- Brazil

- /

- Tech Hardware

- /

- BOVESPA:POSI3

Should You Be Adding Positivo Tecnologia (BVMF:POSI3) To Your Watchlist Today?

Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.'

In the age of tech-stock blue-sky investing, my choice may seem old fashioned; I still prefer profitable companies like Positivo Tecnologia (BVMF:POSI3). While that doesn't make the shares worth buying at any price, you can't deny that successful capitalism requires profit, eventually. Conversely, a loss-making company is yet to prove itself with profit, and eventually the sweet milk of external capital may run sour.

See our latest analysis for Positivo Tecnologia

How Fast Is Positivo Tecnologia Growing Its Earnings Per Share?

In a capitalist society capital chases profits, and that means share prices tend rise with earnings per share (EPS). So like a ray of sunshine through a gap in the clouds, improving EPS is considered a good sign. You can imagine, then, that it almost knocked my socks off when I realized that Positivo Tecnologia grew its EPS from R$0.11 to R$0.39, in one short year. Even though that growth rate is unlikely to be repeated, that looks like a breakout improvement.

I like to see top-line growth as an indication that growth is sustainable, and I look for a high earnings before interest and taxation (EBIT) margin to point to a competitive moat (though some companies with low margins also have moats). Positivo Tecnologia's EBIT margins have fallen over the last twelve months, but the flat revenue sends a message of stability. That doesn't inspire a great deal of confidence.

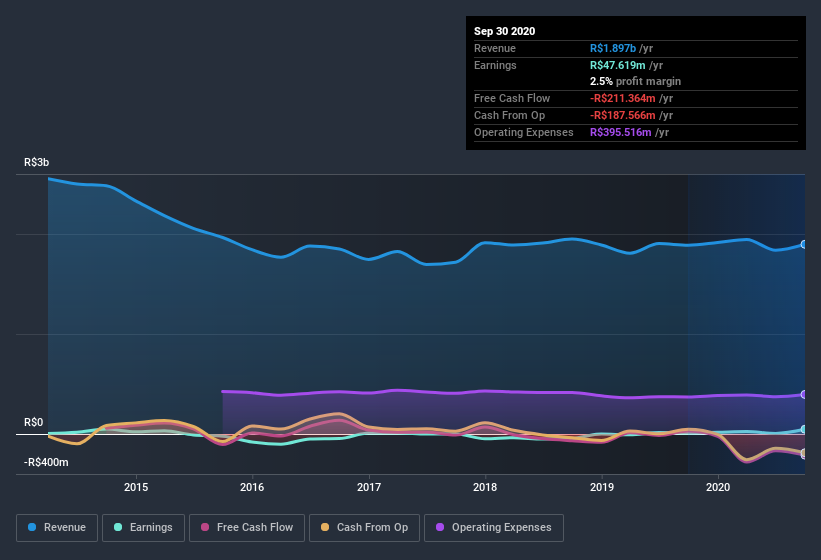

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

Positivo Tecnologia isn't a huge company, given its market capitalization of R$625m. That makes it extra important to check on its balance sheet strength.

Are Positivo Tecnologia Insiders Aligned With All Shareholders?

Personally, I like to see high insider ownership of a company, since it suggests that it will be managed in the interests of shareholders. So as you can imagine, the fact that Positivo Tecnologia insiders own a significant number of shares certainly appeals to me. Actually, with 44% of the company to their names, insiders are profoundly invested in the business. I'm reassured by this kind of alignment, as it suggests the business will be run for the benefit of shareholders. In terms of absolute value, insiders have R$276m invested in the business, using the current share price. That's nothing to sneeze at!

Should You Add Positivo Tecnologia To Your Watchlist?

Positivo Tecnologia's earnings have taken off like any random crypto-currency did, back in 2017. That EPS growth certainly has my attention, and the large insider ownership only serves to further stoke my interest. The hope is, of course, that the strong growth marks a fundamental improvement in the business economics. So yes, on this short analysis I do think it's worth considering Positivo Tecnologia for a spot on your watchlist. Before you take the next step you should know about the 3 warning signs for Positivo Tecnologia that we have uncovered.

Although Positivo Tecnologia certainly looks good to me, I would like it more if insiders were buying up shares. If you like to see insider buying, too, then this free list of growing companies that insiders are buying, could be exactly what you're looking for.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you’re looking to trade Positivo Tecnologia, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About BOVESPA:POSI3

Positivo Tecnologia

Engages in the development, trading, and industrialization of information technology (IT) solutions in Brazil and internationally.

Good value with adequate balance sheet and pays a dividend.