- Canada

- /

- Diversified Financial

- /

- TSX:AI

Should You Worry About Atrium Mortgage Investment Corporation's (TSE:AI) CEO Salary Level?

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

Rob Goodall has been the CEO of Atrium Mortgage Investment Corporation (TSE:AI) since 1994. This report will, first, examine the CEO compensation levels in comparison to CEO compensation at companies of similar size. Then we'll look at a snap shot of the business growth. And finally we will reflect on how common stockholders have fared in the last few years, as a secondary measure of performance. This process should give us an idea about how appropriately the CEO is paid.

View our latest analysis for Atrium Mortgage Investment

How Does Rob Goodall's Compensation Compare With Similar Sized Companies?

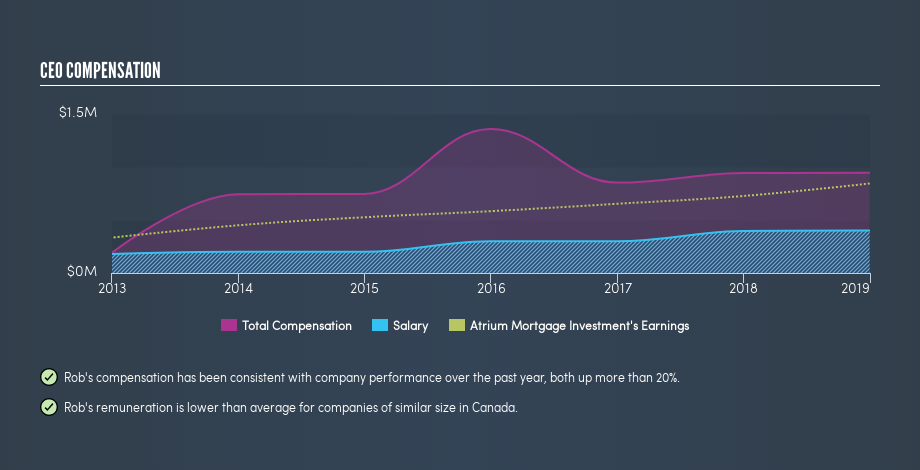

At the time of writing our data says that Atrium Mortgage Investment Corporation has a market cap of CA$533m, and is paying total annual CEO compensation of CA$945k. (This number is for the twelve months until December 2018). While this analysis focuses on total compensation, it's worth noting the salary is lower, valued at CA$400k. As part of our analysis we looked at companies in the same jurisdiction, with market capitalizations of CA$262m to CA$1.0b. The median total CEO compensation was CA$1.4m.

A first glance this seems like a real positive for shareholders, since Rob Goodall is paid less than the average total compensation paid by similar sized companies. Though positive, it's important we delve into the performance of the actual business.

You can see a visual representation of the CEO compensation at Atrium Mortgage Investment, below.

Is Atrium Mortgage Investment Corporation Growing?

Over the last three years, Atrium Mortgage Investment Corporation has not seen its earnings per share change much, though they have deteriorated slightly, according to a line of best fit. It achieved revenue growth of 17% over the last year.

The lack of earnings per share growth in the last three years is unimpressive. And while it's good to see some good revenue growth recently, the growth isn't really fast enough for me to put aside my concerns around earnings. These factors suggest that the business performance wouldn't really justify a high pay packet for the CEO.

Has Atrium Mortgage Investment Corporation Been A Good Investment?

Most shareholders would probably be pleased with Atrium Mortgage Investment Corporation for providing a total return of 37% over three years. As a result, some may believe the CEO should be paid more than is normal for companies of similar size.

In Summary...

It looks like Atrium Mortgage Investment Corporation pays its CEO less than similar sized companies.

It's well worth noting that while Rob Goodall is paid less than most company leaders (at similar sized companies), there isn't much EPS growth. Having said that, returns to shareholders have been great. We would like to see EPS growth, but in our view it seems the CEO is remunerated reasonably. Whatever your view on compensation, you might want to check if insiders are buying or selling Atrium Mortgage Investment shares (free trial).

Important note: Atrium Mortgage Investment may not be the best stock to buy. You might find something better in this list of interesting companies with high ROE and low debt.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About TSX:AI

Atrium Mortgage Investment

Provides financing solutions to the commercial real estate and development communities in Canada.

Good value with proven track record and pays a dividend.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Silver's Breakout to over $50US will make Magma’s future shine with drill sampling returning 115g/t Silver and 2.3 g/t Gold at its Peru Mine

SEGRO's Revenue to Rise 14.7% Amidst Optimistic Growth Plans

After the AI Party: A Sobering Look at Microsoft's Future

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026