- Brazil

- /

- Transportation

- /

- BOVESPA:VAMO3

Earnings Tell The Story For Vamos Locação de Caminhões, Máquinas e Equipamentos S.A. (BVMF:VAMO3)

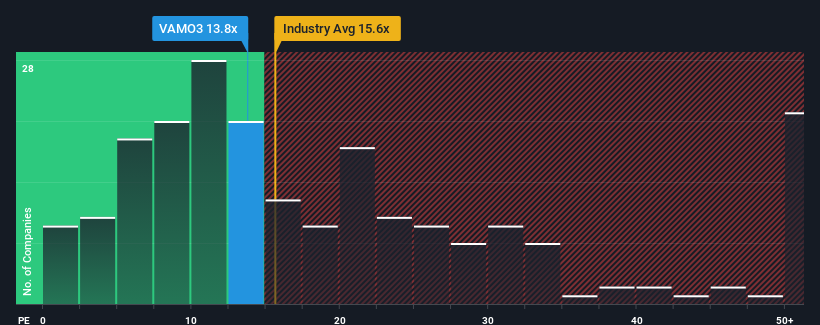

With a price-to-earnings (or "P/E") ratio of 13.8x Vamos Locação de Caminhões, Máquinas e Equipamentos S.A. (BVMF:VAMO3) may be sending bearish signals at the moment, given that almost half of all companies in Brazil have P/E ratios under 9x and even P/E's lower than 6x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's as high as it is.

While the market has experienced earnings growth lately, Vamos Locação de Caminhões Máquinas e Equipamentos' earnings have gone into reverse gear, which is not great. It might be that many expect the dour earnings performance to recover substantially, which has kept the P/E from collapsing. If not, then existing shareholders may be extremely nervous about the viability of the share price.

See our latest analysis for Vamos Locação de Caminhões Máquinas e Equipamentos

What Are Growth Metrics Telling Us About The High P/E?

In order to justify its P/E ratio, Vamos Locação de Caminhões Máquinas e Equipamentos would need to produce impressive growth in excess of the market.

Retrospectively, the last year delivered a frustrating 22% decrease to the company's bottom line. Still, the latest three year period has seen an excellent 98% overall rise in EPS, in spite of its unsatisfying short-term performance. Although it's been a bumpy ride, it's still fair to say the earnings growth recently has been more than adequate for the company.

Looking ahead now, EPS is anticipated to climb by 23% each year during the coming three years according to the eight analysts following the company. With the market only predicted to deliver 18% per annum, the company is positioned for a stronger earnings result.

With this information, we can see why Vamos Locação de Caminhões Máquinas e Equipamentos is trading at such a high P/E compared to the market. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Final Word

Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of Vamos Locação de Caminhões Máquinas e Equipamentos' analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. It's hard to see the share price falling strongly in the near future under these circumstances.

Plus, you should also learn about these 5 warning signs we've spotted with Vamos Locação de Caminhões Máquinas e Equipamentos (including 3 which make us uncomfortable).

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BOVESPA:VAMO3

Vamos Locação de Caminhões Máquinas e Equipamentos

Together with its subsidiaries engages in the leasing, reselling, and selling of trucks, machinery, and equipment in Brazil.

High growth potential slight.

Market Insights

Community Narratives