- Brazil

- /

- Transportation

- /

- BOVESPA:VAMO3

Vamos Locação de Caminhões Máquinas e Equipamentos' (BVMF:VAMO3) Anemic Earnings Might Be Worse Than You Think

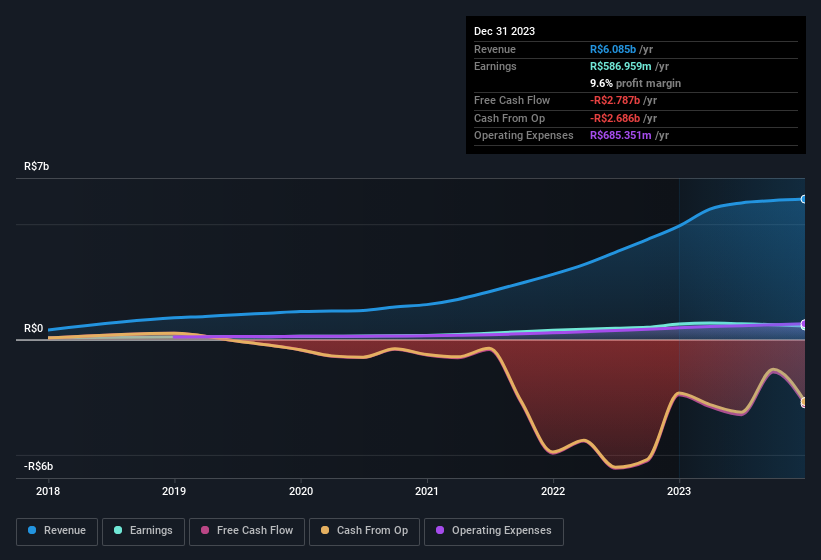

The subdued market reaction suggests that Vamos Locação de Caminhões, Máquinas e Equipamentos S.A.'s (BVMF:VAMO3) recent earnings didn't contain any surprises. Our analysis suggests that along with soft profit numbers, investors should be aware of some other underlying weaknesses in the numbers.

View our latest analysis for Vamos Locação de Caminhões Máquinas e Equipamentos

Examining Cashflow Against Vamos Locação de Caminhões Máquinas e Equipamentos' Earnings

In high finance, the key ratio used to measure how well a company converts reported profits into free cash flow (FCF) is the accrual ratio (from cashflow). To get the accrual ratio we first subtract FCF from profit for a period, and then divide that number by the average operating assets for the period. The ratio shows us how much a company's profit exceeds its FCF.

As a result, a negative accrual ratio is a positive for the company, and a positive accrual ratio is a negative. That is not intended to imply we should worry about a positive accrual ratio, but it's worth noting where the accrual ratio is rather high. To quote a 2014 paper by Lewellen and Resutek, "firms with higher accruals tend to be less profitable in the future".

For the year to December 2023, Vamos Locação de Caminhões Máquinas e Equipamentos had an accrual ratio of 0.28. We can therefore deduce that its free cash flow fell well short of covering its statutory profit, suggesting we might want to think twice before putting a lot of weight on the latter. In the last twelve months it actually had negative free cash flow, with an outflow of R$2.8b despite its profit of R$587.0m, mentioned above. Coming off the back of negative free cash flow last year, we imagine some shareholders might wonder if its cash burn of R$2.8b, this year, indicates high risk. Notably, the company has issued new shares, thus diluting existing shareholders and reducing their share of future earnings.

That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

One essential aspect of assessing earnings quality is to look at how much a company is diluting shareholders. In fact, Vamos Locação de Caminhões Máquinas e Equipamentos increased the number of shares on issue by 7.8% over the last twelve months by issuing new shares. Therefore, each share now receives a smaller portion of profit. Per share metrics like EPS help us understand how much actual shareholders are benefitting from the company's profits, while the net income level gives us a better view of the company's absolute size. Check out Vamos Locação de Caminhões Máquinas e Equipamentos' historical EPS growth by clicking on this link.

How Is Dilution Impacting Vamos Locação de Caminhões Máquinas e Equipamentos' Earnings Per Share (EPS)?

Vamos Locação de Caminhões Máquinas e Equipamentos has improved its profit over the last three years, with an annualized gain of 228% in that time. In comparison, earnings per share only gained 138% over the same period. Net profit actually dropped by 12% in the last year. Unfortunately for shareholders, though, the earnings per share result was even worse, declining 18%. And so, you can see quite clearly that dilution is influencing shareholder earnings.

If Vamos Locação de Caminhões Máquinas e Equipamentos' EPS can grow over time then that drastically improves the chances of the share price moving in the same direction. However, if its profit increases while its earnings per share stay flat (or even fall) then shareholders might not see much benefit. For the ordinary retail shareholder, EPS is a great measure to check your hypothetical "share" of the company's profit.

Our Take On Vamos Locação de Caminhões Máquinas e Equipamentos' Profit Performance

As it turns out, Vamos Locação de Caminhões Máquinas e Equipamentos couldn't match its profit with cashflow and its dilution means that shareholders own less of the company than the did before (unless they bought more shares). For the reasons mentioned above, we think that a perfunctory glance at Vamos Locação de Caminhões Máquinas e Equipamentos' statutory profits might make it look better than it really is on an underlying level. So while earnings quality is important, it's equally important to consider the risks facing Vamos Locação de Caminhões Máquinas e Equipamentos at this point in time. For example, we've found that Vamos Locação de Caminhões Máquinas e Equipamentos has 4 warning signs (3 are significant!) that deserve your attention before going any further with your analysis.

Our examination of Vamos Locação de Caminhões Máquinas e Equipamentos has focussed on certain factors that can make its earnings look better than they are. And, on that basis, we are somewhat skeptical. But there are plenty of other ways to inform your opinion of a company. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying to be useful.

If you're looking to trade Vamos Locação de Caminhões Máquinas e Equipamentos, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BOVESPA:VAMO3

Vamos Locação de Caminhões Máquinas e Equipamentos

Together with its subsidiaries engages in the leasing, reselling, and selling of trucks, machinery, and equipment in Brazil.

Undervalued with proven track record.

Market Insights

Community Narratives