- Brazil

- /

- Marine and Shipping

- /

- BOVESPA:LOGN3

Log-In Logística Intermodal S.A.'s (BVMF:LOGN3) 29% Cheaper Price Remains In Tune With Revenues

The Log-In Logística Intermodal S.A. (BVMF:LOGN3) share price has fared very poorly over the last month, falling by a substantial 29%. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 34% in that time.

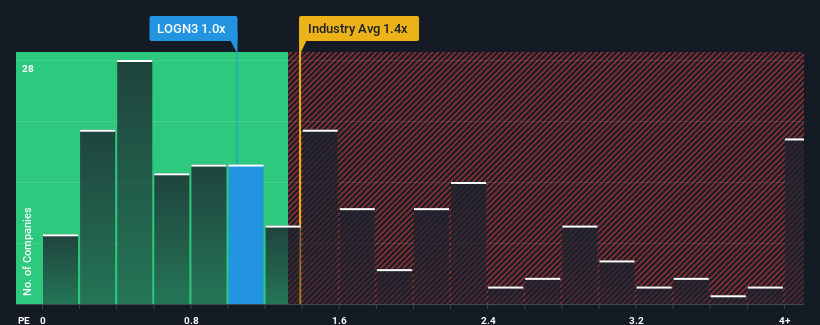

Although its price has dipped substantially, you could still be forgiven for feeling indifferent about Log-In Logística Intermodal's P/S ratio of 1x, since the median price-to-sales (or "P/S") ratio for the Shipping industry in Brazil is also close to 1.5x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

See our latest analysis for Log-In Logística Intermodal

What Does Log-In Logística Intermodal's Recent Performance Look Like?

Log-In Logística Intermodal could be doing better as it's been growing revenue less than most other companies lately. Perhaps the market is expecting future revenue performance to lift, which has kept the P/S from declining. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

Keen to find out how analysts think Log-In Logística Intermodal's future stacks up against the industry? In that case, our free report is a great place to start.How Is Log-In Logística Intermodal's Revenue Growth Trending?

The only time you'd be comfortable seeing a P/S like Log-In Logística Intermodal's is when the company's growth is tracking the industry closely.

Retrospectively, the last year delivered an exceptional 16% gain to the company's top line. The strong recent performance means it was also able to grow revenue by 99% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Looking ahead now, revenue is anticipated to climb by 7.9% during the coming year according to the only analyst following the company. With the industry predicted to deliver 7.1% growth , the company is positioned for a comparable revenue result.

With this information, we can see why Log-In Logística Intermodal is trading at a fairly similar P/S to the industry. Apparently shareholders are comfortable to simply hold on while the company is keeping a low profile.

What We Can Learn From Log-In Logística Intermodal's P/S?

Log-In Logística Intermodal's plummeting stock price has brought its P/S back to a similar region as the rest of the industry. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've seen that Log-In Logística Intermodal maintains an adequate P/S seeing as its revenue growth figures match the rest of the industry. Right now shareholders are comfortable with the P/S as they are quite confident future revenue won't throw up any surprises. Unless these conditions change, they will continue to support the share price at these levels.

We don't want to rain on the parade too much, but we did also find 4 warning signs for Log-In Logística Intermodal (1 is potentially serious!) that you need to be mindful of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BOVESPA:LOGN3

Log-In Logística Intermodal

Log-in Logística Intermodal S.A. engages in the provision of integrated logistics solutions for moving and transporting door-to-door containers and cargo in Brazil, Austria, and internationally.

Acceptable track record with mediocre balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.