Canadian Imperial Bank of Commerce (TSX:CM) Enhances Client Experience with Strategic Expedia Alliance

Reviewed by Simply Wall St

Canadian Imperial Bank of Commerce (TSX:CM) is currently experiencing a mix of growth opportunities and operational challenges. Recent developments include a strategic partnership with Expedia Group and the launch of CIBC AI, which underscore its commitment to innovation, despite facing pressures from rising expenses and a decrease in net income. In the following discussion, we will explore CIBC's financial health, strategic initiatives, growth potential, and the external risks impacting its performance.

Innovative Factors Supporting Canadian Imperial Bank of Commerce

Canadian Imperial Bank of Commerce (CIBC) has demonstrated strong financial health, marked by a capital liquidity position and a CET1 ratio of 13.3%, exceeding regulatory requirements. The bank's strategic initiatives, such as the launch of CIBC AI, reflect its commitment to innovation and client engagement. This innovation is complemented by a solid dividend history, with payments growing consistently over the past decade. The bank's net income of $1.9 billion and earnings per share of $1.93, as reported by Victor Dodig, President and CEO, highlight its profitability. Despite being considered expensive with a Price-To-Earnings Ratio of 11.9x compared to the North American Banks industry average of 11.4x, CIBC is trading significantly below its estimated fair value of CA$147.04, suggesting potential upside.

Critical Issues Affecting CIBC's Performance and Areas for Growth

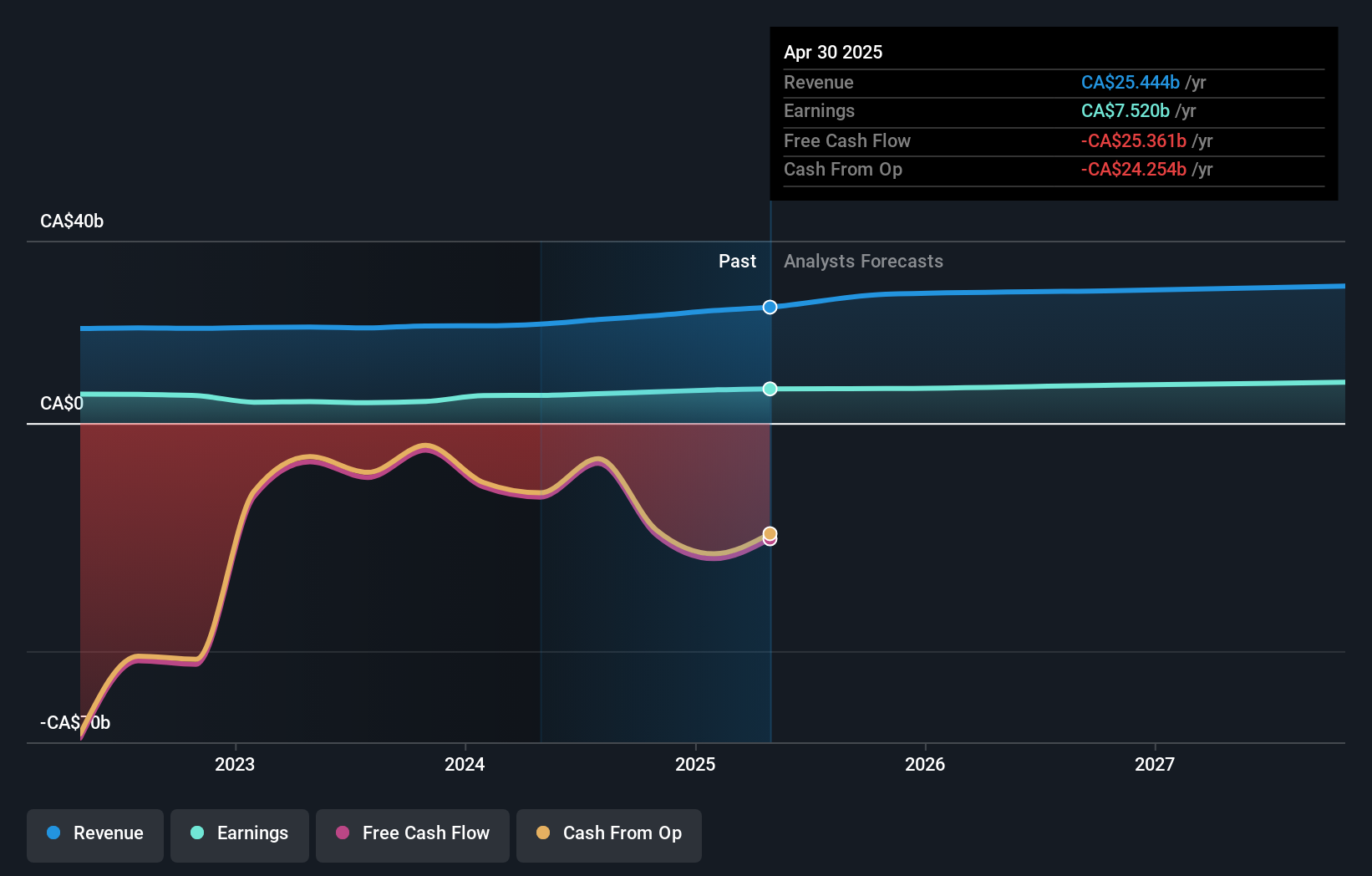

Challenges persist, including the impact of tighter monetary policies that have slowed loan demand. Expenses have risen by 7%, partly due to a software impairment charge, as noted by CFO Robert Sedran. Additionally, net income of $476 million saw a 4% decrease year-over-year. The bank's Return on Equity (ROE) remains low at 11.7%, below the 20% benchmark, indicating room for improvement. CIBC's earnings growth forecast of 3.4% annually lags behind the Canadian market's 14.5%, suggesting the need for strategic adjustments to enhance growth prospects.

Potential Strategies for Leveraging Growth and Competitive Advantage

Opportunities for CIBC include expanding its wealth management business and leveraging strategic alliances like the recent partnership with Expedia Group. This collaboration enhances the value proposition for Aventura Credit Card clients, offering access to Expedia's extensive travel inventory. The bank's investments in CRM technology are also paying dividends, evidenced by improved client Net Promoter Scores. As business activity is expected to pick up through 2025, CIBC's focus on executing its strategy and generating premium ROE could strengthen its market position.

Competitive Pressures and Market Risks Facing CIBC

External threats include elevated unemployment rates and macroeconomic challenges, which have led to a slight increase in the net write-off ratio by 3 basis points. While the bank has seen improvements in gross impaired loan ratios, the ongoing stress in the U.S. office market remains a concern. CIBC's strategic response includes closely monitoring portfolios and engaging with pre-delinquent clients early. Additionally, significant insider selling over the past three months and shareholder dilution due to a 2.2% increase in shares outstanding could impact investor confidence.

Canadian Imperial Bank of Commerce's strong financial health, highlighted by a CET1 ratio of 13.3%, positions it well to withstand regulatory pressures and economic fluctuations. The bank's strategic initiatives, such as CIBC AI, and its consistent dividend growth underscore its commitment to innovation and shareholder value. Although its Price-To-Earnings Ratio of 11.9x is higher than the industry average, the bank's current trading price is significantly below its estimated fair value of CA$147.04, indicating potential for price appreciation. However, challenges such as rising expenses and a lower-than-desired Return on Equity of 11.7% suggest that CIBC must refine its strategies to enhance earnings growth. By capitalizing on partnerships and technology investments, CIBC can potentially improve its market position and drive future performance, despite facing macroeconomic risks and competitive pressures.

Summing It All Up

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

About TSX:CM

Canadian Imperial Bank of Commerce

A diversified financial institution, provides various financial products and services to personal, business, public sector, and institutional clients in Canada, the United States, and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives