Laurentian Bank Stock Outlook After Recent Interest Rate News and Five Year Gains of 55%

Reviewed by Bailey Pemberton

Thinking about what to do next with Laurentian Bank of Canada stock? You are certainly not alone. As seasoned investors and curious newcomers alike scan the numbers, the bank's stock price tells an intriguing story. Despite a slight dip of 1.7% in the last week and a 4.4% pullback over the past month, the year-to-date performance stands at a strong 10.4%. Zoom out further, and you will see a robust 25.8% return over the past year and an impressive 55.7% gain in five years. These numbers paint a picture of resilience and growth, hinting at shifts in market perception and an evolving risk landscape.

Recent market developments surrounding Canadian banks, including changing interest rate expectations and industry-wide strategic adjustments, have injected fresh volatility into the sector. For Laurentian Bank of Canada, these forces seem to have influenced short-term moves, but the longer-term trajectory suggests the company has turned a corner in the eyes of many investors. Its valuation is now catching renewed attention.

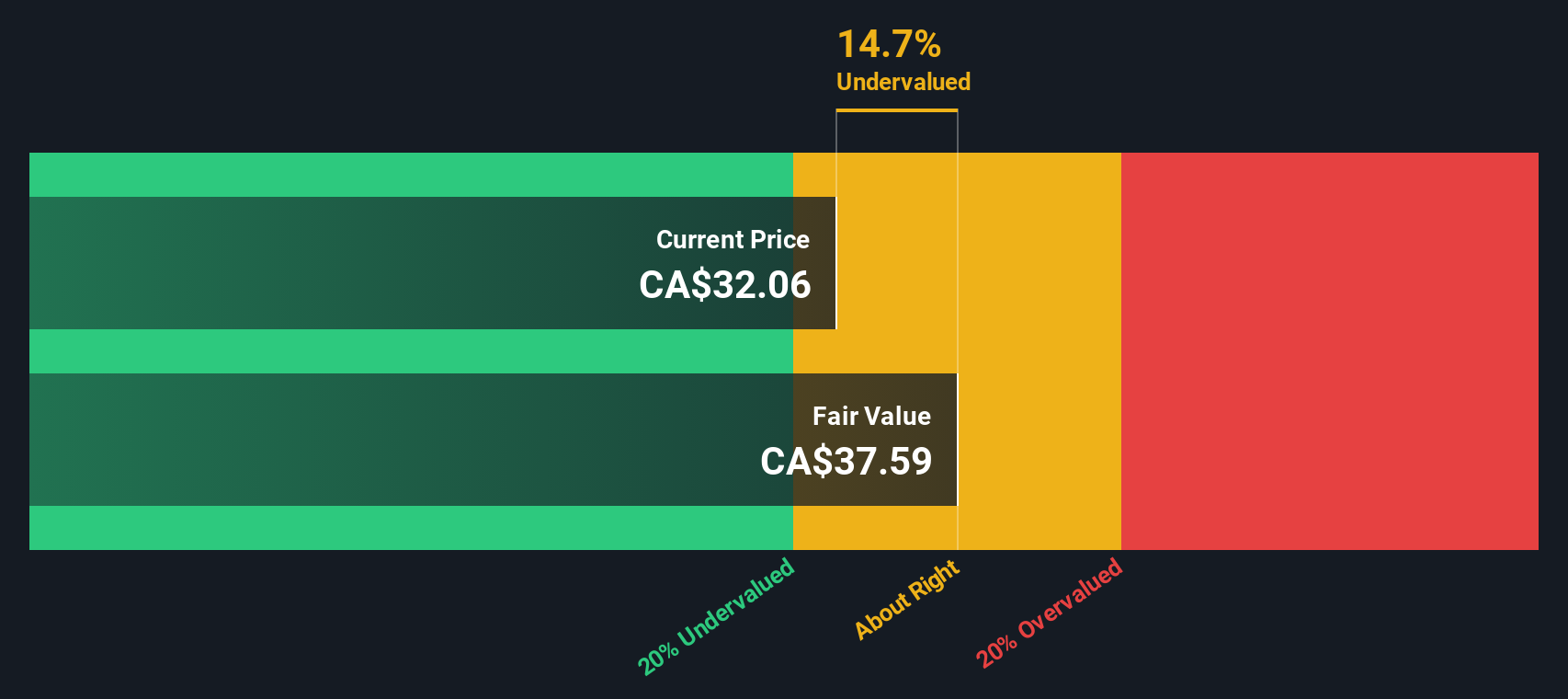

When it comes to valuing a stock, numbers matter. Perspective matters as well. Laurentian Bank of Canada currently boasts a valuation score of 4, out of a possible 6, based on standard undervaluation checks. That means the stock is considered undervalued in four separate ways. But how exactly do those valuation methods work, and what can they really tell you? Let’s break down the classic approaches. There is also an even smarter way to think about what this score means for your portfolio.

Why Laurentian Bank of Canada is lagging behind its peers

Approach 1: Laurentian Bank of Canada Excess Returns Analysis

The Excess Returns valuation model helps investors evaluate whether a bank's stock is creating value beyond its cost of equity. It does this by comparing the returns generated on invested capital to the minimum return shareholders require. In essence, if a company consistently earns more on its equity than it costs to fund that equity, it produces positive excess returns and is typically considered an attractive investment.

For Laurentian Bank of Canada, the current Book Value stands at CA$58.90 per share. The Stable EPS is estimated at CA$3.32 per share, derived from return on equity projections by seven analysts. However, the bank's Cost of Equity is slightly higher at CA$4.37 per share, resulting in a negative Excess Return of CA$-1.05 per share. The company’s Average Return on Equity is calculated at 5.52 percent, and its long-term Stable Book Value is projected at CA$60.03 per share, based on consensus from six analysts.

According to this valuation, the stock's intrinsic value reflects a 15.0 percent discount to its current price, which may indicate that it is undervalued at today’s levels.

Result: UNDERVALUED

Our Excess Returns analysis suggests Laurentian Bank of Canada is undervalued by 15.0%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

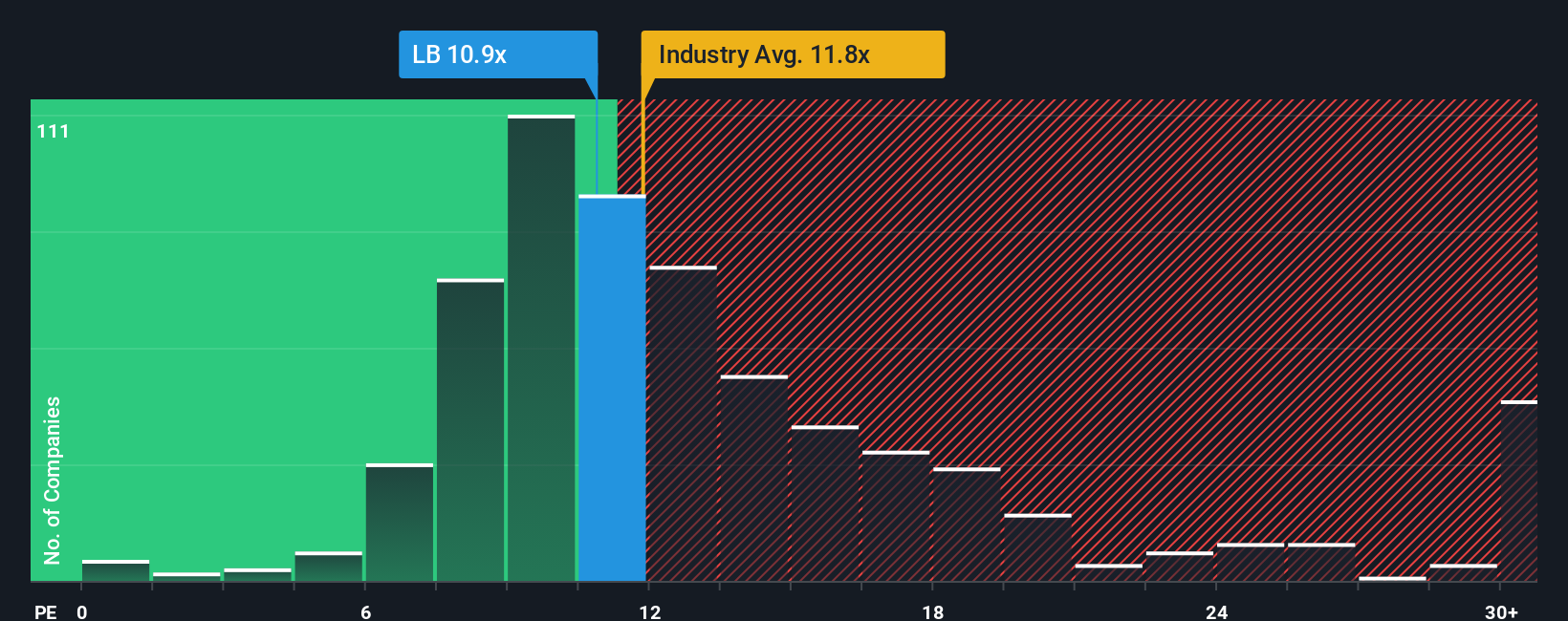

Approach 2: Laurentian Bank of Canada Price vs Earnings

For profitable companies like Laurentian Bank of Canada, the price-to-earnings (PE) ratio is a widely used and effective valuation metric. It provides a simple way to see how much investors are willing to pay per dollar of the company's earnings, serving as a quick temperature check on market sentiment and profit outlook.

The “right” PE ratio for a stock is influenced by expectations for future growth, market risks, and investor confidence. Companies expected to grow earnings rapidly or operate with less risk generally trade at higher PE ratios than those facing uncertainty or stagnation.

Currently, Laurentian Bank of Canada trades at a PE ratio of 10.5x. Compared to the Canadian Banks industry average of 10.3x and a peer group average of 15.3x, the stock appears cheaper on this metric. However, simple comparisons can miss important context.

Simply Wall St’s proprietary “Fair Ratio” is designed to account for not just industry averages but company-specific factors such as earnings growth, risk profile, profit margins, and size. For Laurentian Bank of Canada, the Fair Ratio is calculated at 10.8x, just slightly above the actual multiple. This suggests that, factoring in all relevant details, the stock is trading very close to its appropriate valuation.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Laurentian Bank of Canada Narrative

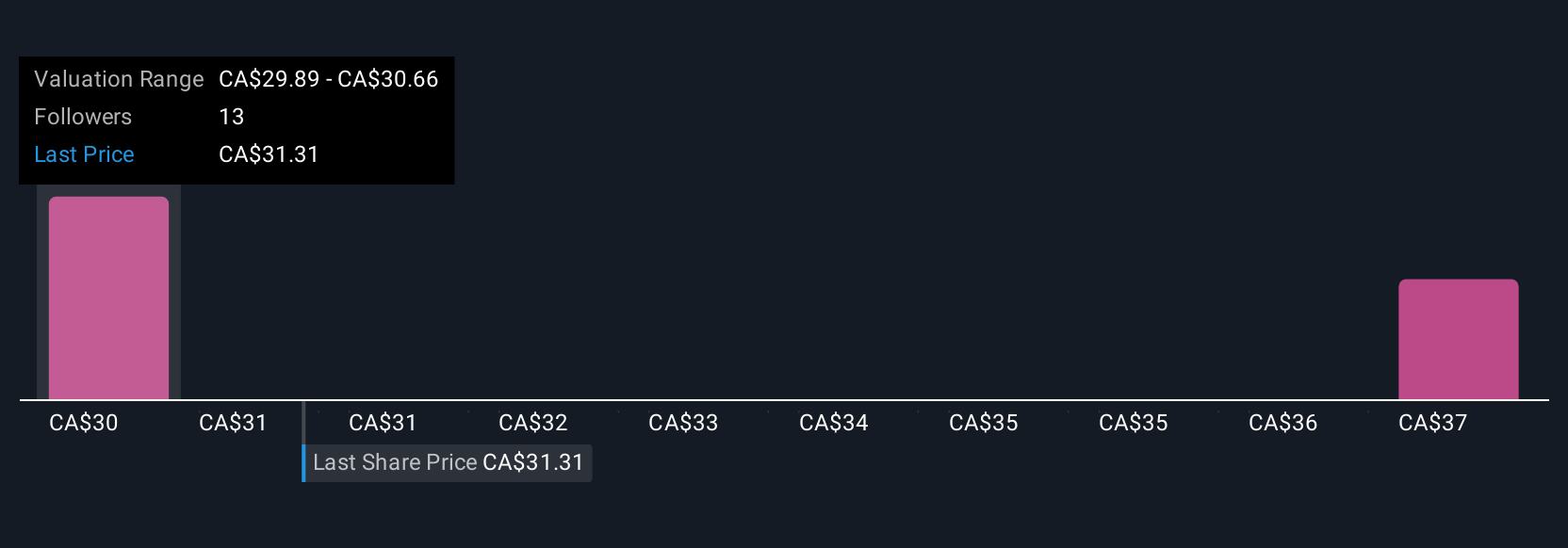

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is a story you create about a company, connecting your view of its opportunities and risks with concrete numbers: your forecast for its future revenue, earnings, profit margins, and fair value.

Unlike traditional ratios or models, a Narrative weaves together what you believe will drive the business, such as digital transformation or lending trends, with your own financial projections. This results in your personal estimate of what the stock is really worth.

This makes Narratives a simple yet powerful tool that anyone can access directly on the Simply Wall St Community page, used by millions of investors. Narratives help you explain your investment thesis and also show, moment by moment, if the current share price is above or below your calculated fair value so you can decide if it’s time to buy, hold, or sell.

Importantly, Narratives are updated automatically as soon as new news or earnings are released, so your fair value stays in sync with the latest information. For example, with Laurentian Bank of Canada, some investors see big upside from tech upgrades and loan demand (with a fair value up at CA$35), while others worry about costs and credit risk (with a fair value closer to CA$25). This highlights how different stories can drive very different investing decisions.

Do you think there's more to the story for Laurentian Bank of Canada? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:LB

Laurentian Bank of Canada

Provides various financial services to personal, commercial, and institutional customers in Canada and the United States.

Mediocre balance sheet second-rate dividend payer.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Rocket Lab USA Will Ignite a 30% Revenue Growth Journey

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion