- Canada

- /

- Diversified Financial

- /

- TSX:HCG

With EPS Growth And More, Home Capital Group (TSE:HCG) Is Interesting

Like a puppy chasing its tail, some new investors often chase 'the next big thing', even if that means buying 'story stocks' without revenue, let alone profit. Unfortunately, high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson.

In the age of tech-stock blue-sky investing, my choice may seem old fashioned; I still prefer profitable companies like Home Capital Group (TSE:HCG). While profit is not necessarily a social good, it's easy to admire a business that can consistently produce it. While a well funded company may sustain losses for years, unless its owners have an endless appetite for subsidizing the customer, it will need to generate a profit eventually, or else breathe its last breath.

View our latest analysis for Home Capital Group

How Fast Is Home Capital Group Growing?

If a company can keep growing earnings per share (EPS) long enough, its share price will eventually follow. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. I, for one, am blown away by the fact that Home Capital Group has grown EPS by 46% per year, over the last three years. That sort of growth never lasts long, but like a shooting star it is well worth watching when it happens.

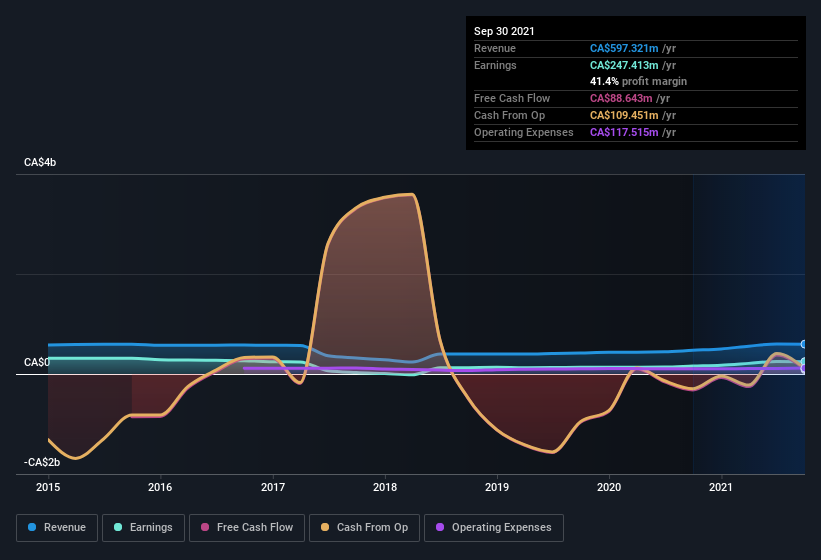

I like to take a look at earnings before interest and (EBIT) tax margins, as well as revenue growth, to get another take on the quality of the company's growth. I note that Home Capital Group's revenue from operations was lower than its revenue in the last twelve months, so that could distort my analysis of its margins. While we note Home Capital Group's EBIT margins were flat over the last year, revenue grew by a solid 26% to CA$597m. That's progress.

In the chart below, you can see how the company has grown earnings, and revenue, over time. Click on the chart to see the exact numbers.

Of course the knack is to find stocks that have their best days in the future, not in the past. You could base your opinion on past performance, of course, but you may also want to check this interactive graph of professional analyst EPS forecasts for Home Capital Group.

Are Home Capital Group Insiders Aligned With All Shareholders?

Like the kids in the streets standing up for their beliefs, insider share purchases give me reason to believe in a brighter future. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

Over the last 12 months Home Capital Group insiders spent CA$110k more buying shares than they received from selling them. Although I don't particularly like to see selling, the fact that they put more capital in, than they extracted, is a positive in my mind. Zooming in, we can see that the biggest insider purchase was by Independent Director James Lisson for CA$89k worth of shares, at about CA$29.63 per share.

Is Home Capital Group Worth Keeping An Eye On?

Home Capital Group's earnings have taken off like any random crypto-currency did, back in 2017. Growth investors should find it difficult to look past that strong EPS move. And indeed, it could be a sign that the business is at an inflection point. For me, this situation certainly piques my interest. Of course, just because Home Capital Group is growing does not mean it is undervalued. If you're wondering about the valuation, check out this gauge of its price-to-earnings ratio, as compared to its industry.

The good news is that Home Capital Group is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Home Capital Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:HCG

Home Capital Group

Home Capital Group Inc., through its subsidiary, Home Trust Company, provides residential and non-residential mortgage lending, securitization of residential mortgage products, consumer lending, and credit card services in Canada.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives