David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We can see that CCR S.A. (BVMF:CCRO3) does use debt in its business. But should shareholders be worried about its use of debt?

When Is Debt Dangerous?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. The first step when considering a company's debt levels is to consider its cash and debt together.

Check out our latest analysis for CCR

What Is CCR's Net Debt?

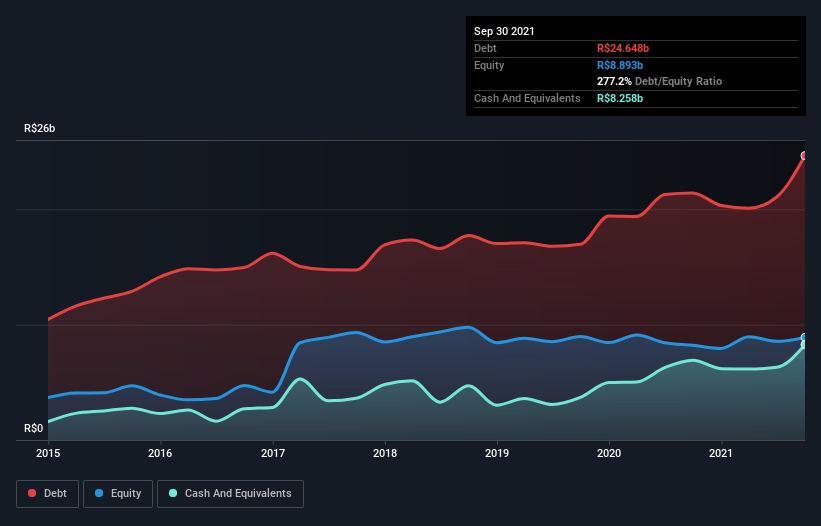

You can click the graphic below for the historical numbers, but it shows that as of September 2021 CCR had R$24.6b of debt, an increase on R$21.4b, over one year. On the flip side, it has R$8.26b in cash leading to net debt of about R$16.4b.

How Strong Is CCR's Balance Sheet?

According to the last reported balance sheet, CCR had liabilities of R$6.71b due within 12 months, and liabilities of R$23.8b due beyond 12 months. Offsetting this, it had R$8.26b in cash and R$1.61b in receivables that were due within 12 months. So its liabilities total R$20.7b more than the combination of its cash and short-term receivables.

This is a mountain of leverage relative to its market capitalization of R$24.3b. This suggests shareholders would be heavily diluted if the company needed to shore up its balance sheet in a hurry.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

CCR has net debt worth 2.4 times EBITDA, which isn't too much, but its interest cover looks a bit on the low side, with EBIT at only 4.5 times the interest expense. While that doesn't worry us too much, it does suggest the interest payments are somewhat of a burden. It is well worth noting that CCR's EBIT shot up like bamboo after rain, gaining 49% in the last twelve months. That'll make it easier to manage its debt. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately the future profitability of the business will decide if CCR can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. During the last three years, CCR produced sturdy free cash flow equating to 69% of its EBIT, about what we'd expect. This cold hard cash means it can reduce its debt when it wants to.

Our View

When it comes to the balance sheet, the standout positive for CCR was the fact that it seems able to grow its EBIT confidently. But the other factors we noted above weren't so encouraging. For instance it seems like it has to struggle a bit to handle its total liabilities. It's also worth noting that CCR is in the Infrastructure industry, which is often considered to be quite defensive. When we consider all the elements mentioned above, it seems to us that CCR is managing its debt quite well. Having said that, the load is sufficiently heavy that we would recommend any shareholders keep a close eye on it. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. These risks can be hard to spot. Every company has them, and we've spotted 3 warning signs for CCR (of which 1 is a bit unpleasant!) you should know about.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About BOVESPA:MOTV3

Motiva Infraestrutura de Mobilidade

Provides infrastructure services for highway, rail, and airport concessions in Brazil.

Fair value with moderate growth potential.

Market Insights

Community Narratives