Exploring Three TSX Dividend Stocks Including National Bank of Canada

Reviewed by Simply Wall St

Over the past year, the Canadian market has shown robust growth with a 13% increase, despite a recent flat performance over the last week. In this context, dividend stocks like National Bank of Canada can be appealing for their potential to provide investors with steady income streams in addition to capital appreciation opportunities.

Top 10 Dividend Stocks In Canada

| Name | Dividend Yield | Dividend Rating |

| Bank of Nova Scotia (TSX:BNS) | 6.51% | ★★★★★★ |

| Whitecap Resources (TSX:WCP) | 7.02% | ★★★★★★ |

| Power Corporation of Canada (TSX:POW) | 5.64% | ★★★★★☆ |

| Enghouse Systems (TSX:ENGH) | 3.56% | ★★★★★☆ |

| Secure Energy Services (TSX:SES) | 3.51% | ★★★★★☆ |

| Boston Pizza Royalties Income Fund (TSX:BPF.UN) | 8.61% | ★★★★★☆ |

| Russel Metals (TSX:RUS) | 4.38% | ★★★★★☆ |

| Canadian Natural Resources (TSX:CNQ) | 4.07% | ★★★★★☆ |

| Royal Bank of Canada (TSX:RY) | 3.81% | ★★★★★☆ |

| Sun Life Financial (TSX:SLF) | 4.66% | ★★★★★☆ |

Click here to see the full list of 31 stocks from our Top TSX Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

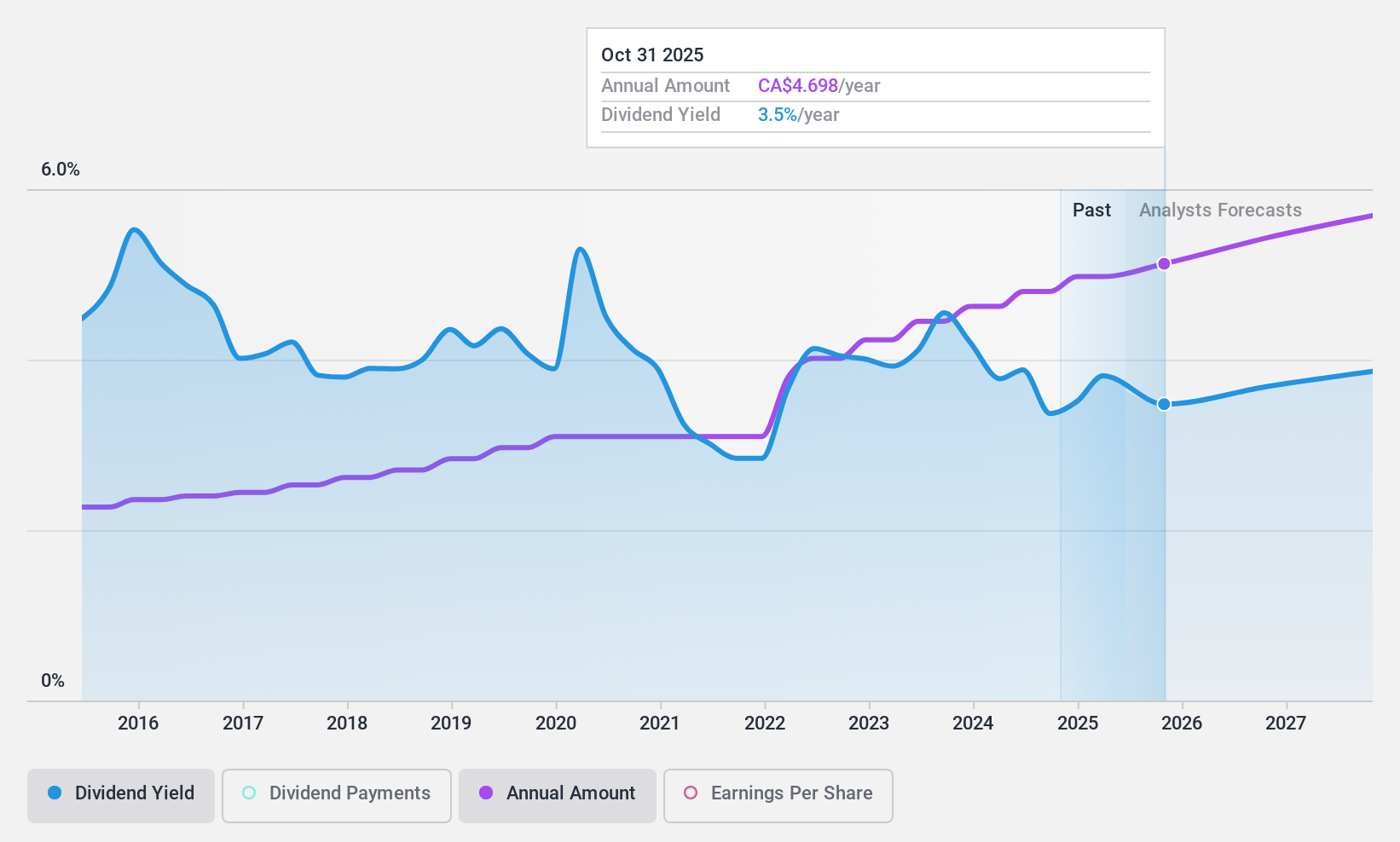

National Bank of Canada (TSX:NA)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: National Bank of Canada offers financial services to a diverse clientele, including individuals, businesses, and governmental bodies both in Canada and globally, with a market capitalization of approximately CA$39.22 billion.

Operations: National Bank of Canada generates revenue through its Wealth Management segment (CA$2.54 billion), Personal and Commercial banking (CA$4.32 billion), Financial Markets excluding USSF&I (CA$2.66 billion), and U.S. Specialty Finance and International operations (CA$1.10 billion).

Dividend Yield: 3.7%

National Bank of Canada offers a stable and reliable dividend, maintaining a payout for over a decade with recent dividends well-covered by earnings, showing a 42.5% payout ratio. Despite trading at 33.4% below its estimated fair value and having a lower yield (3.72%) compared to the top Canadian dividend payers, it has demonstrated consistent growth in dividend payments. Revenue forecasts suggest an 8.69% annual increase, supporting future dividend sustainability with an anticipated payout ratio of 46.2% in three years.

- Dive into the specifics of National Bank of Canada here with our thorough dividend report.

- The analysis detailed in our National Bank of Canada valuation report hints at an deflated share price compared to its estimated value.

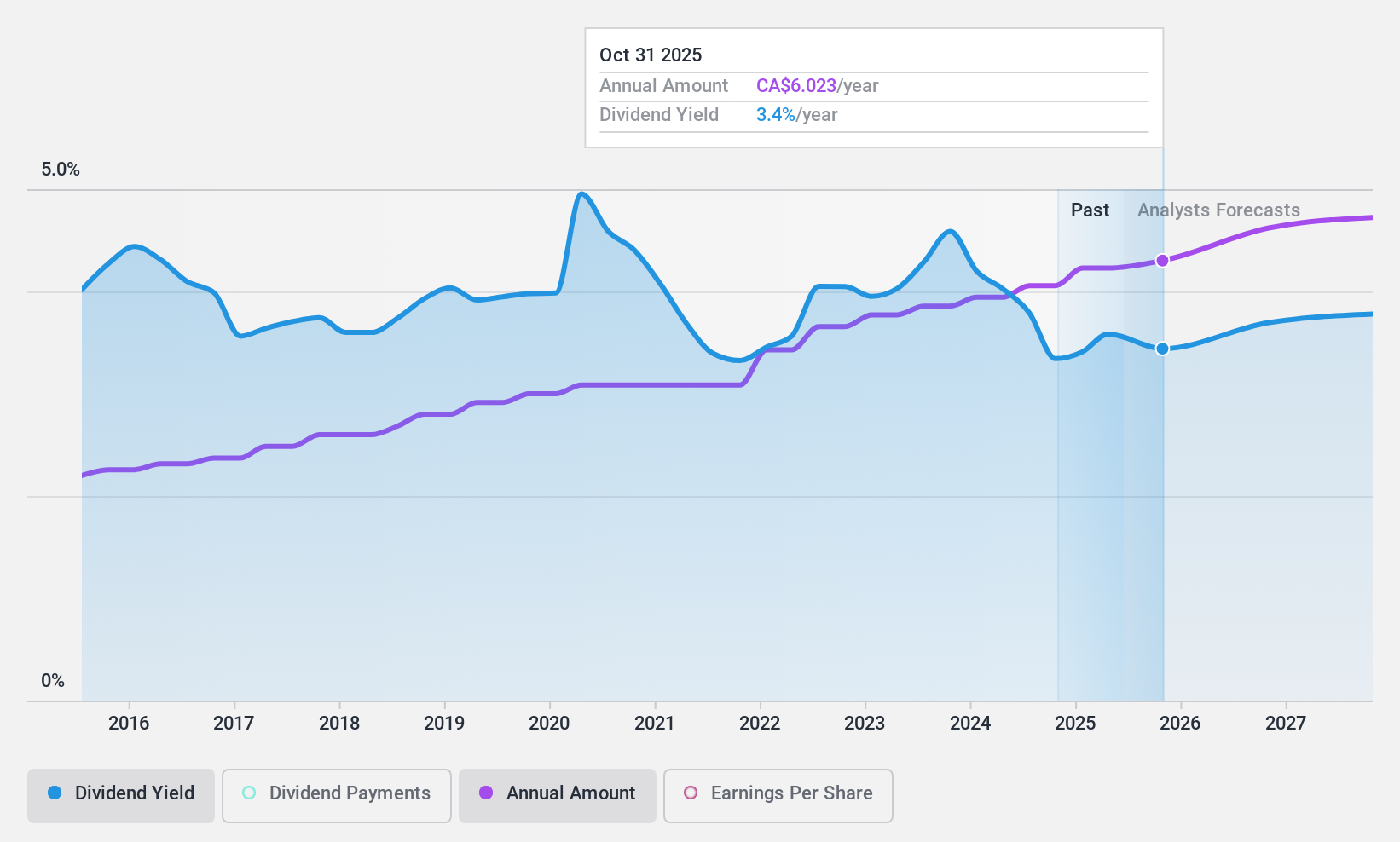

Royal Bank of Canada (TSX:RY)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Royal Bank of Canada is a diversified financial services company with global operations and a market capitalization of approximately CA$204.36 billion.

Operations: Royal Bank of Canada generates revenue through several key segments: Personal & Commercial Banking (CA$20.56 billion), Wealth Management (CA$17.25 billion), Capital Markets (CA$10.19 billion), and Insurance (CA$5.88 billion).

Dividend Yield: 3.8%

Royal Bank of Canada provides a stable dividend, with payments increasing over the past decade and a payout ratio at 50.1%, indicating that dividends are well-covered by earnings. Despite its lower yield of 3.81% compared to higher market averages, RBC's dividends are projected to remain sustainable with similar coverage expected in three years (50.6%). The bank's recent trading price is 26.7% below its estimated fair value, potentially offering an attractive entry point for investors considering long-term income generation through dividends.

- Click here and access our complete dividend analysis report to understand the dynamics of Royal Bank of Canada.

- According our valuation report, there's an indication that Royal Bank of Canada's share price might be on the expensive side.

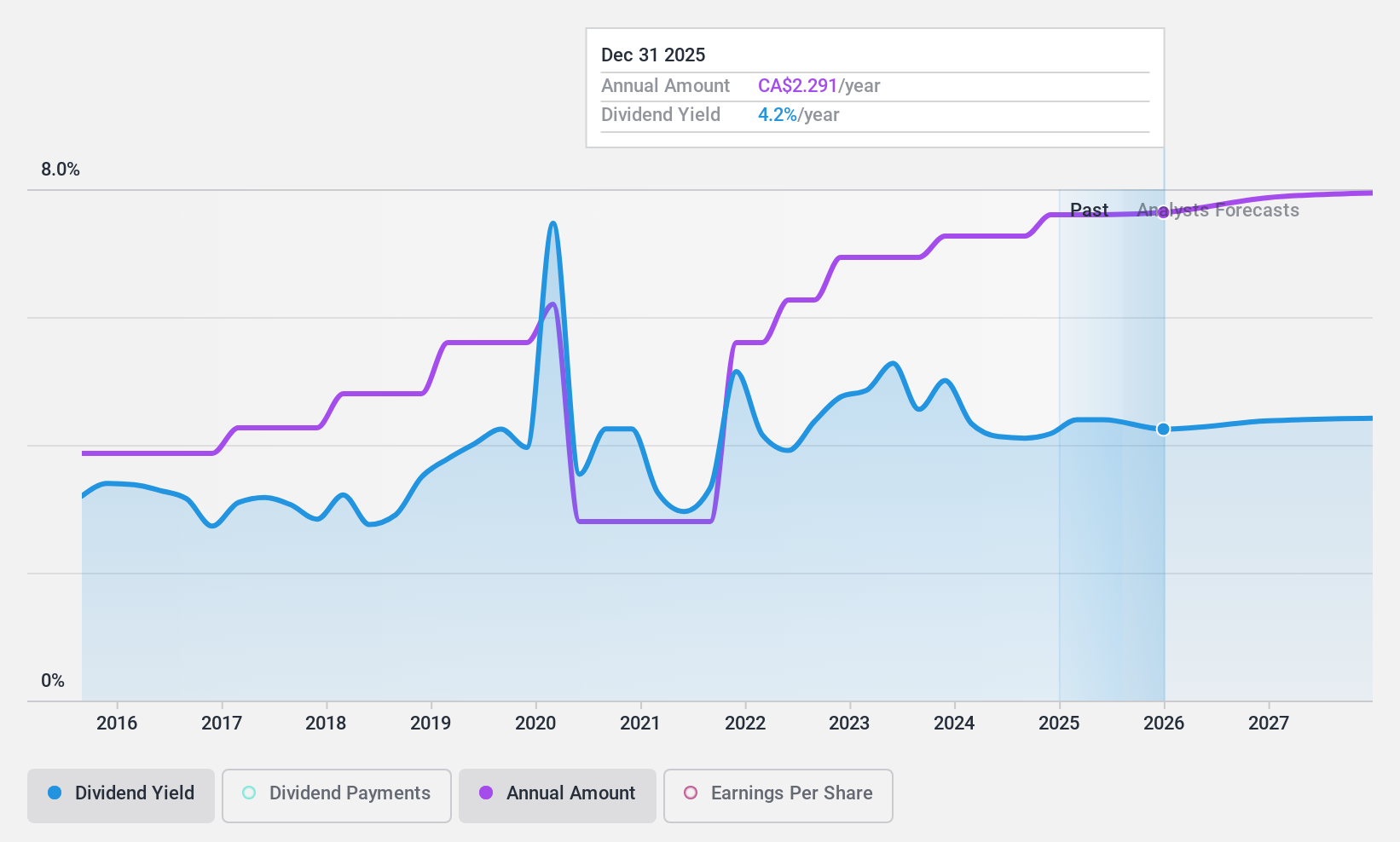

Suncor Energy (TSX:SU)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Suncor Energy Inc. is an integrated energy company with operations across Canada, the United States, and internationally, boasting a market capitalization of approximately CA$72.05 billion.

Operations: Suncor Energy Inc.'s revenue is primarily derived from its Oil Sands segment, which generated CA$23.76 billion, and its Refining and Marketing segment, contributing CA$31.51 billion, with an additional CA$2.17 billion from Exploration and Production.

Dividend Yield: 3.9%

Suncor Energy has shown robust production growth, with oil sands production increasing significantly from the previous year. Despite a lower net income in Q1 2024 compared to the same period last year, the company maintains a quarterly dividend of CA$0.545 per share. However, its dividend yield of 3.93% is below the top tier in Canada's market and has experienced volatility over the past decade. The dividends are reasonably covered by both earnings and cash flow with a payout ratio of 35.2%, suggesting sustainability despite past fluctuations.

- Get an in-depth perspective on Suncor Energy's performance by reading our dividend report here.

- Our comprehensive valuation report raises the possibility that Suncor Energy is priced lower than what may be justified by its financials.

Taking Advantage

- Take a closer look at our Top TSX Dividend Stocks list of 31 companies by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:RY

Royal Bank of Canada

Operates as a diversified financial service company worldwide.

Flawless balance sheet established dividend payer.