Is BMO Stock Still a Good Opportunity After Climbing 25% This Year?

Reviewed by Bailey Pemberton

If you have Bank of Montreal stock on your radar right now, you are not alone. With shares closing most recently at $175.35 and posting a striking 25.4% gain year-to-date, investors are wondering whether this rally still has legs. Longer-term returns multiply that intrigue, with the stock shooting up an impressive 42.1% over the past year and climbing a remarkable 164.2% over the last five years. Even with a brief 1.8% dip in the last month, Bank of Montreal's performance still stands well above many of its peers.

What is fueling these outsized returns? A mix of market confidence and sector momentum, bolstered by ongoing optimism about Canada's economic resilience. While some pullback in the short term signals changing investor sentiment, the broad upward trend suggests that investors continue to believe in the bank's growth story, though perhaps with a keener eye toward emerging risks and opportunities.

Of course, strong returns do not automatically mean the stock is a bargain. If you are leaning toward a valuation-based approach (which many seasoned investors are these days), Bank of Montreal comes in with a valuation score of 2; that is, it is considered undervalued by 2 out of 6 key financial checks. But what exactly goes into these checks, and do the numbers really tell the full story? Let us break down these valuation methods. After that, I will share a smarter perspective for sizing up the stock's true worth.

Bank of Montreal scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Bank of Montreal Excess Returns Analysis

The Excess Returns model offers a clear view into how much Bank of Montreal earns above its cost of capital. This approach centers on how effectively the company converts its equity into higher profits than the minimum return demanded by shareholders. This effectively spotlights long-term value-creating power.

Key data for Bank of Montreal include a Book Value of CA$118.63 per share and an average Return on Equity of 11.69%. Looking forward, the bank is expected to generate stable earnings of CA$13.35 per share, as estimated by twelve analysts. The Cost of Equity, or what shareholders expect as a minimum annual return, is CA$8.31 per share. This means the bank delivers an Excess Return of CA$5.04 per share. These figures reflect healthy value creation over time and are supported by stable book value projections at CA$114.23 per share, based on input from nine analysts.

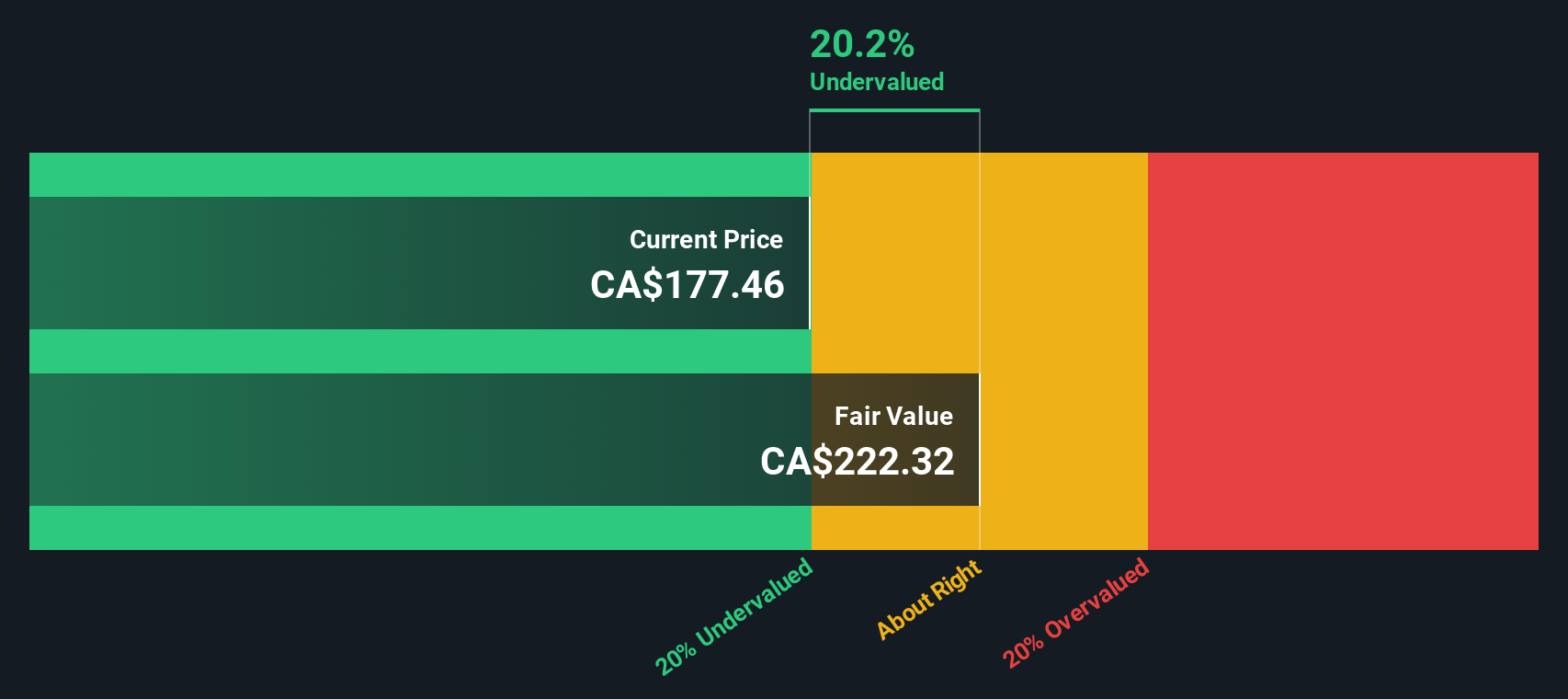

With these fundamentals, the Excess Returns model calculates an intrinsic value for Bank of Montreal shares of CA$221.87. Given the current share price of CA$175.35, this indicates the stock is approximately 21% undervalued.

Result: UNDERVALUED

Our Excess Returns analysis suggests Bank of Montreal is undervalued by 21.0%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Bank of Montreal Price vs Earnings

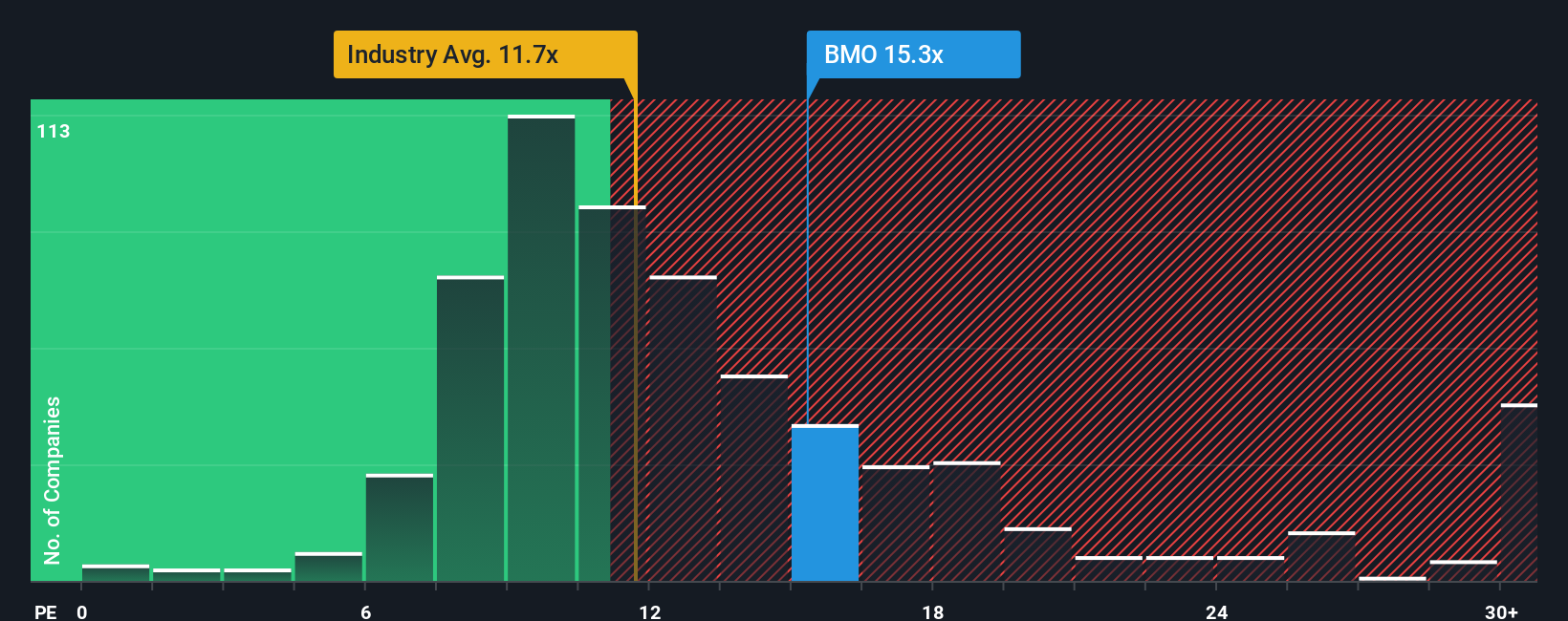

The price-to-earnings (PE) ratio is a tried and true valuation method for profitable companies like Bank of Montreal, as it directly relates the company’s market price to its underlying earnings. For established banks, the PE ratio is especially informative because earnings tend to be stable, allowing for a clearer view of how the market values future profit potential.

Growth expectations and perceived business risk play a major part in determining what a “normal” or “fair” PE should be. Companies with high expected growth or lower risk profiles generally trade at higher PEs, while those facing headwinds or uncertainties often fetch lower multiples.

Bank of Montreal currently trades at a PE of 15.14x, which is noticeably higher than the industry average of 10.16x and somewhat above the average of its banking peers at 13.84x. This premium suggests that investors are willing to pay up for what they see as added quality, stronger growth prospects, or stability.

Rather than relying only on basic industry or peer averages, Simply Wall St’s proprietary Fair Ratio goes a step further. The Fair Ratio for Bank of Montreal is 14.01x, which blends factors like anticipated earnings growth, profit margins, industry nuances, and market cap to better estimate a justified valuation multiple. Because it brings in more real-world variables, the Fair Ratio is a more dynamic and relevant benchmark than looking at peers alone.

With the actual PE just a notch above the Fair Ratio, Bank of Montreal’s valuation appears to be about right for its current fundamentals and risk-reward profile.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Bank of Montreal Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is simply the story you believe about a company. For example, digital transformation, acquisitions, or shifting economic forces may influence Bank of Montreal’s future revenue, earnings, margins, and ultimately its fair value. Narratives connect the dots from a company’s market positioning to a clear financial forecast and a target price, helping you move from numbers alone to an investment thesis you actually understand and control.

Narratives are an easy-to-use tool available to all investors on Simply Wall St’s Community page, where millions already share and update their investment perspectives in real time. By comparing your fair value to the current price, Narratives help clarify whether Bank of Montreal looks like a buy, hold, or sell opportunity through your own lens. Because Narratives are updated automatically as new earnings or news come in, your investment view is always grounded in the latest information.

For Bank of Montreal, one investor might craft a bullish Narrative emphasizing continued digital innovation and strong demographic trends to set a fair value as high as CA$180.00. Another may see risk in muted loan demand or rising costs and assign a more cautious fair value of CA$151.00.

Do you think there's more to the story for Bank of Montreal? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bank of Montreal might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:BMO

Bank of Montreal

Engages in the provision of diversified financial services primarily in North America.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives