Scotiabank (TSX:BNS) Valuation Check After Mixed Earnings, Dividend Confirmation and Ongoing Buybacks

Reviewed by Simply Wall St

The Bank of Nova Scotia (TSX:BNS) just dropped a mixed earnings update that is getting investors to take a closer look at the stock, with stronger fourth quarter numbers contrasting fairly flat full year profit growth.

See our latest analysis for Bank of Nova Scotia.

All of this comes against a backdrop of improving sentiment, with the share price at about $98.30 after a strong year to date share price return and a robust multi year total shareholder return that suggests momentum is building rather than fading.

If Scotiabank’s recent run has you rethinking your portfolio, it could be a good moment to explore other opportunities through fast growing stocks with high insider ownership.

With earnings momentum picking up but the share price now hovering near analyst targets, is Scotiabank still trading below its intrinsic value, or has the market already priced in the next leg of growth?

Most Popular Narrative Narrative: 6.6% Overvalued

With Bank of Nova Scotia last closing at CA$98.30 against a narrative fair value of about CA$92.21, the story leans toward a mildly stretched valuation built on shifting expectations for growth and profitability.

The analysts have a consensus price target of CA$87.071 for Bank of Nova Scotia based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of CA$94.0, and the most bearish reporting a price target of just CA$78.0.

Curious how earnings, margins, and a tightly debated profit multiple combine to justify this premium price tag? The narrative rests on specific growth bets and a carefully chosen future valuation anchor. Want to see which assumptions really carry the weight of that fair value call? Dive in and test whether those numbers line up with your own expectations.

Result: Fair Value of $92.21 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent housing market vulnerability and Latin American political or economic shocks could quickly undermine the optimistic growth and valuation assumptions behind this narrative.

Find out about the key risks to this Bank of Nova Scotia narrative.

Another View: Deep Discount on Cash Flows

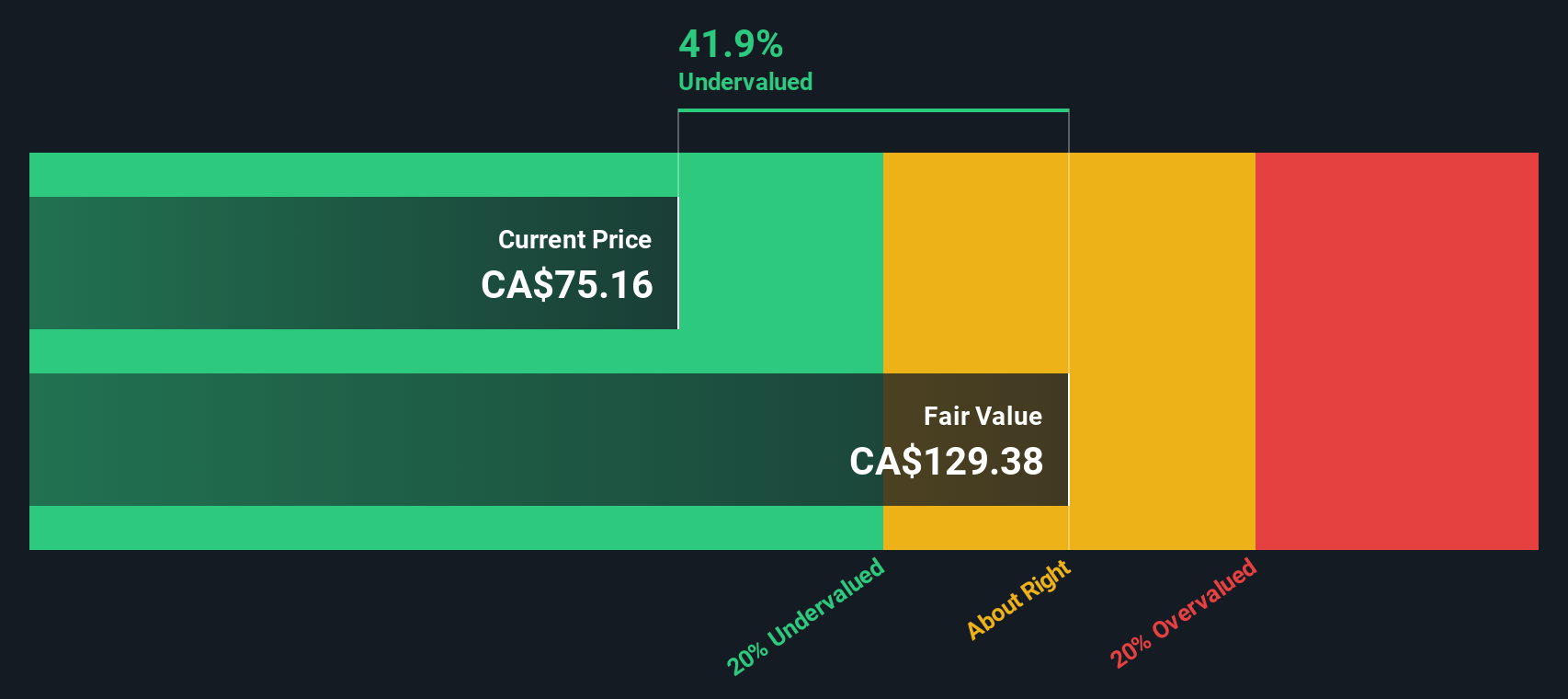

While the narrative fair value suggests Bank of Nova Scotia is modestly overvalued, our DCF model points in the opposite direction, indicating the shares trade about 37% below a fair value of roughly CA$155.80. If the cash flow story is right, is the market misjudging the long term?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Bank of Nova Scotia for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 908 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Bank of Nova Scotia Narrative

If you want to stress test these conclusions or rely on your own research instead, you can quickly build a tailored view in under three minutes with Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Bank of Nova Scotia.

Ready for your next investing move?

Before you log off, put your research to work by lining up a fresh watchlist of high potential ideas that could reshape your long term returns.

- Capture potential future breakouts early by scanning these 3573 penny stocks with strong financials for smaller names backed by solid fundamentals and strengthening balance sheets.

- Seek exposure to structural trends in automation and machine learning by targeting these 26 AI penny stocks that may benefit from enterprise and consumer adoption.

- Look for potential value before the wider market responds by focusing on these 908 undervalued stocks based on cash flows where market prices differ from underlying cash flow strength.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bank of Nova Scotia might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:BNS

Bank of Nova Scotia

Provides various banking products and services in Canada, the United States, Mexico, Peru, Chile, Colombia, the Caribbean and Central America, and internationally.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

TXT will see revenue grow 26% with a profit margin boost of almost 40%

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026