Bank Of Nova Scotia (TSX:BNS) To Redeem USD 1,250 Million Perpetual Capital Notes

Reviewed by Simply Wall St

Bank of Nova Scotia (TSX:BNS) experienced a 2% price movement over the last month, which aligns closely with broader market trends. The company's announcement to redeem USD 1,250 million of its 4.9% Fixed Rate Resetting Perpetual Subordinated Notes may have bolstered investor confidence, echoing its strategic approach to capital management. Concurrently, strong performances in the market, highlighted by rallies in the S&P 500 and Dow Jones, likely elevated investor sentiment, contributing to the modest growth seen in the company's shares. The redemption plan, while not dramatically shifting market perceptions, added weight to the positive market momentum.

Be aware that Bank of Nova Scotia is showing 1 risk in our investment analysis.

The Bank of Nova Scotia's recent decision to redeem US$1.25 billion of its fixed-rate notes aligns with its capital management strategy, potentially enhancing investor confidence and reflecting positively on its financial stability. Over a five-year period up to May 2025, the company's total return, including dividends, was 75.69%, offering a perspective on its longer-term performance. This contrasts with its underperformance relative to the Canadian Banks industry, which saw a 15.9% increase over the past year.

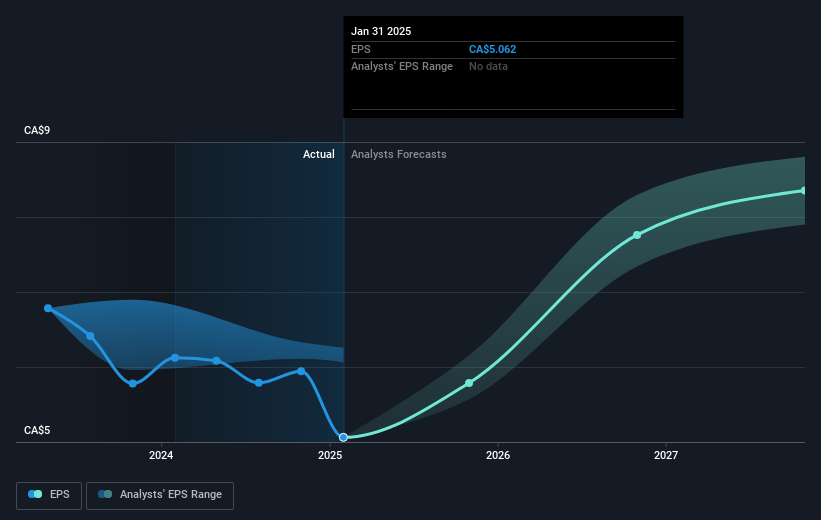

This news may influence revenue and earnings forecasts, as strategic capital redeployment and a focus on growth are expected to enhance shareholder value and return on equity. Analysts predict steady revenue growth and increased profit margins, but heightened credit loss provisions and geopolitical risks pose significant challenges. The current share price of CA$68.53 is still below the consensus price target of CA$76.73, suggesting potential upside as the market assesses these strategic moves. The relatively modest movement in the share price over the last month could reflect cautious optimism among investors regarding these developments.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bank of Nova Scotia might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:BNS

Bank of Nova Scotia

Provides various banking products and services in Canada, the United States, Mexico, Peru, Chile, Colombia, the Caribbean and Central America, and internationally.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives