- Brazil

- /

- Electric Utilities

- /

- BOVESPA:LIGT3

Industry Analysts Just Made A Notable Upgrade To Their Light S.A. (BVMF:LIGT3) Revenue Forecasts

Light S.A. (BVMF:LIGT3) shareholders will have a reason to smile today, with the analysts making substantial upgrades to this year's statutory forecasts. The consensus estimated revenue numbers rose, with their view now clearly much more bullish on the company's business prospects.

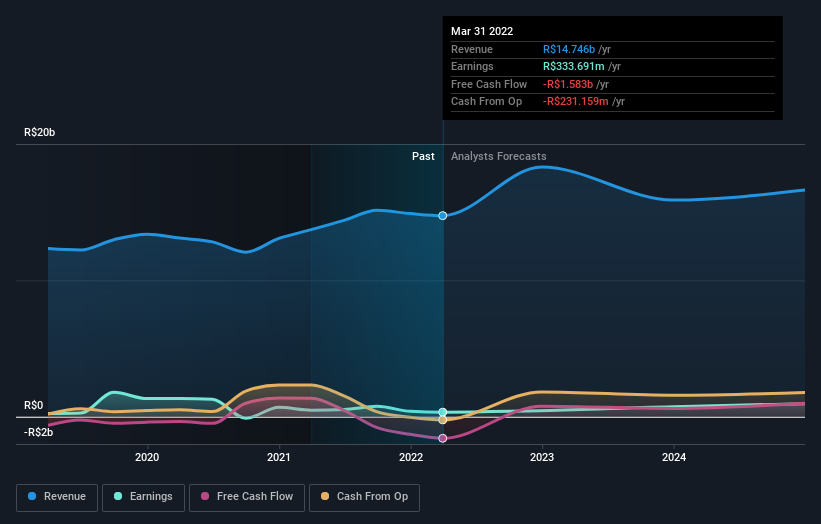

Following the upgrade, the most recent consensus for Light from its nine analysts is for revenues of R$18b in 2022 which, if met, would be a major 24% increase on its sales over the past 12 months. Statutory earnings per share are supposed to nosedive 97% to R$0.03 in the same period. Before this latest update, the analysts had been forecasting revenues of R$15b and earnings per share (EPS) of R$0.79 in 2022. Although sales sentiment looks to be improving, the analysts have made a pretty serious decline to per-share earnings estimates, showing a sharp increase in pessimism recently.

View our latest analysis for Light

Another way we can view these estimates is in the context of the bigger picture, such as how the forecasts stack up against past performance, and whether forecasts are more or less bullish relative to other companies in the industry. The analysts are definitely expecting Light's growth to accelerate, with the forecast 33% annualised growth to the end of 2022 ranking favourably alongside historical growth of 7.3% per annum over the past five years. By contrast, our data suggests that other companies (with analyst coverage) in the same industry are forecast to see their revenue shrink 0.3% per year. So it's clear with the acceleration in growth, Light is expected to grow meaningfully faster than the wider industry.

The Bottom Line

The biggest issue in the new estimates is that analysts have reduced their earnings per share estimates, suggesting business headwinds lay ahead for Light. Fortunately, they also upgraded their revenue estimates, and our data indicates sales are expected to perform better than the wider market. Given that analysts appear to be expecting substantial improvement in the sales pipeline, now could be the right time to take another look at Light.

Analysts are definitely bullish on Light, but no company is perfect. Indeed, you should know that there are several potential concerns to be aware of, including its declining profit margins. You can learn more, and discover the 4 other concerns we've identified, for free on our platform here.

Of course, seeing company management invest large sums of money in a stock can be just as useful as knowing whether analysts are upgrading their estimates. So you may also wish to search this free list of stocks that insiders are buying.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BOVESPA:LIGT3

Light

Engages in the generation, transmission, distribution, and sale of electric power in Brazil.

Undervalued with acceptable track record.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)