National Bank of Canada (TSX:NA) Valuation After Strong Q4 Beat, Dividend Hike and Strategic Growth Moves

Reviewed by Simply Wall St

National Bank of Canada (TSX:NA) just delivered a stronger than expected Q4, powered by big gains in capital markets and wealth management, and backed that up with another dividend hike that signals confidence.

See our latest analysis for National Bank of Canada.

Those moves are resonating with investors, with the share price at about CA$170.76 after a powerful 30.9% year to date share price return and a 33.2% one year total shareholder return, suggesting momentum is building rather than fading.

If this mix of disciplined growth and rising dividends has your attention, it could be a good moment to scan for other bank backed businesses and explore fast growing stocks with high insider ownership

With the share price now edging above the average analyst target yet our intrinsic value work still suggesting upside, investors face a pivotal question: Is National Bank cheap relative to its growth, or is the market already looking ahead?

Most Popular Narrative: 1.7% Overvalued

With National Bank of Canada closing at CA$170.76 against a narrative fair value of about CA$167.93, expectations are finely balanced and heavily dependent on long term earnings power.

Successful integration of Canadian Western Bank (CWB) and rapid realization of cost and funding synergies are progressing ahead of expectations, with revenue synergies yet to come. This positions the bank for accelerated revenue growth and improved net margins as integration milestones are completed over the next 18 months.

Curious what kind of revenue climb, margin reset, and richer future earnings multiple are embedded in that fair value, and how aggressive those assumptions really are? The narrative breaks down a surprisingly ambitious path for earnings and valuation multiples that might change how you see the current share price.

Result: Fair Value of $167.93 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, those upbeat assumptions could unravel if net interest margins keep compressing or credit losses rise faster than expected in a softer economy.

Find out about the key risks to this National Bank of Canada narrative.

Another View: DCF Points to Deep Value

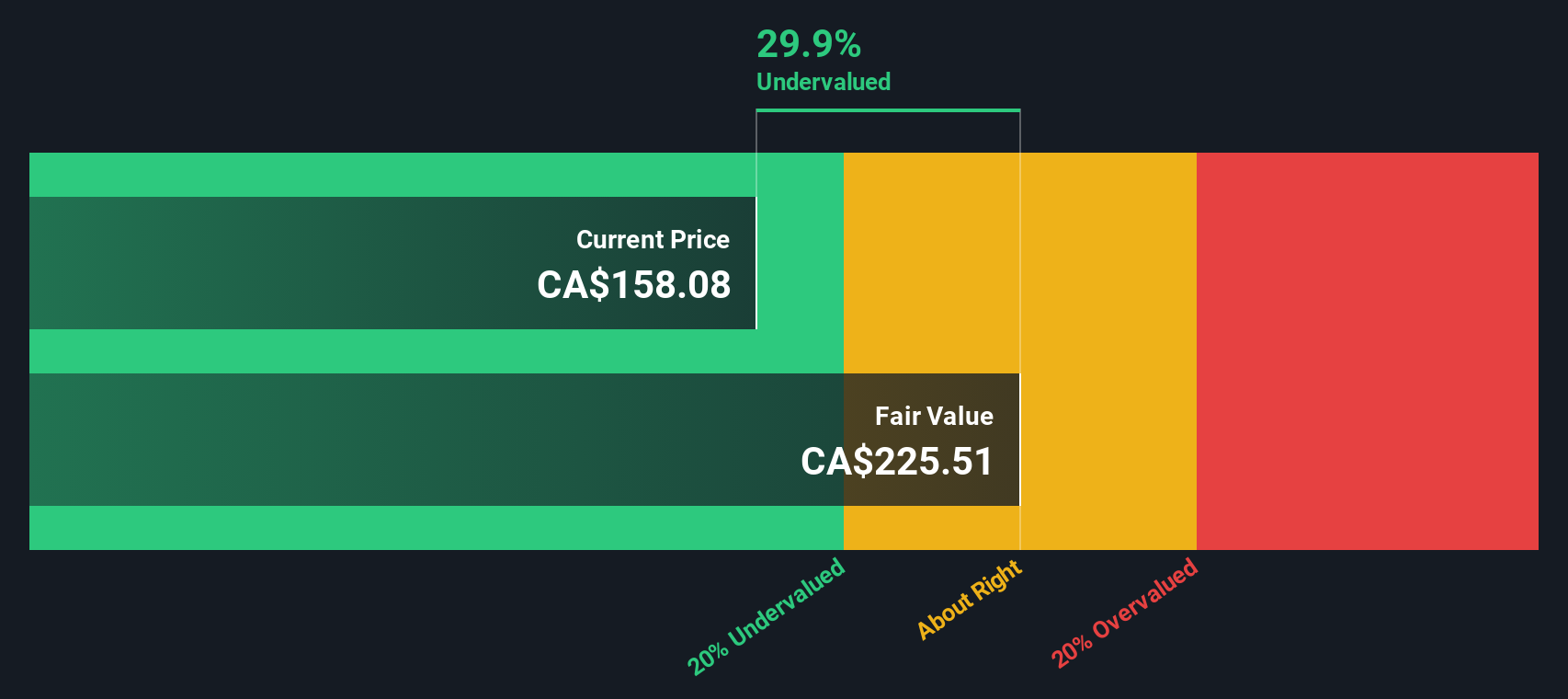

Our DCF model paints a very different picture, putting fair value near CA$236.83 and implying National Bank might be about 28% undervalued at CA$170.76. If cash flows really compound as expected, is the market underestimating this bank or just demanding a bigger safety margin?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out National Bank of Canada for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 906 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own National Bank of Canada Narrative

If you would rather dig into the numbers yourself and challenge these assumptions, you can build a full narrative in just a few minutes: Do it your way

A great starting point for your National Bank of Canada research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If you stop with just one bank, you could miss out on other powerful opportunities. Use the Simply Wall St Screener to surface your next great holding.

- Capitalize on mispriced opportunities by scanning these 906 undervalued stocks based on cash flows that the market has not fully appreciated yet.

- Ride the next wave of innovation by targeting these 26 AI penny stocks positioned at the forefront of artificial intelligence growth.

- Strengthen your income stream by focusing on these 15 dividend stocks with yields > 3% that can potentially boost long term total returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if National Bank of Canada might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:NA

National Bank of Canada

Provides financial services to individuals, businesses, institutional clients, and governments in Canada and internationally.

Excellent balance sheet established dividend payer.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026