Royal Bank of Canada (TSX:RY) Introduces No Fee Accounts For Indigenous Clients Across Canada

Reviewed by Simply Wall St

Royal Bank of Canada (TSX:RY) recently introduced a no monthly fee bank account for Indigenous clients, part of its Reconciliation Action Plan, complementing broader financial inclusivity efforts. These initiatives were announced around the same time RBC reported strong earnings growth, notably a 4% dividend increase. In a quarter marked by a broader market surge inspired by potential interest rate cuts, RBC's share performance, a 7.57% rise, aligns with wider market trends. With market indices reaching record highs, particularly following Federal Reserve signals of future rate cuts, RBC's performance may reflect these macroeconomic conditions, alongside its progressive company actions.

Be aware that Royal Bank of Canada is showing 1 possible red flag in our investment analysis.

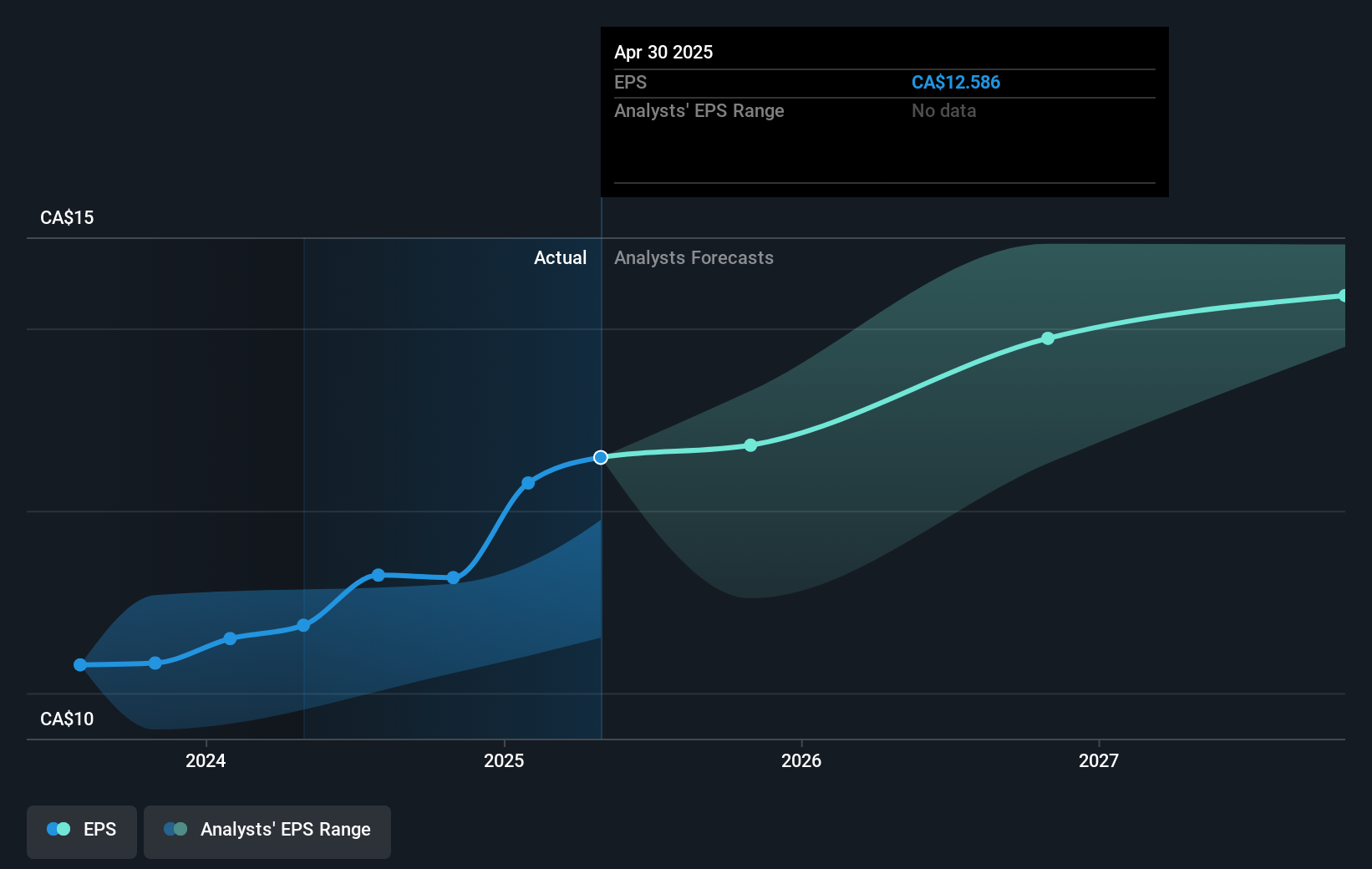

The introduction of a no monthly fee bank account for Indigenous clients by Royal Bank of Canada underscores its commitment to financial inclusivity, which may enhance the bank's public image and customer base. This initiative, along with its recent earnings growth and dividend increase, can positively influence future revenue and earnings forecasts, particularly as the bank continues its digital expansion and streamlines processes for greater customer satisfaction. Looking ahead, these efforts could bolster transaction volumes and revenue growth, aligning with analysts' expectations of future performance.

Over the past five years, Royal Bank of Canada's total shareholder return stood at 125.12%, a substantial increase that reflects the company's robust performance. Over the past year alone, RBC underperformed the Canadian Banks industry, which returned 27.1%, highlighting a divergence from broader industry trends. Despite this, the bank's strong historical performance provides context for its current valuation.

The current share price of CA$189.41 shows a slight discount to the consensus price target of CA$192.29, which represents a modest price movement compared to a valuation estimate. Analysts anticipate revenue growth of 7.7% annually over the next three years, with earnings expected to rise to CA$19.9 billion by 2028. As company strategies, such as the HSBC Canada acquisition, begin to realize synergies, these forecasts may become more attainable, impacting its trading multiples and aligning the price closer to analyst estimates.

Review our historical performance report to gain insights into Royal Bank of Canada's track record.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:RY

Royal Bank of Canada

Operates as a diversified financial service company worldwide.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives