Shareholders in Locaweb Serviços de Internet (BVMF:LWSA3) have lost 54%, as stock drops 9.0% this past week

The nature of investing is that you win some, and you lose some. And there's no doubt that Locaweb Serviços de Internet S.A. (BVMF:LWSA3) stock has had a really bad year. The share price has slid 54% in that time. On the bright side, the stock is actually up 29% in the last three years. The falls have accelerated recently, with the share price down 34% in the last three months. This could be related to the recent financial results - you can catch up on the most recent data by reading our company report.

If the past week is anything to go by, investor sentiment for Locaweb Serviços de Internet isn't positive, so let's see if there's a mismatch between fundamentals and the share price.

See our latest analysis for Locaweb Serviços de Internet

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

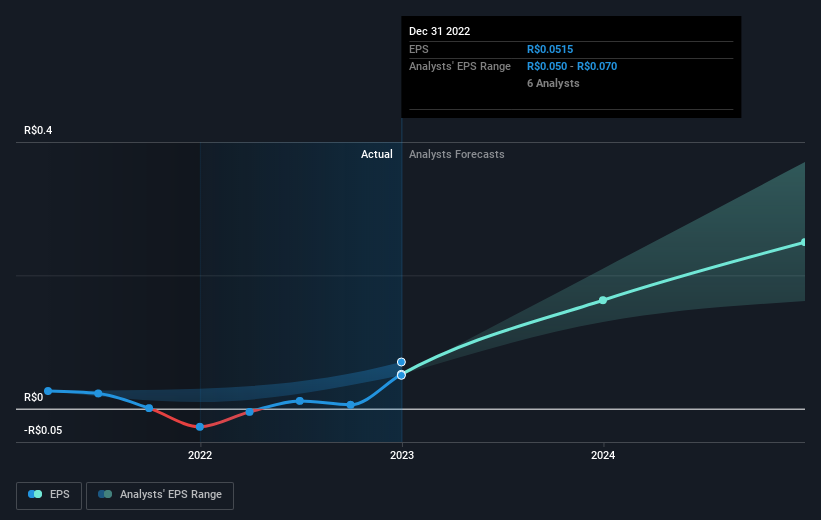

During the last year Locaweb Serviços de Internet grew its earnings per share, moving from a loss to a profit.

It's good to see it turn a profit, but we note it was reasonably close to profitability last year. A glance at the share price action tells us it has fallen well short of expectations. Sentiment seems negative, despite the newfound profitability - so contrarians may want to take a look at the stock.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

We know that Locaweb Serviços de Internet has improved its bottom line lately, but is it going to grow revenue? If you're interested, you could check this free report showing consensus revenue forecasts.

A Different Perspective

The last twelve months weren't great for Locaweb Serviços de Internet shares, which performed worse than the market, costing holders 54%, including dividends. The market shed around 16%, no doubt weighing on the stock price. Fortunately the longer term story is brighter, with total returns averaging about 9% per year over three years. Sometimes when a good quality long term winner has a weak period, it's turns out to be an opportunity, but you really need to be sure that the quality is there. It's always interesting to track share price performance over the longer term. But to understand Locaweb Serviços de Internet better, we need to consider many other factors. To that end, you should be aware of the 2 warning signs we've spotted with Locaweb Serviços de Internet .

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Brazilian exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BOVESPA:LWSA3

Locaweb Serviços de Internet

Offers hosting, software licensing, and technical support services in Brazil.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives