As trade tensions ease and central banks maintain steady interest rates, the Canadian market is experiencing a period of cautious optimism. In this environment, dividend stocks on the TSX can offer investors a reliable income stream, making them an attractive option for those looking to navigate economic uncertainties while benefiting from stable returns.

Top 10 Dividend Stocks In Canada

| Name | Dividend Yield | Dividend Rating |

| Whitecap Resources (TSX:WCP) | 8.38% | ★★★★★☆ |

| Russel Metals (TSX:RUS) | 4.12% | ★★★★★☆ |

| Olympia Financial Group (TSX:OLY) | 6.80% | ★★★★★☆ |

| IGM Financial (TSX:IGM) | 5.11% | ★★★★★☆ |

| Power Corporation of Canada (TSX:POW) | 4.46% | ★★★★★☆ |

| Canadian Imperial Bank of Commerce (TSX:CM) | 4.30% | ★★★★★☆ |

| Royal Bank of Canada (TSX:RY) | 3.49% | ★★★★★☆ |

| National Bank of Canada (TSX:NA) | 3.61% | ★★★★★☆ |

| Acadian Timber (TSX:ADN) | 6.57% | ★★★★★☆ |

| Sun Life Financial (TSX:SLF) | 4.05% | ★★★★★☆ |

Click here to see the full list of 25 stocks from our Top TSX Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Bird Construction (TSX:BDT)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Bird Construction Inc. is a Canadian company that offers construction services, with a market cap of CA$1.39 billion.

Operations: Bird Construction Inc. generates revenue of CA$3.40 billion from its operations in the general contracting sector of the construction industry in Canada.

Dividend Yield: 3.2%

Bird Construction's dividend payments, with a payout ratio of 31.9%, are well-covered by earnings and cash flows, ensuring sustainability despite a history of volatility. Trading significantly below its estimated fair value, Bird offers good relative value among peers. Recent project awards exceeding $650 million highlight growth potential and operational strength, which may support future dividend stability. However, its current yield is lower than the top Canadian dividend payers at 3.23%.

- Get an in-depth perspective on Bird Construction's performance by reading our dividend report here.

- In light of our recent valuation report, it seems possible that Bird Construction is trading behind its estimated value.

Bank of Montreal (TSX:BMO)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Bank of Montreal offers diversified financial services mainly in North America and has a market capitalization of CA$103.24 billion.

Operations: Bank of Montreal's revenue is primarily derived from Canadian Personal and Commercial Banking at CA$9.82 billion, U.S. Personal and Commercial Banking at CA$8.20 billion, BMO Capital Markets at CA$6.56 billion, and BMO Wealth Management at CA$5.89 billion.

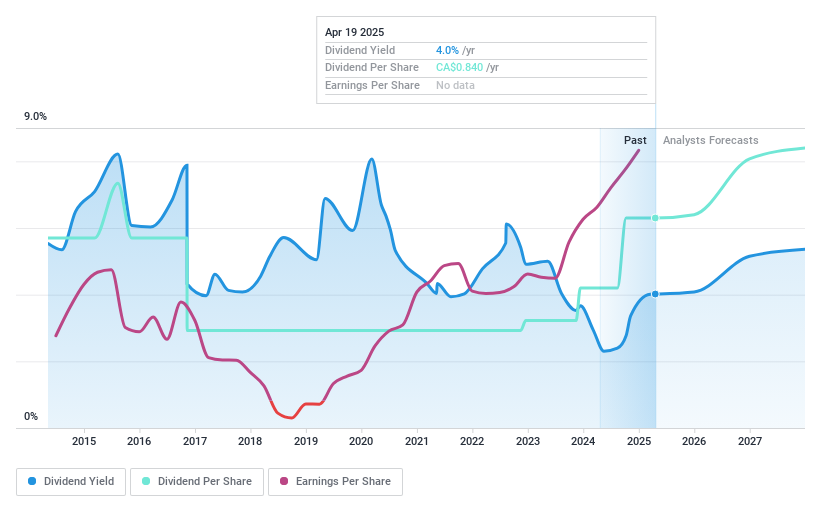

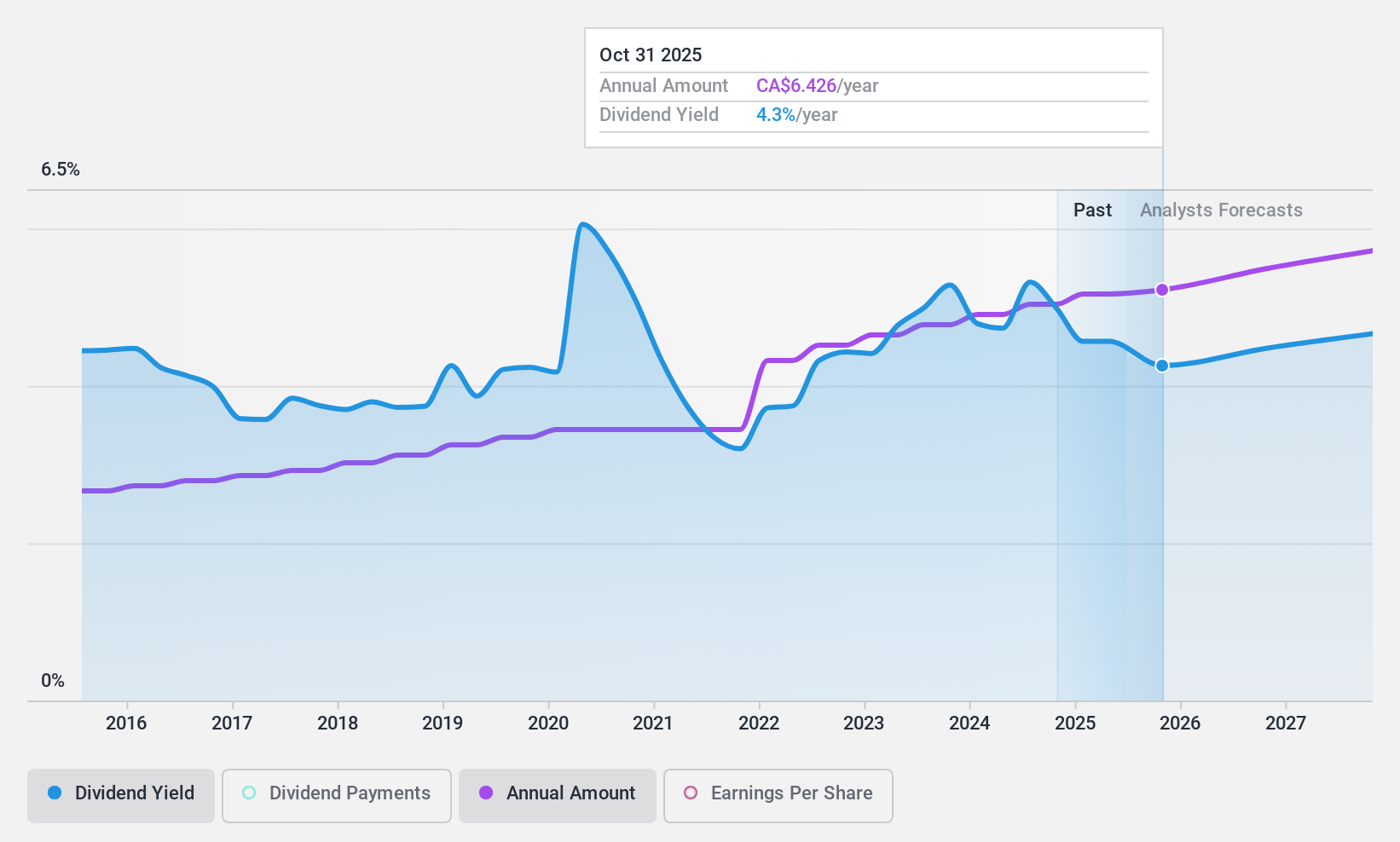

Dividend Yield: 4.5%

Bank of Montreal's dividend yield of 4.48% is stable and has grown over the past decade, though it remains below Canada's top dividend payers. The payout ratio is sustainable at 58.3%, with future earnings expected to cover dividends comfortably. Trading at a discount to its estimated fair value enhances its attractiveness for investors seeking value. Recent debt redemption efforts, including a $1.25 billion note, reflect sound financial management supporting long-term stability in dividend payments.

- Take a closer look at Bank of Montreal's potential here in our dividend report.

- Our valuation report unveils the possibility Bank of Montreal's shares may be trading at a discount.

IGM Financial (TSX:IGM)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: IGM Financial Inc. operates in the asset management sector in Canada with a market cap of CA$10.40 billion.

Operations: IGM Financial Inc.'s revenue is primarily derived from its Wealth Management segment, contributing CA$2.50 billion, and its Asset Management segment, contributing CA$1.28 billion.

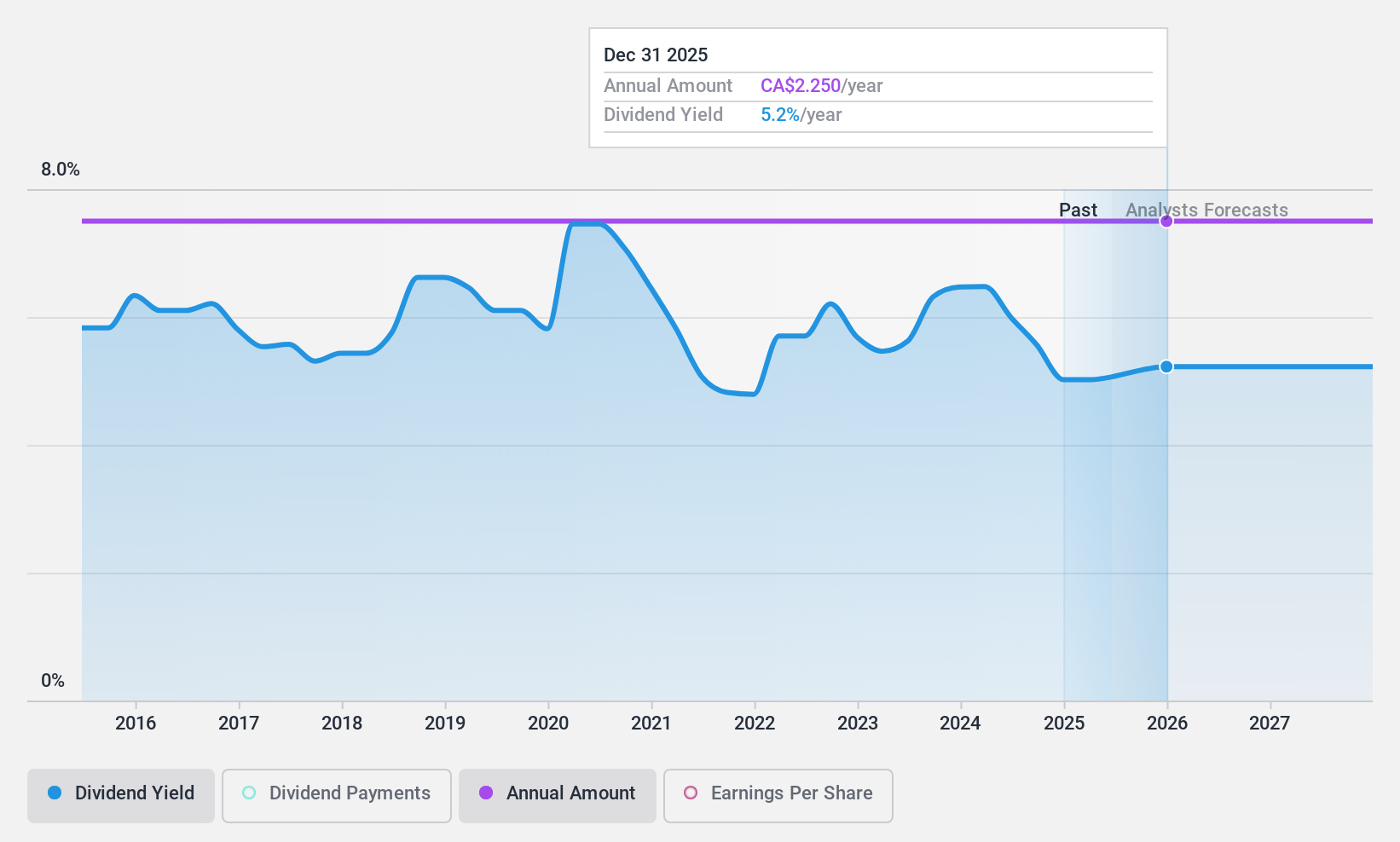

Dividend Yield: 5.1%

IGM Financial offers a stable dividend yield of 5.11%, though it trails the top Canadian dividend payers. The dividends are well-supported by earnings and cash flows, with payout ratios of 56.5% and 54.8%, respectively, indicating sustainability. Recent earnings growth and a revenue increase to C$875.8 million bolster its financial position, while new board appointments may influence future strategies positively. Trading below estimated fair value adds appeal for value-focused investors seeking reliable income streams.

- Navigate through the intricacies of IGM Financial with our comprehensive dividend report here.

- Our expertly prepared valuation report IGM Financial implies its share price may be lower than expected.

Make It Happen

- Explore the 25 names from our Top TSX Dividend Stocks screener here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bank of Montreal might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:BMO

Bank of Montreal

Provides diversified financial services primarily in North America.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives