Is National Bank of Canada (TSX:NA) Fairly Valued After Strong Recent Returns?

Reviewed by Kshitija Bhandaru

National Bank of Canada (TSX:NA) shares have shown some movement in recent weeks, catching the eye of investors who track large-cap Canadian banks. Given its steady performance this year, many are reevaluating its place in their portfolios.

See our latest analysis for National Bank of Canada.

National Bank of Canada’s share price continues to edge higher, reflecting steady confidence among investors, and the 15.7% year-to-date share price return suggests momentum is building. On a longer horizon, shareholders have enjoyed a robust 19% total return over the past year and an exceptional 90% total return over three years. This demonstrates that the bank has quietly been a strong performer.

If recent gains in financials have you thinking about what else could surprise, this is a perfect moment to expand your search and discover fast growing stocks with high insider ownership

Yet with shares up sharply and recent returns outpacing the broader sector, the key question is whether National Bank of Canada is now undervalued or if its strong growth prospects are already reflected in the current price.

Most Popular Narrative: Fairly Valued

With National Bank of Canada's latest close of CA$150.99 sitting just above the most-followed narrative's fair value of CA$148.46, analysts appear to believe the current price is in line with fundamentals. The narrow gap between price and valuation reflects a consensus that the market is neither overly optimistic nor pessimistic about the stock right now.

Successful integration of Canadian Western Bank (CWB) and rapid realization of cost and funding synergies are progressing ahead of expectations, with revenue synergies yet to come. This positions the bank for accelerated revenue growth and improved net margins as integration milestones are completed over the next 18 months.

What’s powering this steady stance? The narrative hinges on a bold bet: integration wins and operational efficiency are set to reshape future earnings. Want to know how this story weaves together growth forecasts, margin bets, and where today’s price really stands? The real test is buried in the assumptions behind this seemingly cautious fair value. Explore what makes or breaks the case for National Bank of Canada.

Result: Fair Value of $148.46 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, if rising technology costs outpace revenue or if regional exposure increases vulnerability, National Bank's current momentum may be at risk.

Find out about the key risks to this National Bank of Canada narrative.

Another View: Are Shares Really That Cheap?

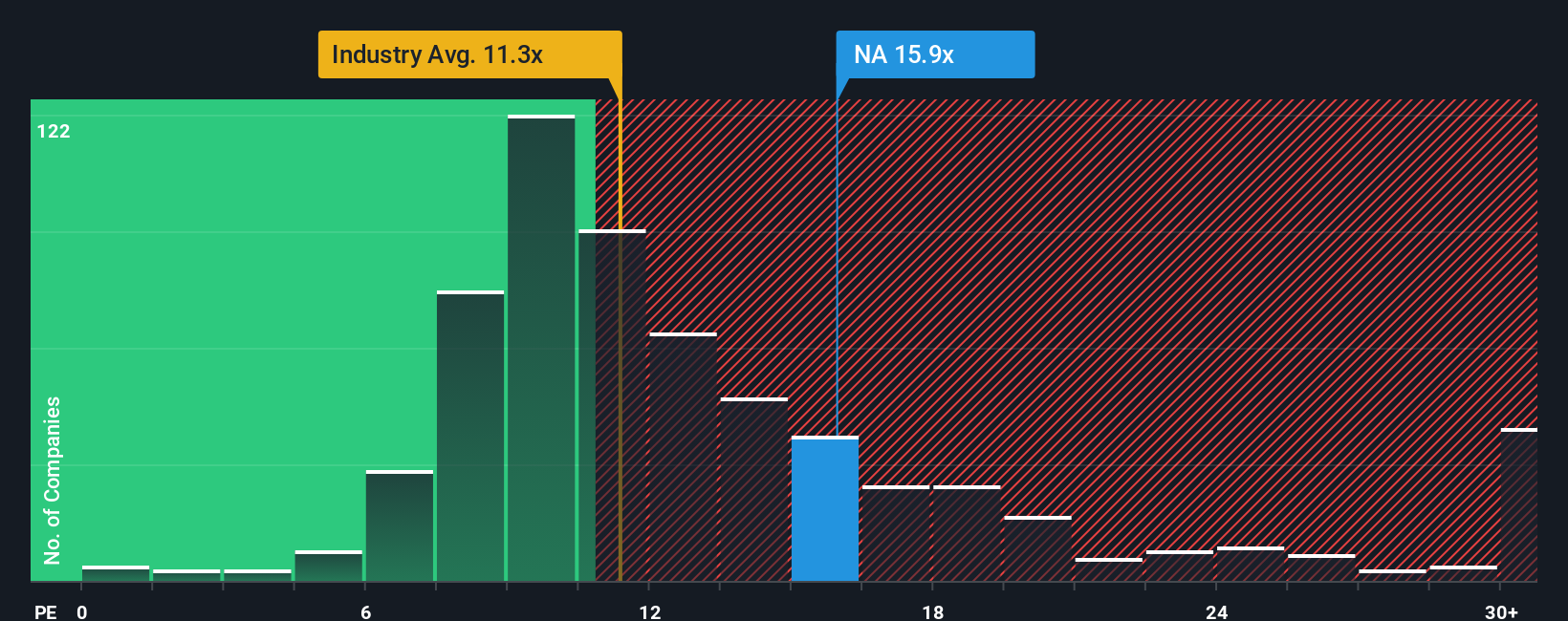

Looking through the lens of actual earnings ratios, National Bank of Canada changes the narrative. The stock currently trades at a price-to-earnings ratio of 15.8x, which is notably higher than both its peer average of 13.6x and the broader Banks sector at just 11.3x. The fair ratio, as calculated by regression models, lands at 13.1x.

This suggests investors are paying a premium, not a discount, for those growth prospects. However, does this extra optimism signal an opportunity or expose you to downside if growth slows? The gap is worth watching.

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out National Bank of Canada for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own National Bank of Canada Narrative

If you see the numbers differently or want to shape your own perspective, it takes less than three minutes to build a personal view from the ground up. So why not Do it your way

A great starting point for your National Bank of Canada research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Maximize your investing edge by going beyond the obvious. There are opportunities the crowd might be missing. Secure your advantage by moving fast on these trends before everyone else catches on.

- Power up your returns by targeting income-friendly picks. Tap into strong yields and steady cash flow via these 18 dividend stocks with yields > 3%.

- Stay ahead of the tech curve and seize tomorrow’s biggest disruptors. Zero in on emerging leaders through these 24 AI penny stocks.

- Sprint toward real value by pinpointing stocks that the market has yet to fully recognize, using these 878 undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if National Bank of Canada might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:NA

National Bank of Canada

Provides financial services to individuals, businesses, institutional clients, and governments in Canada and internationally.

Excellent balance sheet established dividend payer.

Market Insights

Community Narratives