- Brazil

- /

- Electric Utilities

- /

- BOVESPA:CPLE3

Those who invested in Companhia Paranaense de Energia - COPEL (BVMF:CPLE3) five years ago are up 233%

The most you can lose on any stock (assuming you don't use leverage) is 100% of your money. But on the bright side, you can make far more than 100% on a really good stock. Long term Companhia Paranaense de Energia - COPEL (BVMF:CPLE3) shareholders would be well aware of this, since the stock is up 110% in five years. On top of that, the share price is up 22% in about a quarter. But this could be related to the strong market, which is up 12% in the last three months.

Let's take a look at the underlying fundamentals over the longer term, and see if they've been consistent with shareholders returns.

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Companhia Paranaense de Energia - COPEL's earnings per share are down 9.9% per year, despite strong share price performance over five years.

This means it's unlikely the market is judging the company based on earnings growth. Since the change in EPS doesn't seem to correlate with the change in share price, it's worth taking a look at other metrics.

There's no sign of growing dividends, which might have explained the resilient share price. It could be that the revenue growth of 3.2% per year is viewed as evidence that Companhia Paranaense de Energia - COPEL is growing. Indeed, revenue growth, rather than EPS, might be the current focus of the business.

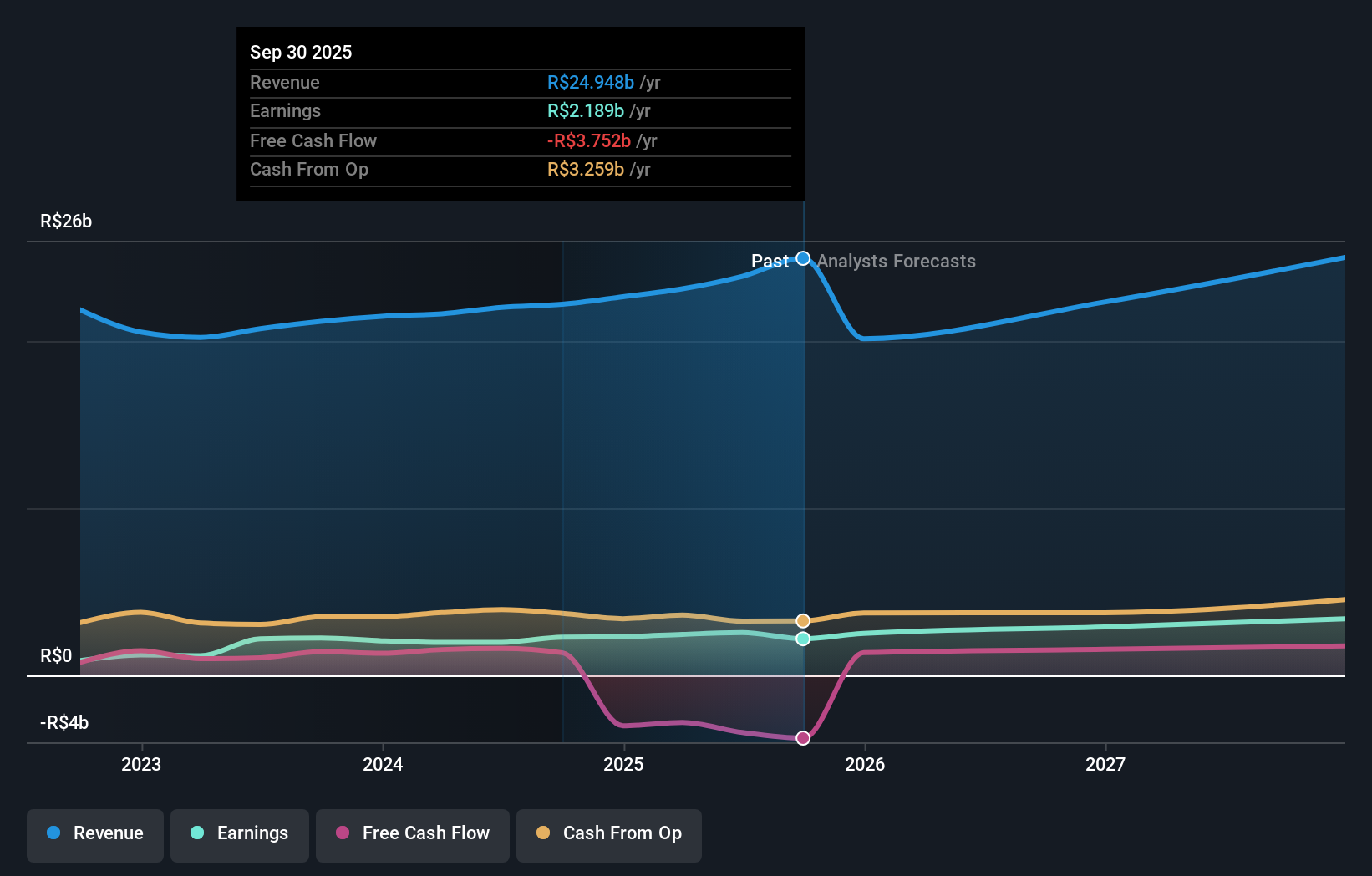

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

Companhia Paranaense de Energia - COPEL is well known by investors, and plenty of clever analysts have tried to predict the future profit levels. So it makes a lot of sense to check out what analysts think Companhia Paranaense de Energia - COPEL will earn in the future (free analyst consensus estimates)

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. In the case of Companhia Paranaense de Energia - COPEL, it has a TSR of 233% for the last 5 years. That exceeds its share price return that we previously mentioned. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

It's good to see that Companhia Paranaense de Energia - COPEL has rewarded shareholders with a total shareholder return of 72% in the last twelve months. That's including the dividend. Since the one-year TSR is better than the five-year TSR (the latter coming in at 27% per year), it would seem that the stock's performance has improved in recent times. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. It's always interesting to track share price performance over the longer term. But to understand Companhia Paranaense de Energia - COPEL better, we need to consider many other factors. Consider risks, for instance. Every company has them, and we've spotted 2 warning signs for Companhia Paranaense de Energia - COPEL you should know about.

Of course Companhia Paranaense de Energia - COPEL may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Brazilian exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BOVESPA:CPLE3

Companhia Paranaense de Energia - COPEL

Engages in the generation, transformation, distribution, and sale of electricity to industrial, residential, commercial, rural, and other customers in Brazil.

Limited growth with imperfect balance sheet.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026