- Brazil

- /

- Electric Utilities

- /

- BOVESPA:EQTL3

Investing in Equatorial Energia (BVMF:EQTL3) five years ago would have delivered you a 139% gain

The most you can lose on any stock (assuming you don't use leverage) is 100% of your money. But when you pick a company that is really flourishing, you can make more than 100%. One great example is Equatorial Energia S.A. (BVMF:EQTL3) which saw its share price drive 117% higher over five years. We note the stock price is up 2.9% in the last seven days.

Let's take a look at the underlying fundamentals over the longer term, and see if they've been consistent with shareholders returns.

Check out our latest analysis for Equatorial Energia

SWOT Analysis for Equatorial Energia

- Debt is well covered by earnings.

- Earnings declined over the past year.

- Dividend is low compared to the top 25% of dividend payers in the Electric Utilities market.

- Expensive based on P/E ratio and estimated fair value.

- Shareholders have been diluted in the past year.

- Annual earnings are forecast to grow faster than the Brazilian market.

- Debt is not well covered by operating cash flow.

- Paying a dividend but company has no free cash flows.

- Revenue is forecast to grow slower than 20% per year.

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

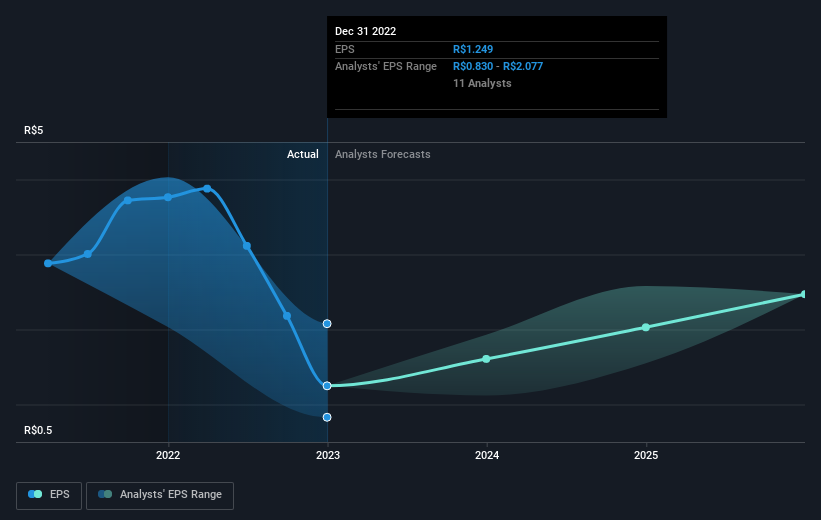

During five years of share price growth, Equatorial Energia achieved compound earnings per share (EPS) growth of 4.5% per year. This EPS growth is slower than the share price growth of 17% per year, over the same period. So it's fair to assume the market has a higher opinion of the business than it did five years ago. That's not necessarily surprising considering the five-year track record of earnings growth.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

Dive deeper into Equatorial Energia's key metrics by checking this interactive graph of Equatorial Energia's earnings, revenue and cash flow.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. In the case of Equatorial Energia, it has a TSR of 139% for the last 5 years. That exceeds its share price return that we previously mentioned. This is largely a result of its dividend payments!

A Different Perspective

We're pleased to report that Equatorial Energia shareholders have received a total shareholder return of 15% over one year. Of course, that includes the dividend. Having said that, the five-year TSR of 19% a year, is even better. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Even so, be aware that Equatorial Energia is showing 3 warning signs in our investment analysis , and 1 of those is a bit concerning...

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Brazilian exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Equatorial might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BOVESPA:EQTL3

Equatorial

Through its subsidiaries, engages in the electricity generation, distribution, and transmission operations in Brazil.

Proven track record second-rate dividend payer.

Market Insights

Community Narratives