Evaluating BMO’s Value Amid Strong 52 Week Rally and Latest Canadian Banking Sector Optimism

Reviewed by Bailey Pemberton

If you are sizing up Bank of Montreal, you are not alone. Investors everywhere seem to be weighing their next move on this stock. It has been quite the ride for BMO shareholders over the last few years, and the numbers tell an impressive story. With a return of 174.4% over the past five years and a jump of 51.6% in just the last year, this is no slow-and-steady bank. Even after a slight dip of 1.1% in the past week, BMO seems to maintain its upward momentum, helped along in part by renewed market confidence in the Canadian financial sector as interest rates stabilized this spring. In the last month alone, shares are up 3.0%, and the year-to-date gain stands at a remarkable 28.8%, outpacing many of its North American peers.

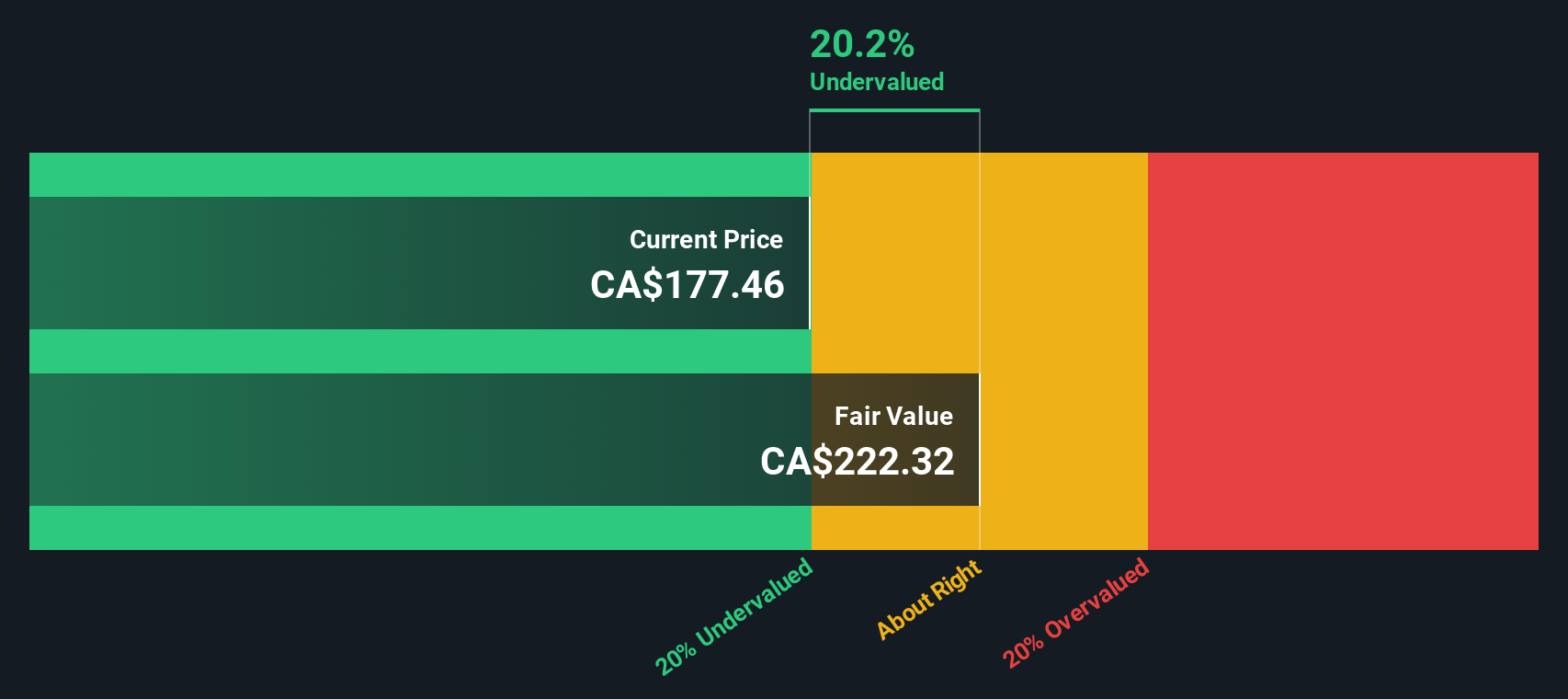

But if you are trying to decide whether to buy, hold, or cash in your gains, it helps to look past the sheer excitement of the chart. Is BMO actually undervalued at its current price of $180.02, or has the recent surge stretched its fundamentals? According to our valuation scorecard, the company is only undervalued in one out of six standard checks, resulting in a value score of just 1. That might give some investors pause but also raises interesting questions about how these scoring systems work and what really matters when you are hunting for the next big opportunity.

In the sections ahead, we will break down exactly how these valuation methods stack up for BMO, and if you stick with us, share an often-overlooked insight that just might change how you look at value investing altogether.

Bank of Montreal scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Bank of Montreal Excess Returns Analysis

The Excess Returns valuation model examines how effectively Bank of Montreal generates returns above its cost of equity. Instead of simply looking at profits, this method focuses on what shareholders actually gain by investing in the bank relative to what that capital costs. It measures whether the company is creating meaningful value for its owners or simply covering its expenses.

According to this model, Bank of Montreal has a book value of CA$118.63 per share and delivers stable earnings per share of CA$13.35, based on projections from twelve analysts. The bank's cost of equity is estimated at CA$8.30 per share. After covering this cost, the calculated excess return stands at CA$5.05 per share. This means BMO generates significant value beyond its equity cost, supported by an average return on equity of 11.69%. Analysts also forecast a stable book value of CA$114.23 per share in the coming years.

The intrinsic value calculated by this method implies BMO is currently trading at a 19.0% discount to its fair value. Compared to its current share price of CA$180.02, the results suggest the stock is undervalued.

Result: UNDERVALUED

Our Excess Returns analysis suggests Bank of Montreal is undervalued by 19.0%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Bank of Montreal Price vs Earnings

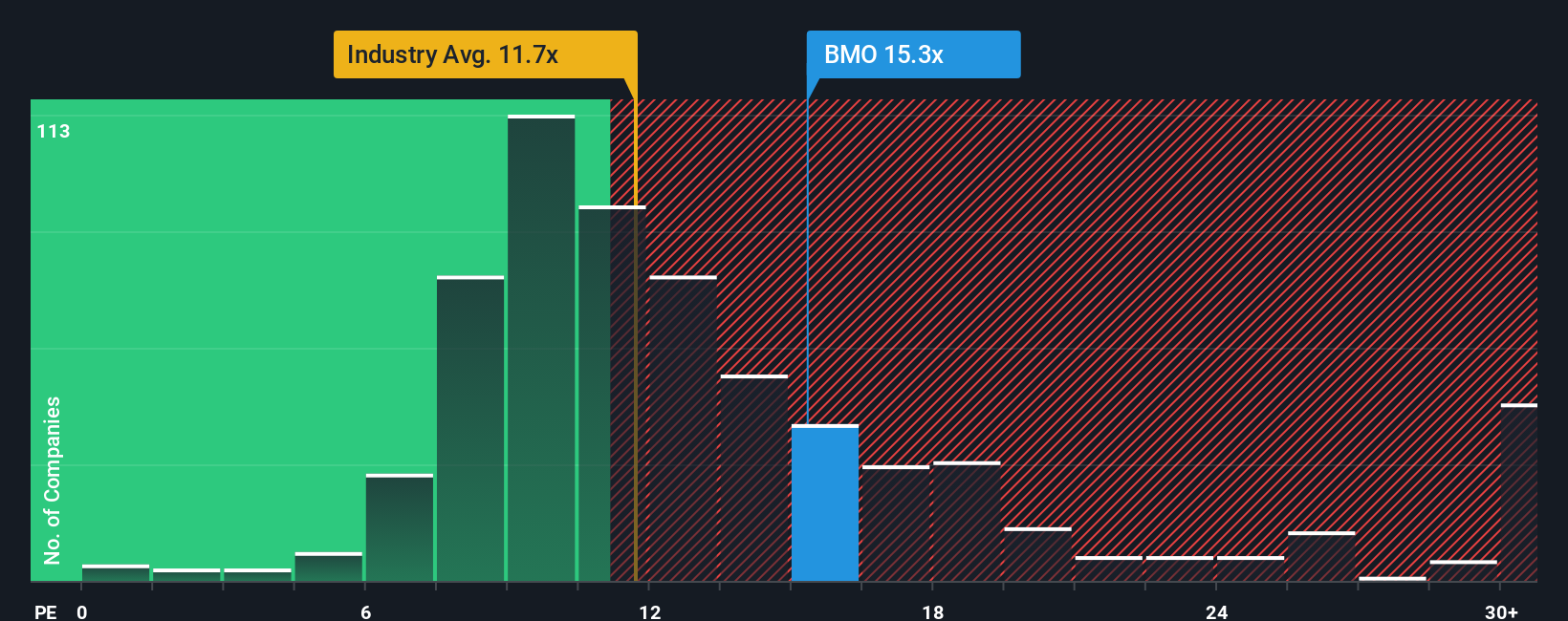

The price-to-earnings (PE) ratio is one of the most widely used valuation tools for profitable companies like Bank of Montreal, because it measures how much investors are willing to pay for each dollar of earnings. Essentially, it helps you see whether the market's expectations align with actual performance and future growth prospects.

A "normal" or "fair" PE ratio for a stock depends not just on its current earnings, but also on how quickly those earnings are expected to grow, its risk profile, and how it stacks up against sector peers. Companies with higher growth or more stable profits often justify higher PE ratios compared to more volatile or slower-growing firms.

Bank of Montreal currently trades at a PE ratio of 15.54x. That is higher than the broader Canadian banking industry average of 10.36x, and above peer banks at 13.96x. However, benchmarks can only tell part of the story. Enter the Simply Wall St Fair Ratio, a proprietary metric designed to show a "fair" multiple based on an extensive set of factors including BMO’s projected earnings growth, profit margins, market capitalization, industry context, and risk factors. The Fair Ratio for BMO stands at 14.00x. Unlike raw peer or industry averages, this Fair Ratio adjusts for the qualities that make BMO unique within the sector and market.

Since the current PE ratio of 15.54x is just above the Fair Ratio of 14.00x, BMO’s shares look a bit more expensive than our comprehensive measure would suggest, but not by a wide margin. As the difference is greater than 0.10, this points to a modest overvaluation at current prices.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Bank of Montreal Narrative

Earlier we mentioned that there is an even better way to understand valuation. Let us introduce you to Narratives. A Narrative is simply a story you create about a company, connecting your own view of its potential with forecasts for future financials like revenue, earnings, and margins, all leading to an estimated fair value. This approach goes beyond static numbers and allows you to tie the latest business events or trends directly to your investing thesis, so your decision making stays personal, dynamic, and relevant.

On Simply Wall St’s Community page, Narratives are available as an accessible tool used by millions of investors. They help you cut through the noise by comparing your own Fair Value to the current Price, making it easier to decide when a stock looks attractive or too expensive. Importantly, Narratives are continuously refreshed as new earnings, news, or company actions come in, so your analysis updates in real time.

For example, two different investors might see Bank of Montreal in strikingly different lights. One could craft a narrative focused on BMO’s digital transformation and stable revenue growth, leading them to a high Fair Value estimate of CA$180.00 per share. Another, more cautious investor might emphasize economic headwinds and assign a significantly lower Fair Value, such as CA$151.00. With Narratives, your investment story truly powers your strategy.

Do you think there's more to the story for Bank of Montreal? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bank of Montreal might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:BMO

Bank of Montreal

Engages in the provision of diversified financial services primarily in North America.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives