- Brazil

- /

- Electric Utilities

- /

- BOVESPA:CPFE3

CPFL Energia S.A. Just Beat EPS By 7.7%: Here's What Analysts Think Will Happen Next

CPFL Energia S.A. (BVMF:CPFE3) defied analyst predictions to release its quarterly results, which were ahead of market expectations. The company beat expectations with revenues of R$11b arriving 6.0% ahead of forecasts. Statutory earnings per share (EPS) were R$0.98, 7.7% ahead of estimates. Following the result, the analysts have updated their earnings model, and it would be good to know whether they think there's been a strong change in the company's prospects, or if it's business as usual. So we gathered the latest post-earnings forecasts to see what estimates suggest is in store for next year.

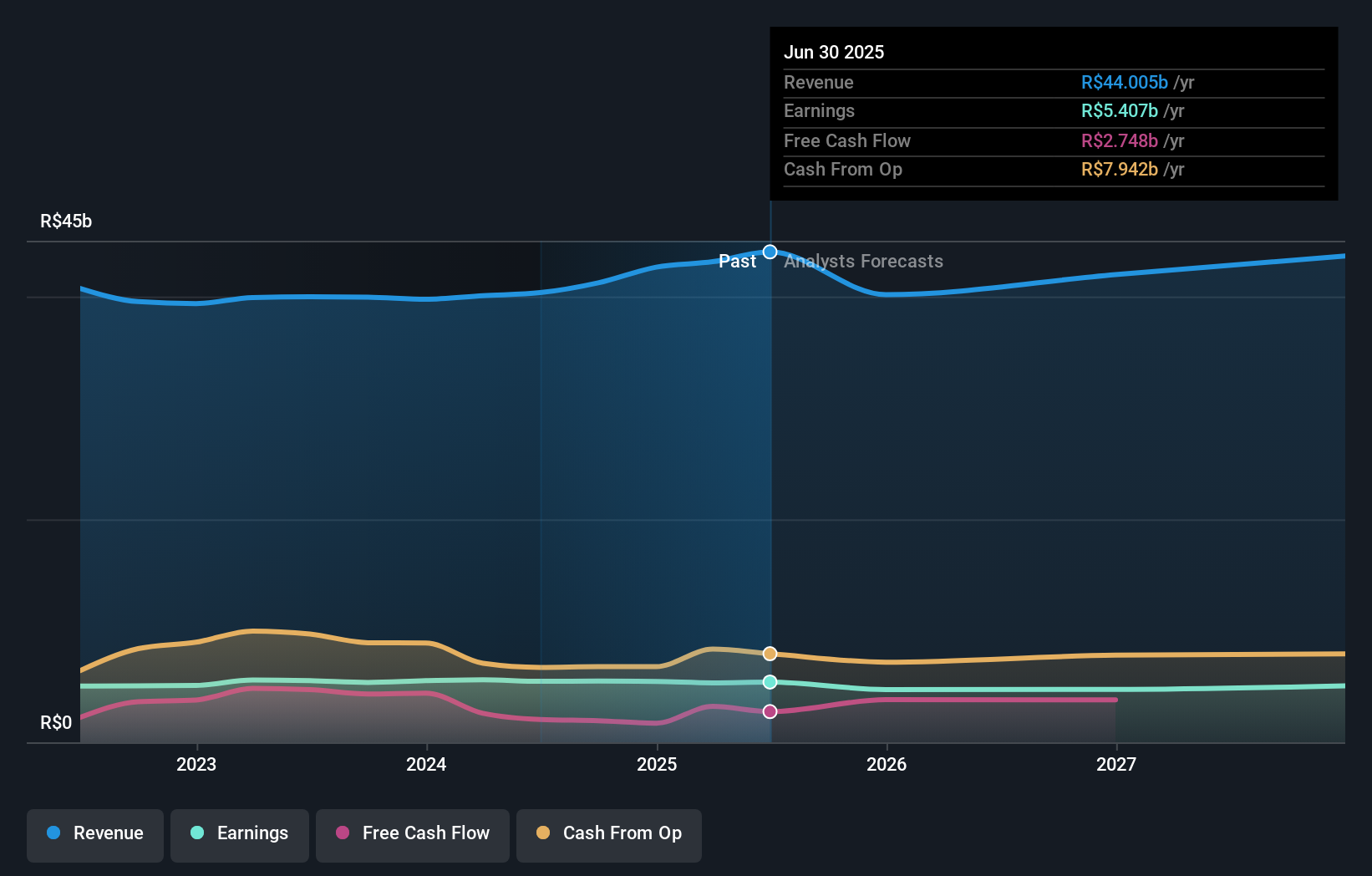

Following the recent earnings report, the consensus from eleven analysts covering CPFL Energia is for revenues of R$40.2b in 2025. This implies a chunky 8.7% decline in revenue compared to the last 12 months. Statutory earnings per share are forecast to sink 13% to R$4.10 in the same period. Yet prior to the latest earnings, the analysts had been anticipated revenues of R$39.6b and earnings per share (EPS) of R$4.01 in 2025. The analysts seems to have become more bullish on the business, judging by their new earnings per share estimates.

View our latest analysis for CPFL Energia

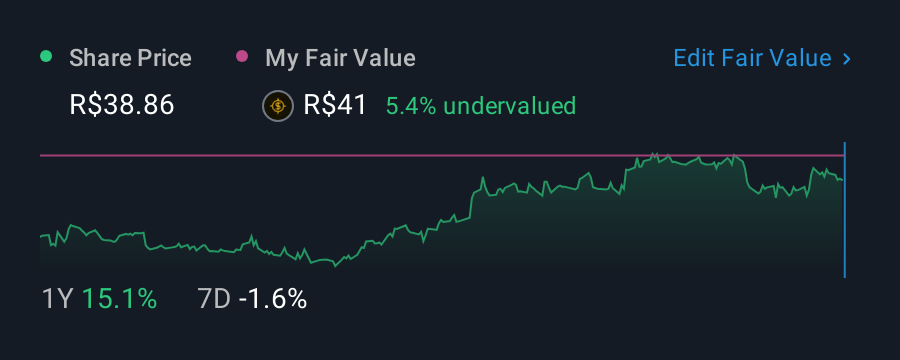

There's been no major changes to the consensus price target of R$41.00, suggesting that the improved earnings per share outlook is not enough to have a long-term positive impact on the stock's valuation. The consensus price target is just an average of individual analyst targets, so - it could be handy to see how wide the range of underlying estimates is. The most optimistic CPFL Energia analyst has a price target of R$45.90 per share, while the most pessimistic values it at R$35.60. Still, with such a tight range of estimates, it suggeststhe analysts have a pretty good idea of what they think the company is worth.

These estimates are interesting, but it can be useful to paint some more broad strokes when seeing how forecasts compare, both to the CPFL Energia's past performance and to peers in the same industry. These estimates imply that revenue is expected to slow, with a forecast annualised decline of 17% by the end of 2025. This indicates a significant reduction from annual growth of 6.4% over the last five years. By contrast, our data suggests that other companies (with analyst coverage) in the industry are forecast to see their revenue decline 1.8% annually for the foreseeable future. So it's pretty clear that CPFL Energia's revenues are expected to shrink faster than the wider industry.

The Bottom Line

The biggest takeaway for us is the consensus earnings per share upgrade, which suggests a clear improvement in sentiment around CPFL Energia's earnings potential next year. They also made no changes to their revenue estimates, implying the business is not expected to experience any major impacts to the current trajectory in the near term, even though it is expected to trail the wider industry. The consensus price target held steady at R$41.00, with the latest estimates not enough to have an impact on their price targets.

Following on from that line of thought, we think that the long-term prospects of the business are much more relevant than next year's earnings. We have estimates - from multiple CPFL Energia analysts - going out to 2027, and you can see them free on our platform here.

That said, it's still necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with CPFL Energia (at least 1 which can't be ignored) , and understanding these should be part of your investment process.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BOVESPA:CPFE3

CPFL Energia

Through its subsidiaries, operates as an energy company in Brazil.

Adequate balance sheet and fair value.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.