Bank of Nova Scotia (TSE:BNS) Has Affirmed Its Dividend Of CA$0.90

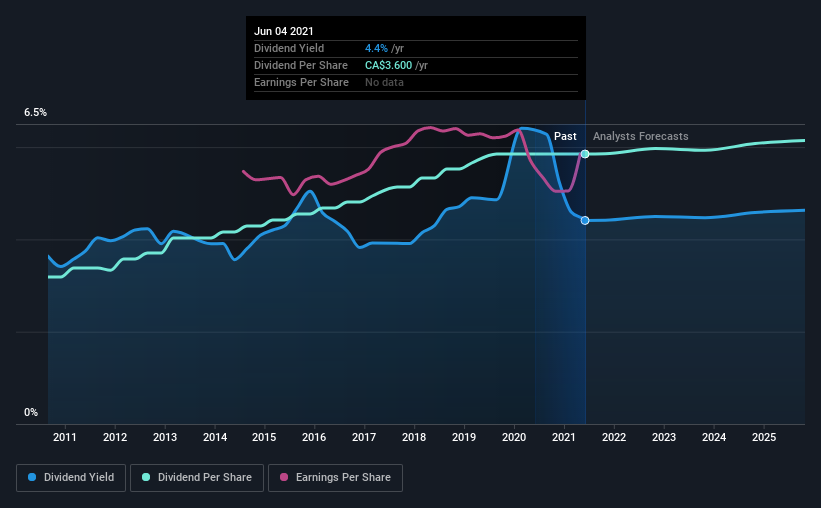

The board of The Bank of Nova Scotia (TSE:BNS) has announced that it will pay a dividend of CA$0.90 per share on the 28th of July. This means the annual payment is 4.4% of the current stock price, which is above the average for the industry.

View our latest analysis for Bank of Nova Scotia

Bank of Nova Scotia's Payment Has Solid Earnings Coverage

A big dividend yield for a few years doesn't mean much if it can't be sustained. Prior to this announcement, Bank of Nova Scotia's earnings easily covered the dividend, but free cash flows were negative. No cash flows could definitely make returning cash to shareholders difficult, or at least mean the balance sheet will come under pressure.

The next year is set to see EPS grow by 20.7%. If the dividend continues on this path, the payout ratio could be 50% by next year, which we think can be pretty sustainable going forward.

Bank of Nova Scotia Has A Solid Track Record

Even over a long history of paying dividends, the company's distributions have been remarkably stable. The first annual payment during the last 10 years was CA$1.96 in 2011, and the most recent fiscal year payment was CA$3.60. This works out to be a compound annual growth rate (CAGR) of approximately 6.3% a year over that time. The dividend has been growing very nicely for a number of years, and has given its shareholders some nice income in their portfolios.

Bank of Nova Scotia May Find It Hard To Grow The Dividend

Some investors will be chomping at the bit to buy some of the company's stock based on its dividend history. However, Bank of Nova Scotia has only grown its earnings per share at 2.4% per annum over the past five years. Bank of Nova Scotia is struggling to find viable investments, so it is returning more to shareholders. While this isn't necessarily a negative, it definitely signals that dividend growth could be constrained in the future unless earnings start to pick up again.

Our Thoughts On Bank of Nova Scotia's Dividend

In summary, while it's good to see that the dividend hasn't been cut, we are a bit cautious about Bank of Nova Scotia's payments, as there could be some issues with sustaining them into the future. The low payout ratio is a redeeming feature, but generally we are not too happy with the payments Bank of Nova Scotia has been making. We would probably look elsewhere for an income investment.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. Companies that are growing earnings tend to be the best dividend stocks over the long term. See what the 11 analysts we track are forecasting for Bank of Nova Scotia for free with public analyst estimates for the company. If you are a dividend investor, you might also want to look at our curated list of high performing dividend stock.

If you're looking for stocks to buy, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Bank of Nova Scotia might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TSX:BNS

Bank of Nova Scotia

Provides various banking products and services in Canada, the United States, Mexico, Peru, Chile, Colombia, the Caribbean and Central America, and internationally.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives