- Brazil

- /

- Marine and Shipping

- /

- BOVESPA:HBSA3

Hidrovias do Brasil S.A. (BVMF:HBSA3) Might Not Be As Mispriced As It Looks After Plunging 29%

To the annoyance of some shareholders, Hidrovias do Brasil S.A. (BVMF:HBSA3) shares are down a considerable 29% in the last month, which continues a horrid run for the company. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 46% share price drop.

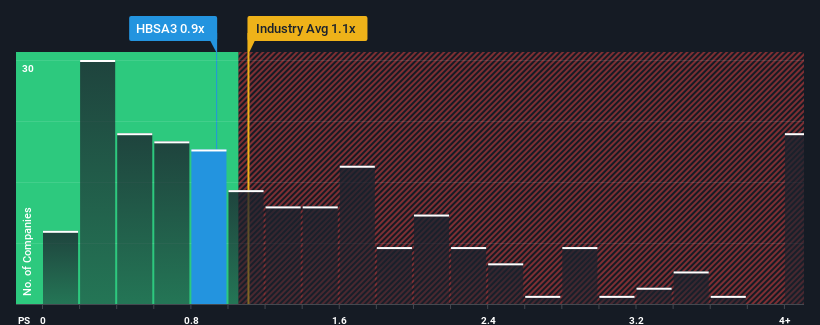

In spite of the heavy fall in price, you could still be forgiven for feeling indifferent about Hidrovias do Brasil's P/S ratio of 0.9x, since the median price-to-sales (or "P/S") ratio for the Shipping industry in Brazil is about the same. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

Check out our latest analysis for Hidrovias do Brasil

How Hidrovias do Brasil Has Been Performing

Hidrovias do Brasil could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. One possibility is that the P/S ratio is moderate because investors think this poor revenue performance will turn around. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Hidrovias do Brasil.Is There Some Revenue Growth Forecasted For Hidrovias do Brasil?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Hidrovias do Brasil's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 18% decrease to the company's top line. That put a dampener on the good run it was having over the longer-term as its three-year revenue growth is still a noteworthy 28% in total. So we can start by confirming that the company has generally done a good job of growing revenue over that time, even though it had some hiccups along the way.

Looking ahead now, revenue is anticipated to remain buoyant, climbing by 27% during the coming year according to the five analysts following the company. That would be an excellent outcome when the industry is expected to decline by 0.1%.

With this information, we find it odd that Hidrovias do Brasil is trading at a fairly similar P/S to the industry. Apparently some shareholders are skeptical of the contrarian forecasts and have been accepting lower selling prices.

What We Can Learn From Hidrovias do Brasil's P/S?

With its share price dropping off a cliff, the P/S for Hidrovias do Brasil looks to be in line with the rest of the Shipping industry. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've established that Hidrovias do Brasil currently trades on a lower than expected P/S since its growth forecasts are potentially beating a struggling industry. There could be some unobserved threats to revenue preventing the P/S ratio from matching the positive outlook. Perhaps there is some hesitation about the company's ability to keep swimming against the current of the broader industry turmoil. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

Having said that, be aware Hidrovias do Brasil is showing 1 warning sign in our investment analysis, you should know about.

If these risks are making you reconsider your opinion on Hidrovias do Brasil, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Hidrovias do Brasil might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BOVESPA:HBSA3

Hidrovias do Brasil

An integrated logistics solutions company in Brazil and internationally.

High growth potential and slightly overvalued.

Market Insights

Community Narratives