- Canada

- /

- Telecom Services and Carriers

- /

- TSX:QBR.A

Top TSX Dividend Stocks To Watch In October 2024

Reviewed by Simply Wall St

Over the last 7 days, the Canadian market has risen by 1.4%, contributing to a notable 22% increase over the past year, with earnings forecasted to grow by 15% annually. In this thriving environment, identifying dividend stocks that offer both reliable income and potential for capital appreciation is key for investors looking to capitalize on these favorable conditions.

Top 10 Dividend Stocks In Canada

| Name | Dividend Yield | Dividend Rating |

| Whitecap Resources (TSX:WCP) | 6.91% | ★★★★★★ |

| Labrador Iron Ore Royalty (TSX:LIF) | 7.82% | ★★★★★☆ |

| Power Corporation of Canada (TSX:POW) | 5.08% | ★★★★★☆ |

| Enghouse Systems (TSX:ENGH) | 3.31% | ★★★★★☆ |

| Russel Metals (TSX:RUS) | 4.14% | ★★★★★☆ |

| Firm Capital Mortgage Investment (TSX:FC) | 8.57% | ★★★★★☆ |

| Sun Life Financial (TSX:SLF) | 4.10% | ★★★★★☆ |

| National Bank of Canada (TSX:NA) | 3.35% | ★★★★★☆ |

| Royal Bank of Canada (TSX:RY) | 3.31% | ★★★★★☆ |

| Canadian Natural Resources (TSX:CNQ) | 4.31% | ★★★★★☆ |

Click here to see the full list of 29 stocks from our Top TSX Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Bank of Montreal (TSX:BMO)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Bank of Montreal offers diversified financial services primarily in North America and has a market cap of CA$93.28 billion.

Operations: Bank of Montreal generates revenue through several key segments: CA$10.20 billion from Canadian Personal and Commercial Banking, CA$8.89 billion from U.S. Personal and Commercial Banking, CA$7.61 billion from BMO Wealth Management, and CA$6.47 billion from BMO Capital Markets, while Corporate Services reported a loss of CA$1.75 million.

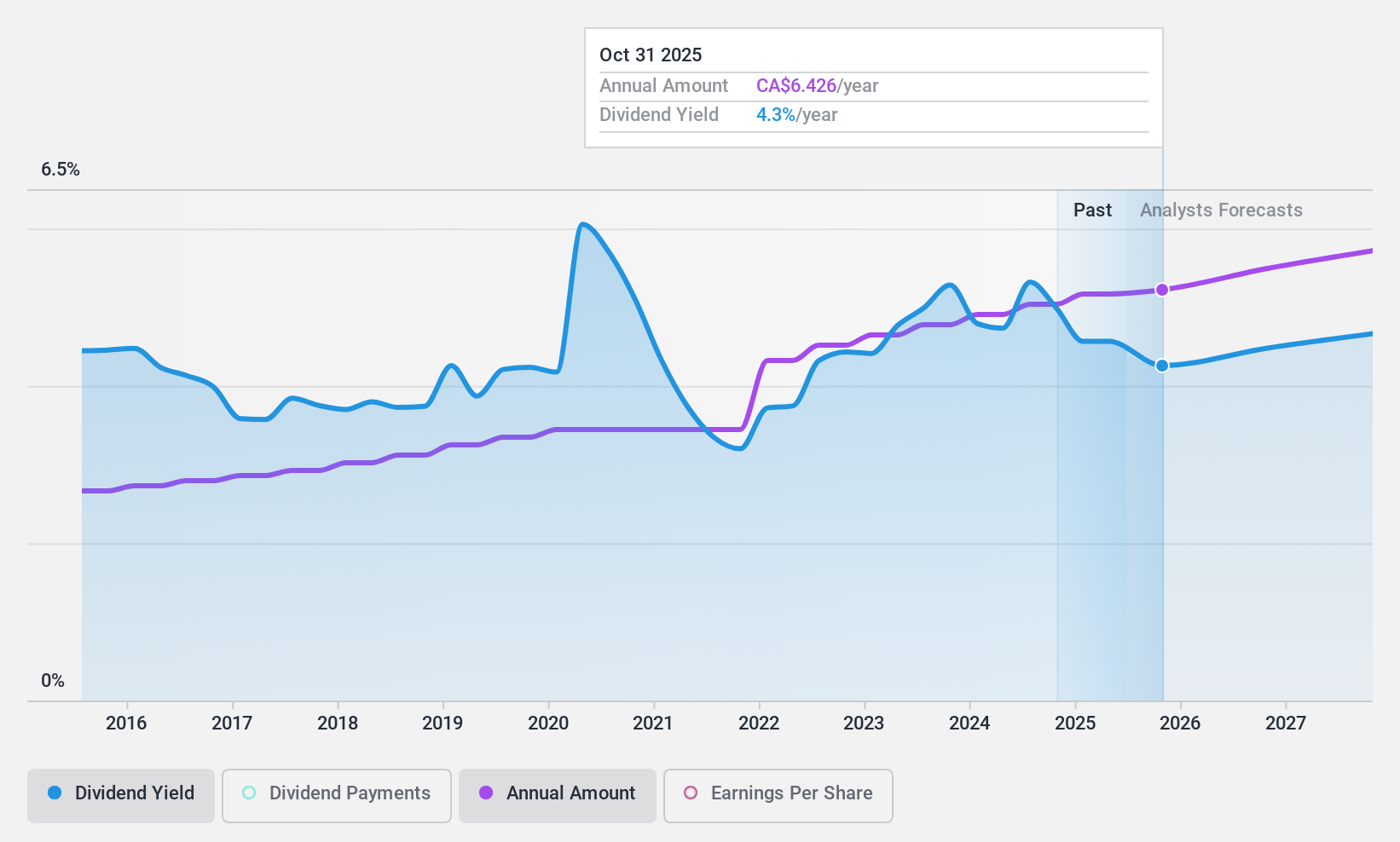

Dividend Yield: 4.8%

Bank of Montreal offers a reliable dividend yield of 4.85%, although it is lower than the top Canadian dividend payers. The bank's dividends have been stable and growing over the past decade, supported by a sustainable payout ratio currently at 69.5% and forecasted to improve to 53.2% in three years. Recent fixed-income offerings indicate ongoing strategic financial management, potentially enhancing its capacity for consistent dividend payments despite a low allowance for bad loans at 71%.

- Click to explore a detailed breakdown of our findings in Bank of Montreal's dividend report.

- In light of our recent valuation report, it seems possible that Bank of Montreal is trading beyond its estimated value.

Canadian Imperial Bank of Commerce (TSX:CM)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Canadian Imperial Bank of Commerce is a diversified financial institution offering a range of financial products and services to personal, business, public sector, and institutional clients in Canada, the United States, and internationally, with a market cap of approximately CA$80.05 billion.

Operations: Canadian Imperial Bank of Commerce generates revenue through its Canadian Personal and Business Banking segment (CA$8.80 billion), Capital Markets and Direct Financial Services (CA$5.61 billion), U.S. Commercial Banking and Wealth Management (CA$2.02 billion), and Canadian Commercial Banking and Wealth Management (CA$5.46 billion).

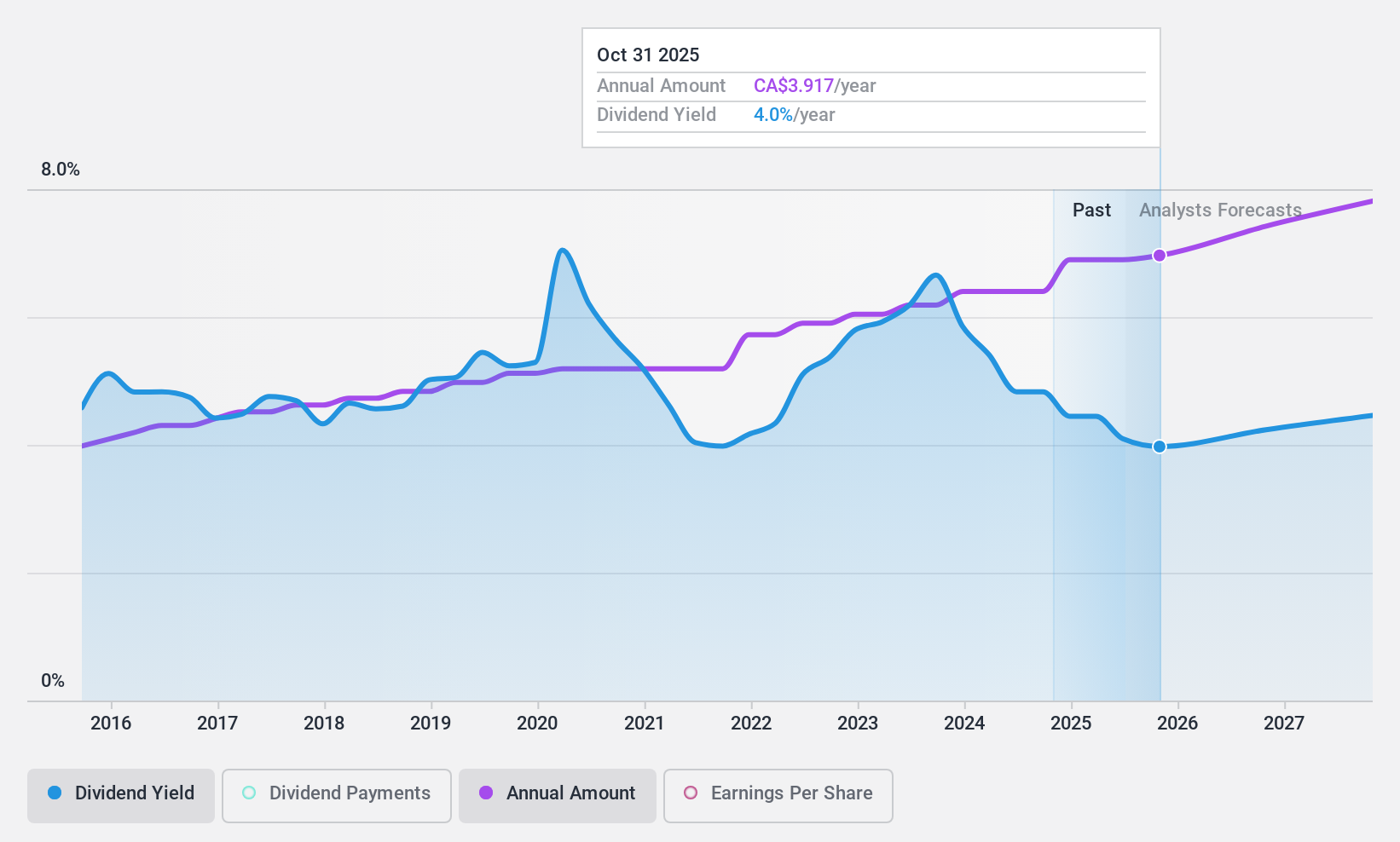

Dividend Yield: 4.2%

Canadian Imperial Bank of Commerce provides a stable dividend yield of 4.25%, which is below the top Canadian dividend payers. The bank's dividends have been reliable and increasing over the past decade, with a sustainable payout ratio of 51.7%. Recent financial maneuvers, including a $20 billion shelf registration and multiple fixed-income offerings, suggest strategic capital management to support ongoing dividend payments despite recent insider selling and shareholder dilution concerns.

- Delve into the full analysis dividend report here for a deeper understanding of Canadian Imperial Bank of Commerce.

- Insights from our recent valuation report point to the potential undervaluation of Canadian Imperial Bank of Commerce shares in the market.

Quebecor (TSX:QBR.A)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Quebecor Inc. operates in the telecommunications, media, and sports and entertainment sectors in Canada with a market cap of CA$8.29 billion.

Operations: Quebecor Inc.'s revenue is primarily derived from its telecommunications segment, which generated CA$4.89 billion, followed by the media segment with CA$724 million, and the sports and entertainment segment contributing CA$208.2 million.

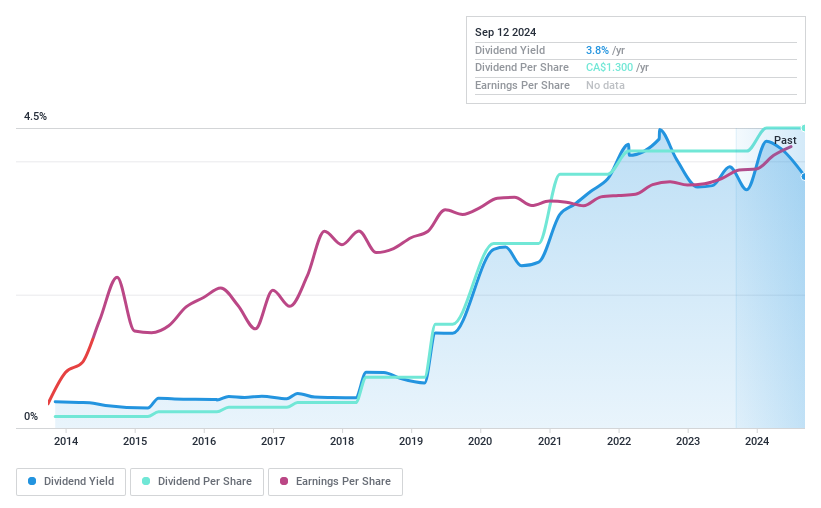

Dividend Yield: 3.7%

Quebecor offers a stable dividend yield of 3.65%, lower than the top Canadian dividend payers, but supported by a low payout ratio of 39.2%. The company's dividends have been consistently reliable and growing over the past decade. Recent earnings growth and strategic share buybacks underscore its commitment to shareholder value, despite high debt levels. With shares trading below estimated fair value, Quebecor presents an attractive option for income-focused investors seeking stability in their portfolio.

- Get an in-depth perspective on Quebecor's performance by reading our dividend report here.

- Our expertly prepared valuation report Quebecor implies its share price may be lower than expected.

Make It Happen

- Discover the full array of 29 Top TSX Dividend Stocks right here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Quebecor might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:QBR.A

Quebecor

Operates in the telecommunications, media, and sports and entertainment businesses in Canada.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives