- Brazil

- /

- Renewable Energy

- /

- BOVESPA:AURE3

Risks To Shareholder Returns Are Elevated At These Prices For Auren Energia S.A. (BVMF:AURE3)

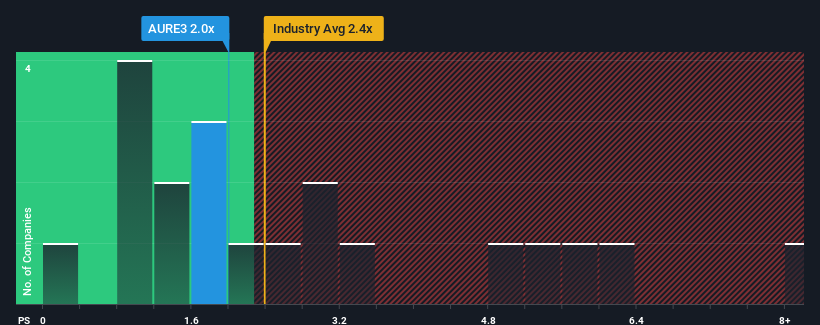

There wouldn't be many who think Auren Energia S.A.'s (BVMF:AURE3) price-to-sales (or "P/S") ratio of 2x is worth a mention when the median P/S for the Renewable Energy industry in Brazil is very similar. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Check out our latest analysis for Auren Energia

How Auren Energia Has Been Performing

Auren Energia's revenue growth of late has been pretty similar to most other companies. Perhaps the market is expecting future revenue performance to show no drastic signs of changing, justifying the P/S being at current levels. Those who are bullish on Auren Energia will be hoping that revenue performance can pick up, so that they can pick up the stock at a slightly lower valuation.

Keen to find out how analysts think Auren Energia's future stacks up against the industry? In that case, our free report is a great place to start.How Is Auren Energia's Revenue Growth Trending?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Auren Energia's to be considered reasonable.

Taking a look back first, we see that the company managed to grow revenues by a handy 6.6% last year. Pleasingly, revenue has also lifted 157% in aggregate from three years ago, partly thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing revenues over that time.

Shifting to the future, estimates from the eight analysts covering the company suggest revenue growth is heading into negative territory, declining 7.9% per annum over the next three years. That's not great when the rest of the industry is expected to grow by 29% per year.

In light of this, it's somewhat alarming that Auren Energia's P/S sits in line with the majority of other companies. Apparently many investors in the company reject the analyst cohort's pessimism and aren't willing to let go of their stock right now. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the negative growth outlook.

What We Can Learn From Auren Energia's P/S?

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

It appears that Auren Energia currently trades on a higher than expected P/S for a company whose revenues are forecast to decline. When we see a gloomy outlook like this, our immediate thoughts are that the share price is at risk of declining, negatively impacting P/S. If the poor revenue outlook tells us one thing, it's that these current price levels could be unsustainable.

Before you settle on your opinion, we've discovered 1 warning sign for Auren Energia that you should be aware of.

If you're unsure about the strength of Auren Energia's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BOVESPA:AURE3

Auren Energia

Engages in the investment platform for the management, operation, acquisition, development and construction of energy generation, transmission and trading assets in Brazil.

Good value with moderate growth potential.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Mastersystem Infotama will achieve 18.9% revenue growth as fair value hits IDR1,650

Insiders Sell, Investors Watch: What’s Going On at PG?

Waiting for the Inevitable

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026