Canadian Imperial Bank of Commerce (TSX:CM) Introduces Adapta Mastercard With Innovative Rewards System

Reviewed by Simply Wall St

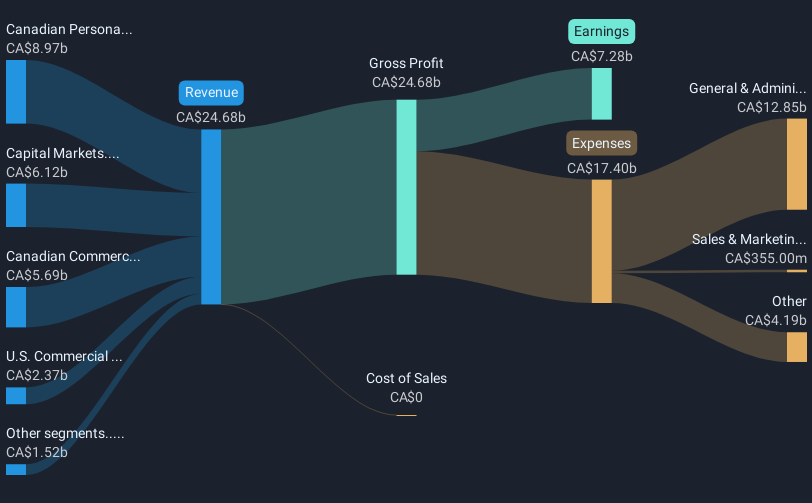

Canadian Imperial Bank of Commerce (TSX:CM) recently made waves with the launch of its Adapta Mastercard, which adapts rewards to cardholders’ spending, enhancing user experience and accessibility. This innovative product release, alongside CIBC Innovation Banking's initiatives like funding arrangements for companies such as Vena Solutions, demonstrates the company's ongoing efforts to expand its financial service offerings. However, the bank's stock price increase of 7% over the past month aligns with broader market trends, notably the 1.8% rise in market indices fueled by positive employment data and hopes of U.S.-China tariff talks.

Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

The introduction of CIBC’s Adapta Mastercard and its strategic initiatives like funding Vena Solutions could enhance client acquisition and satisfaction. These developments may contribute to revenue growth through expanded financial service offerings and improved customer engagement. Over the past five years, CIBC's total shareholder return, which includes both share price appreciation and dividends, was 176.69%. This performance reflects its ability to deliver value over the long term.

For context, while CIBC's recent one-month share price increase aligns with broader market trends, its five-year total return is significantly higher, showcasing its robust long-term growth. In comparison, CIBC has outperformed the Canadian Banks industry, which returned 15.9% over the past year. The innovative digital banking and capital market successes mentioned could bolster earnings and support analysts' forecasts, which anticipate revenue growth of 6.6% annually and an increase in earnings to CA$9.2 billion by 2028.

Despite these optimistic projections, the stock is currently trading at CA$86.47, reflecting a 9.6% potential rise to the analysts' consensus price target of CA$95.64. This suggests room for growth, contingent on executing its strategic plans and navigating economic uncertainties. As always, investors should carefully consider these factors and market conditions before making informed decisions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Canadian Imperial Bank of Commerce, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CM

Canadian Imperial Bank of Commerce

A diversified financial institution, provides various financial products and services to personal, business, public sector, and institutional clients in Canada, the United States, and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives