- Canada

- /

- Diversified Financial

- /

- TSX:HCG

With EPS Growth And More, Home Capital Group (TSE:HCG) Is Interesting

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it completely lacks a track record of revenue and profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses.

In the age of tech-stock blue-sky investing, my choice may seem old fashioned; I still prefer profitable companies like Home Capital Group (TSE:HCG). Now, I'm not saying that the stock is necessarily undervalued today; but I can't shake an appreciation for the profitability of the business itself. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

See our latest analysis for Home Capital Group

Home Capital Group's Earnings Per Share Are Growing.

As one of my mentors once told me, share price follows earnings per share (EPS). Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. Who among us would not applaud Home Capital Group's stratospheric annual EPS growth of 46%, compound, over the last three years? That sort of growth never lasts long, but like a shooting star it is well worth watching when it happens.

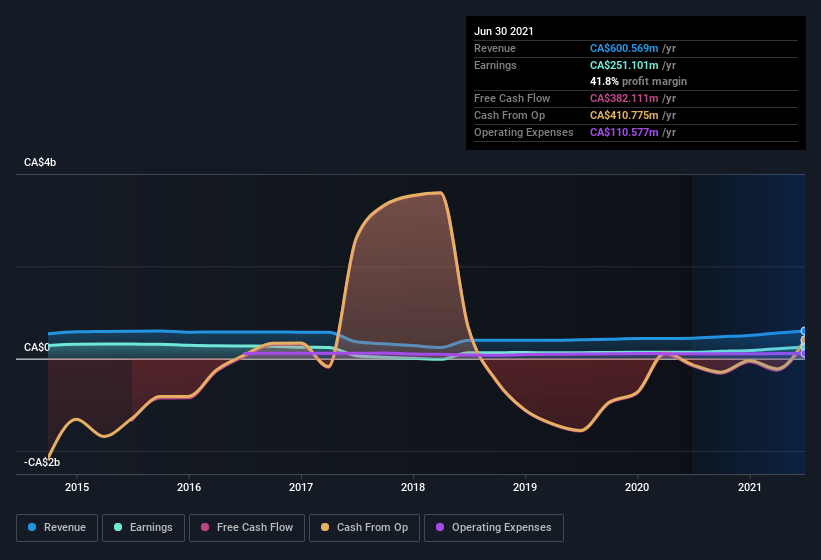

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. I note that Home Capital Group's revenue from operations was lower than its revenue in the last twelve months, so that could distort my analysis of its margins. While we note Home Capital Group's EBIT margins were flat over the last year, revenue grew by a solid 35% to CA$601m. That's a real positive.

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

Fortunately, we've got access to analyst forecasts of Home Capital Group's future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

Are Home Capital Group Insiders Aligned With All Shareholders?

Like the kids in the streets standing up for their beliefs, insider share purchases give me reason to believe in a brighter future. Because oftentimes, the purchase of stock is a sign that the buyer views it as undervalued. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

Insiders both bought and sold Home Capital Group shares in the last year, but the good news is they spent CA$48k more buying than they netted selling. When you weigh that up, it is a mild positive, indicating increased alignment between shareholders and management. Zooming in, we can see that the biggest insider purchase was by James Pelletier for CA$106k worth of shares, at about CA$28.32 per share.

Is Home Capital Group Worth Keeping An Eye On?

Home Capital Group's earnings per share growth have been levitating higher, like a mountain goat scaling the Alps. If you're like me, you'll find it hard to ignore that sort of explosive EPS growth. And indeed, it could be a sign that the business is at an inflection point. For me, this situation certainly piques my interest. Before you take the next step you should know about the 1 warning sign for Home Capital Group that we have uncovered.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Home Capital Group, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

When trading stocks or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Home Capital Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TSX:HCG

Home Capital Group

Home Capital Group Inc., through its subsidiary, Home Trust Company, provides residential and non-residential mortgage lending, securitization of residential mortgage products, consumer lending, and credit card services in Canada.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives