- Canada

- /

- Oil and Gas

- /

- TSX:TAL

TSX Dividend Stocks Including Canadian Imperial Bank of Commerce And 2 More Income Generators

Reviewed by Simply Wall St

In the Canadian market, recent data indicates a slowdown in consumer spending, partly due to a drop in the auto sector and slower population growth, leading to a subdued short-term growth outlook. Despite these challenges, dividend stocks remain an attractive option for investors seeking income generation and stability amid economic uncertainties. In this article, we will explore three TSX dividend stocks including Canadian Imperial Bank of Commerce that offer potential resilience and consistent returns in today's market environment.

Top 10 Dividend Stocks In Canada

| Name | Dividend Yield | Dividend Rating |

| Wajax (TSX:WJX) | 5.04% | ★★★★★☆ |

| Rogers Sugar (TSX:RSI) | 5.57% | ★★★★☆☆ |

| Pulse Seismic (TSX:PSD) | 17.03% | ★★★★★☆ |

| Power Corporation of Canada (TSX:POW) | 3.41% | ★★★★★☆ |

| Pizza Pizza Royalty (TSX:PZA) | 6.16% | ★★★★☆☆ |

| Olympia Financial Group (TSX:OLY) | 6.21% | ★★★★★☆ |

| Hemisphere Energy (TSXV:HME) | 7.92% | ★★★★☆☆ |

| Great-West Lifeco (TSX:GWO) | 3.75% | ★★★★★☆ |

| Canadian Imperial Bank of Commerce (TSX:CM) | 3.23% | ★★★★★☆ |

| Bank of Montreal (TSX:BMO) | 3.70% | ★★★★★☆ |

Click here to see the full list of 16 stocks from our Top TSX Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

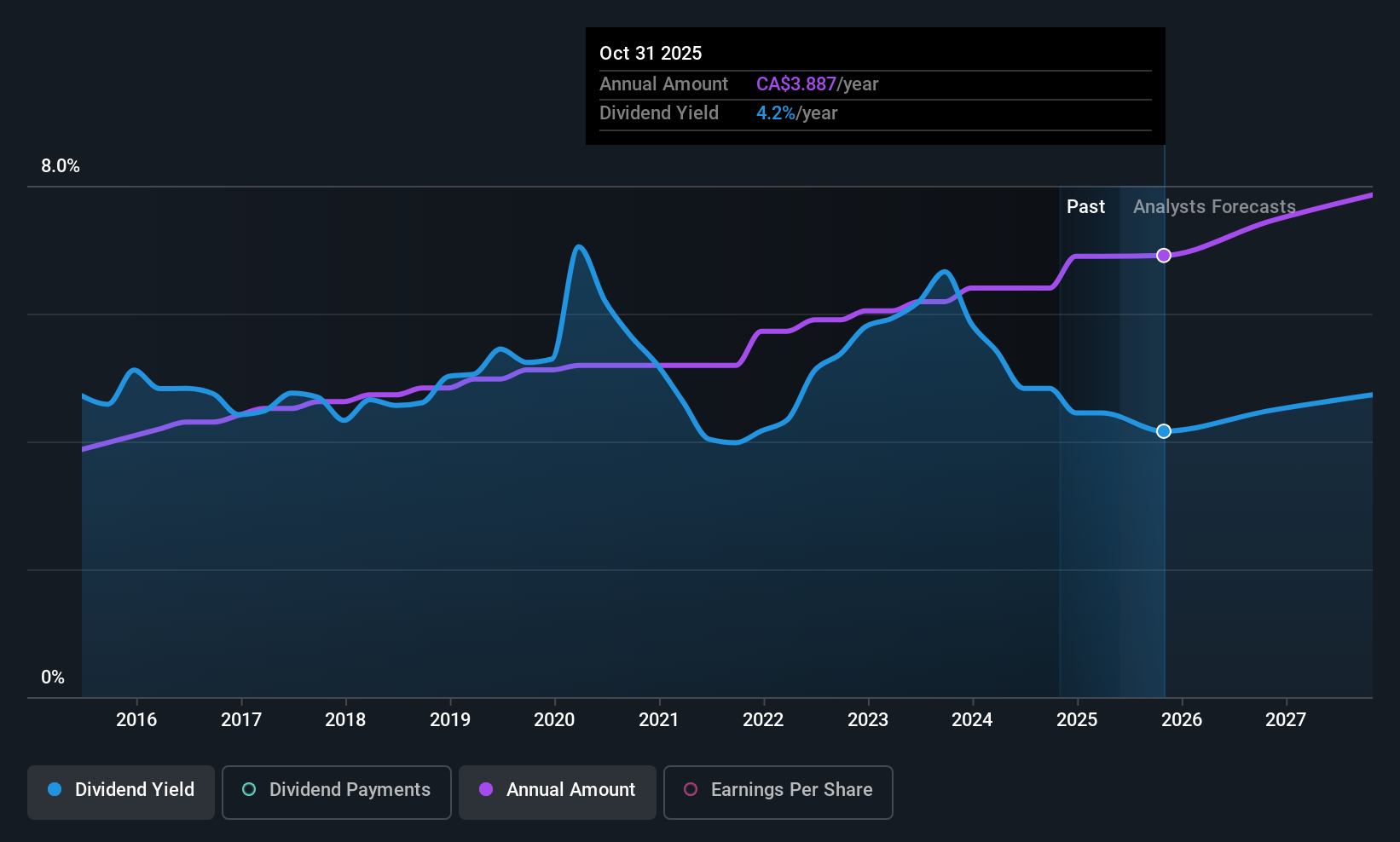

Canadian Imperial Bank of Commerce (TSX:CM)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Canadian Imperial Bank of Commerce is a diversified financial institution offering a range of financial products and services to personal, business, public sector, and institutional clients across Canada, the United States, and internationally with a market cap of CA$111.82 billion.

Operations: Canadian Imperial Bank of Commerce's revenue segments include Canadian Personal and Business Banking (CA$9.47 billion), Capital Markets and Direct Financial Services (CA$6.59 billion), U.S. Commercial Banking and Wealth Management (CA$2.83 billion), and Canadian Commercial Banking and Wealth Management (CA$6.24 billion).

Dividend Yield: 3.2%

Canadian Imperial Bank of Commerce offers a stable dividend yield of 3.24%, lower than the top Canadian payers, but backed by a solid payout ratio of 45.8%, ensuring sustainability. The bank's dividends have been reliable and growing over the past decade. Recent fixed-income offerings, including significant bond issuances, highlight its strong capital management strategy, while ongoing share buybacks reflect efforts to enhance shareholder value amidst robust earnings growth and strategic initiatives in innovation banking.

- Unlock comprehensive insights into our analysis of Canadian Imperial Bank of Commerce stock in this dividend report.

- Our expertly prepared valuation report Canadian Imperial Bank of Commerce implies its share price may be lower than expected.

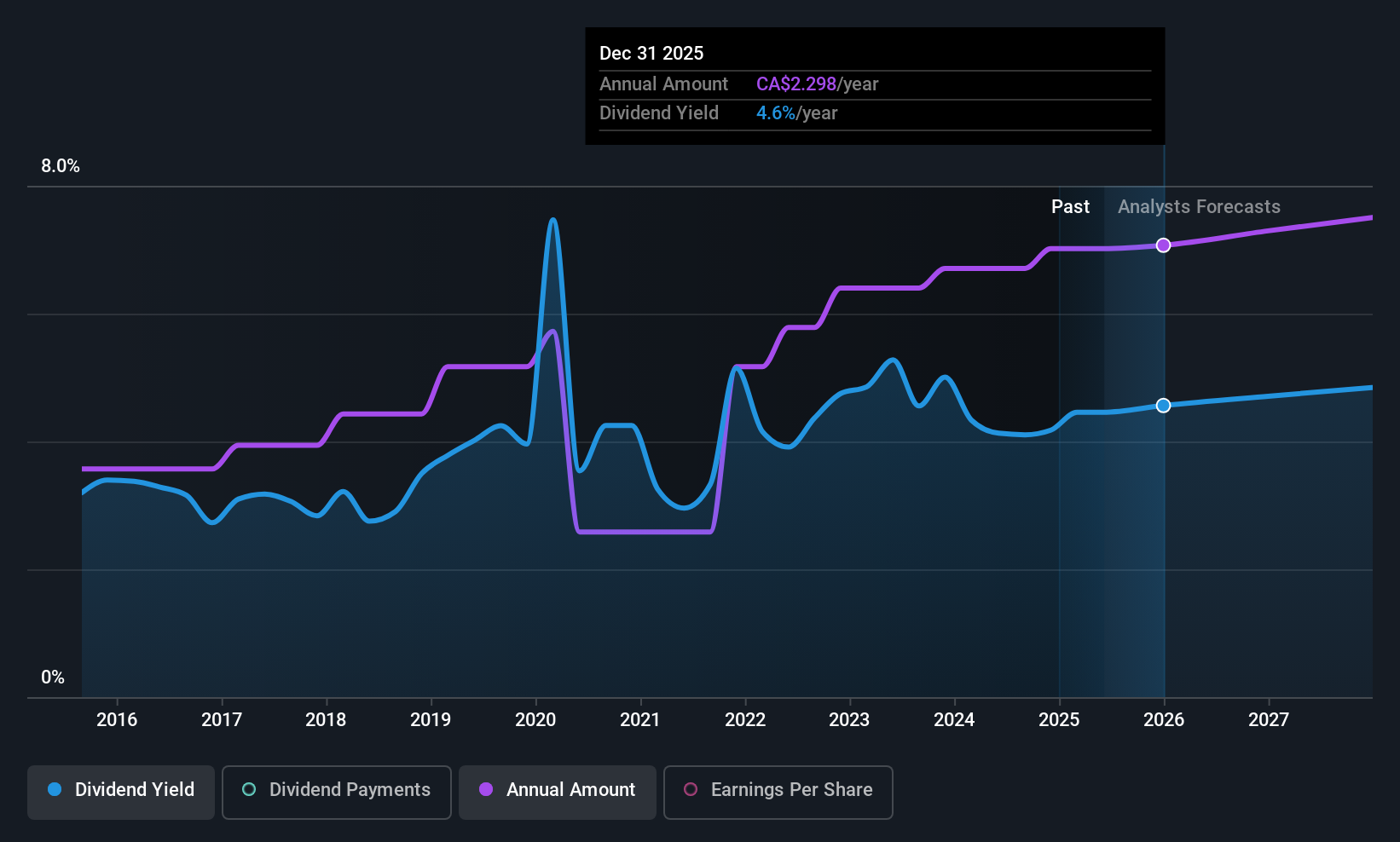

Suncor Energy (TSX:SU)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Suncor Energy Inc. is an integrated energy company operating in Canada, the United States, and internationally with a market cap of CA$75.30 billion.

Operations: Suncor Energy Inc.'s revenue is primarily derived from its Oil Sands segment at CA$25.06 billion, Refining and Marketing at CA$30.57 billion, and Exploration and Production at CA$2.03 billion.

Dividend Yield: 3.8%

Suncor Energy's recent dividend increase to CAD 0.60 per share reflects a commitment to shareholder returns, though its dividend history has been volatile. With a payout ratio of 53.1% and a cash payout ratio of 36%, dividends are well-covered by earnings and cash flows, suggesting sustainability despite past instability. Recent debt financing of $1 billion aims to manage existing obligations efficiently, while ongoing share buybacks further indicate efforts to enhance shareholder value amidst fluctuating profitability.

- Click here to discover the nuances of Suncor Energy with our detailed analytical dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Suncor Energy shares in the market.

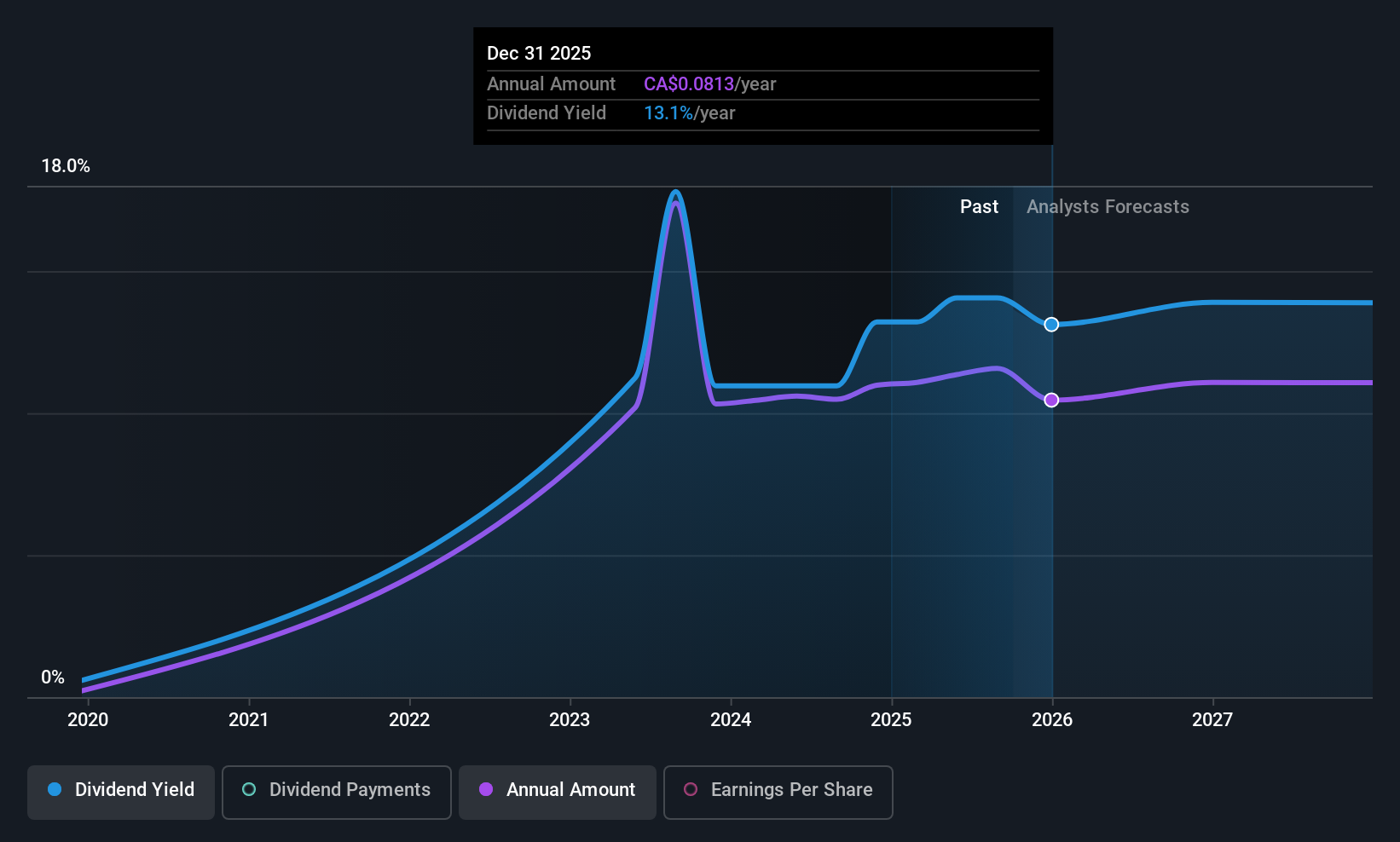

PetroTal (TSX:TAL)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: PetroTal Corp. is involved in the acquisition, exploration, appraisal, development, and production of oil and natural gas properties in Peru with a market cap of CA$351.49 million.

Operations: PetroTal Corp.'s revenue is primarily derived from its oil and gas exploration and production segment, which generated $310.85 million.

Dividend Yield: 21.6%

PetroTal's recent suspension of its quarterly dividend raises concerns for dividend investors, despite a previous strong payout history with $144 million returned via dividends since 2023. The decision reflects the company's need to maintain a minimum cash balance of $60 million amid declining revenue and net income, which fell to US$63.91 million and US$3.6 million respectively in Q3 2025. While dividends were well-covered by earnings and cash flows, production investments are prioritized over immediate shareholder returns.

- Navigate through the intricacies of PetroTal with our comprehensive dividend report here.

- According our valuation report, there's an indication that PetroTal's share price might be on the cheaper side.

Seize The Opportunity

- Dive into all 16 of the Top TSX Dividend Stocks we have identified here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:TAL

PetroTal

Engages in the acquisition, exploration, appraisal, development, and production of oil and natural gas properties in Peru.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.