A Fresh Look at BMO (TSX:BMO) Valuation Following Canadian Deposit Receipts Launch

Reviewed by Simply Wall St

Bank of Montreal (TSX:BMO) has just rolled out a new suite of Canadian deposit receipts, or CDRs. This makes it easier for Canadian investors to own shares in some of the most popular U.S. tech companies without taking on currency risk.

See our latest analysis for Bank of Montreal.

Bank of Montreal’s momentum has been building, fueled by steady demand for its deposit products and a packed schedule of successful fixed-income offerings. Over the past year, shareholders have enjoyed a remarkable 42% total return, and the stock’s 26% year-to-date share price return signals broad confidence in BMO’s long-term strategy. Recent announcements such as new CDR launches and ongoing bond activity continue to draw attention.

If you’re weighing where to look next, this is a great moment to broaden your watchlist and discover fast growing stocks with high insider ownership

After BMO’s sharp rally and ambitious product launches, the key question for investors is whether the stock remains undervalued at these levels or if the market has already factored in all of the future growth potential. Is there still a buying opportunity?

Most Popular Narrative: 4% Overvalued

Bank of Montreal’s fair value estimate sits just below its last close price, hinting at an unsettled verdict around the stock’s next move. This narrative is catching attention for its bold take on what is driving BMO’s business in the years ahead.

BMO’s continued investment in digital and AI-powered banking platforms, such as the LUMI Assistant and multiple award-winning payment innovations, is improving operational efficiency and customer engagement. These initiatives may help drive increased net margins and persistently positive operating leverage.

Want to know what financial engine could power BMO’s next chapter? The consensus narrative leans heavily on ambitious forecasts for revenue growth and margin performance. Are these targets realistic, or is something else at play? Uncover the expectations that shape this valuation and see if your view lines up with these provocative assumptions.

Result: Fair Value of $163.71 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent economic weakness or higher technology and regulatory expenses could easily undermine BMO’s optimistic growth outlook and challenge these consensus assumptions.

Find out about the key risks to this Bank of Montreal narrative.

Another View: A Different Valuation Perspective

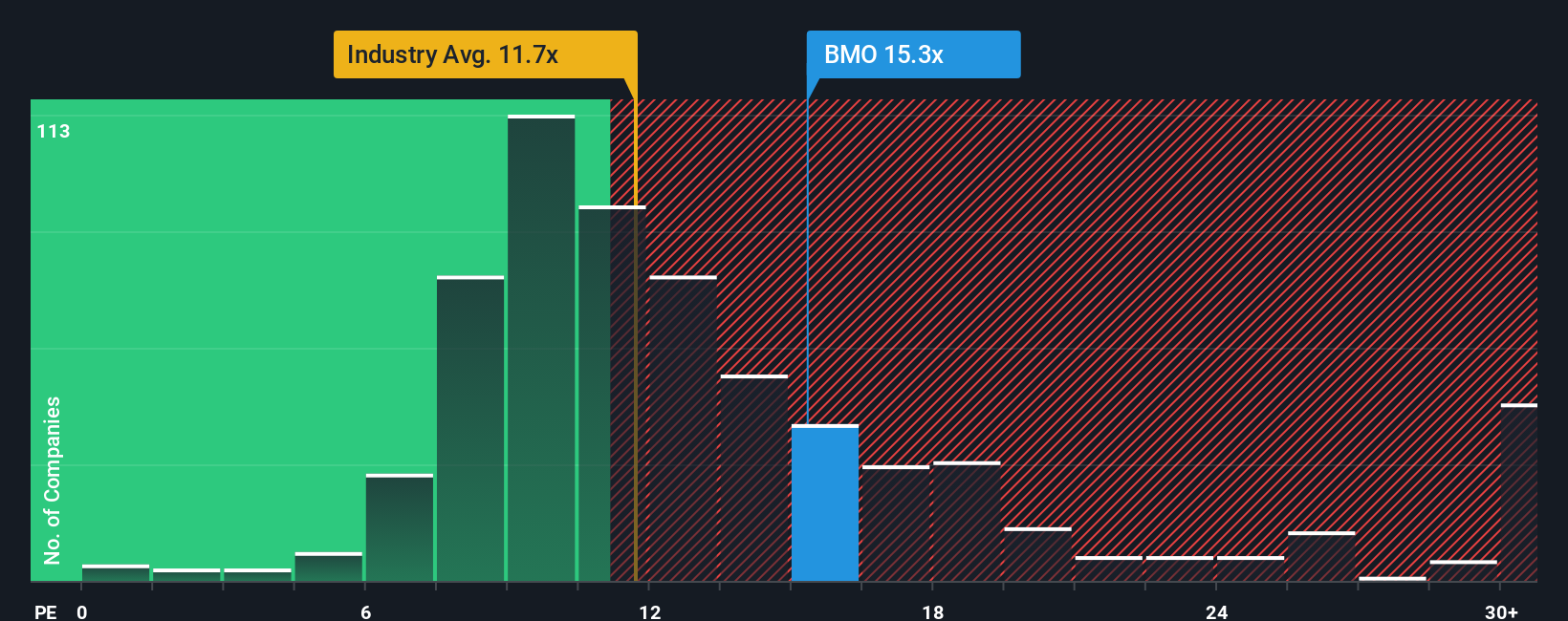

While most analysts benchmark Bank of Montreal against peers using its price-to-earnings ratio, there are notable gaps. BMO trades at 15.2x earnings, noticeably higher than the peer average of 13.9x and the market's fair ratio of 14x. This suggests investors may be paying a premium, which could add risk if performance disappoints. Could this gap close, or will momentum keep pushing valuations higher?

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Bank of Montreal for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Bank of Montreal Narrative

If you see things differently or want to chart your own course, you can explore the numbers and craft a narrative that fits your perspective in just a few minutes, Do it your way.

A great starting point for your Bank of Montreal research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Securing a strong portfolio means acting fast. Don’t watch from the sidelines while major investing themes pass you by. The Simply Wall Street Screener helps you identify fresh opportunities tailored to your interests and goals.

- Unlock resilient long-term income with these 17 dividend stocks with yields > 3%, pinpointing companies that consistently reward shareholders with attractive dividend yields above 3%.

- Boost your growth potential by targeting companies shaping tomorrow’s world. Tap into these 26 AI penny stocks and uncover early leaders in artificial intelligence innovations.

- Tap into global megatrends by reviewing these 80 cryptocurrency and blockchain stocks for businesses positioned to benefit from the explosive adoption of blockchain and digital currencies.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bank of Montreal might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:BMO

Bank of Montreal

Engages in the provision of diversified financial services primarily in North America.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives