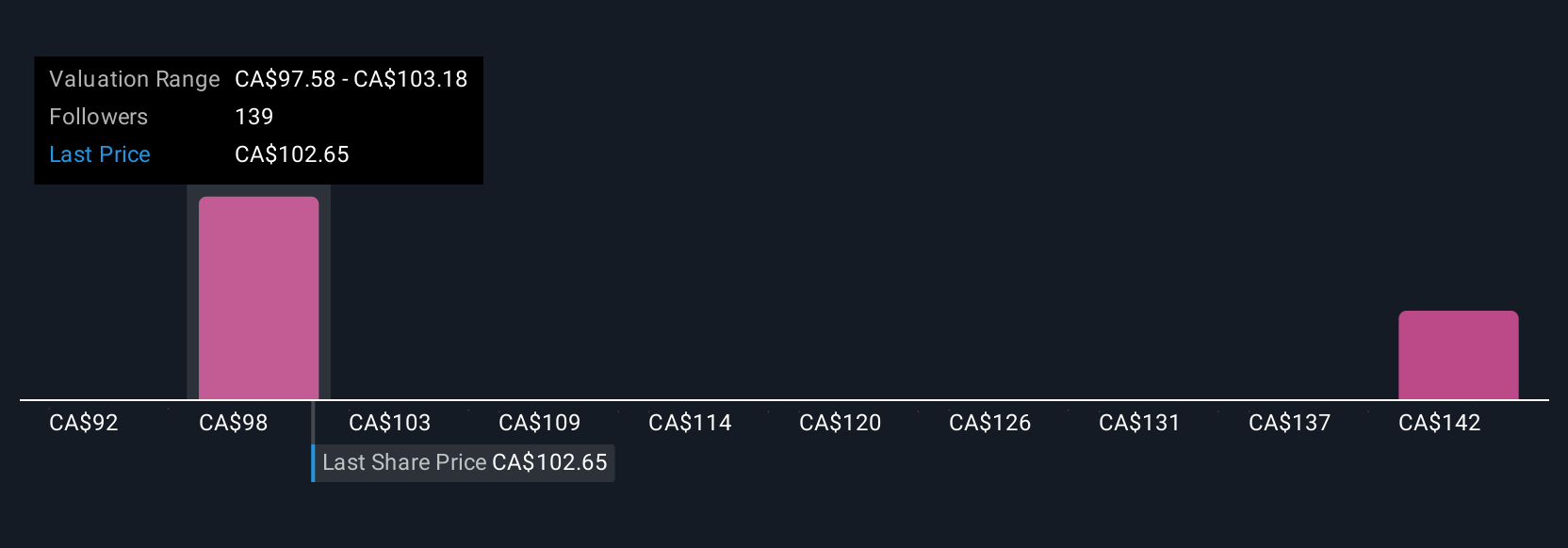

For example, Toronto-Dominion Bank investors currently have widely different Narratives; some believe operational costs and digital competition could limit growth and set a fair value as low as CA$93.00 per share, while others see strong digital innovation and diversified growth supporting much higher values, up to CA$120.00 per share. Your own Narrative reflects what you think is most likely and gives you the power to act with confidence.

Do you think there's more to the story for Toronto-Dominion Bank? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Toronto-Dominion Bank might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:TD

Toronto-Dominion Bank

Provides various financial products and services in Canada, the United States, and internationally.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives