Stock Analysis

Here's Why We Think Bank of Montreal (TSE:BMO) Might Deserve Your Attention Today

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Bank of Montreal (TSE:BMO). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Bank of Montreal with the means to add long-term value to shareholders.

View our latest analysis for Bank of Montreal

Bank of Montreal's Earnings Per Share Are Growing

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS) outcomes. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. It certainly is nice to see that Bank of Montreal has managed to grow EPS by 23% per year over three years. As a general rule, we'd say that if a company can keep up that sort of growth, shareholders will be beaming.

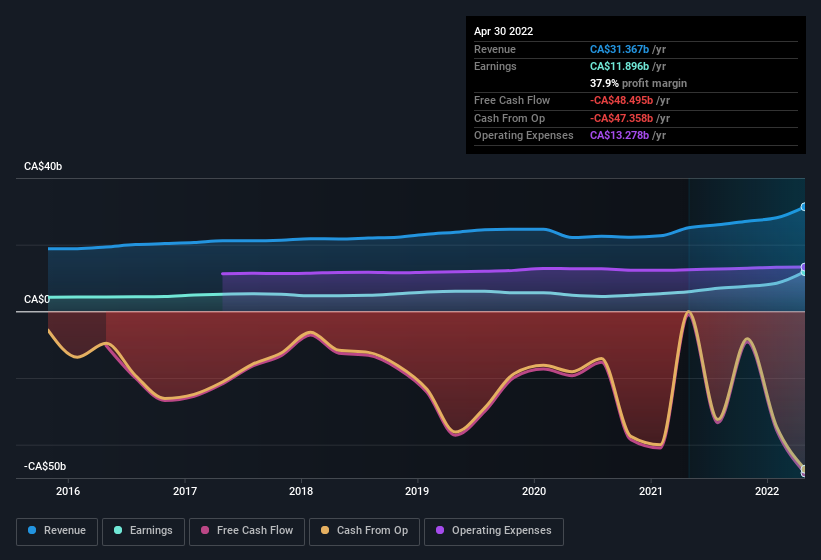

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. It's noted that Bank of Montreal's revenue from operations was lower than its revenue in the last twelve months, so that could distort our analysis of its margins. Bank of Montreal maintained stable EBIT margins over the last year, all while growing revenue 25% to CA$31b. That's progress.

In the chart below, you can see how the company has grown earnings and revenue, over time. Click on the chart to see the exact numbers.

Fortunately, we've got access to analyst forecasts of Bank of Montreal's future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

Are Bank of Montreal Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

It's nice to see that there have been no reports of any insiders selling shares in Bank of Montreal in the previous 12 months. With that in mind, it's heartening that Madhu Ranganathan, the Independent Director of the company, paid CA$45k for shares at around CA$137 each. It seems that at least one insider is prepared to show the market there is potential within Bank of Montreal.

The good news, alongside the insider buying, for Bank of Montreal bulls is that insiders (collectively) have a meaningful investment in the stock. To be specific, they have CA$26m worth of shares. This considerable investment should help drive long-term value in the business. Even though that's only about 0.03% of the company, it's enough money to indicate alignment between the leaders of the business and ordinary shareholders.

Should You Add Bank of Montreal To Your Watchlist?

For growth investors, Bank of Montreal's raw rate of earnings growth is a beacon in the night. On top of that, insiders own a significant piece of the pie when it comes to the company's stock, and one has been buying more. Astute investors will want to keep this stock on watch. Before you take the next step you should know about the 2 warning signs for Bank of Montreal (1 makes us a bit uncomfortable!) that we have uncovered.

The good news is that Bank of Montreal is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're helping make it simple.

Find out whether Bank of Montreal is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:BMO

Bank of Montreal

Provides diversified financial services primarily in North America.

Excellent balance sheet established dividend payer.