Revenues Tell The Story For Locaweb Serviços de Internet S.A. (BVMF:LWSA3) As Its Stock Soars 27%

Locaweb Serviços de Internet S.A. (BVMF:LWSA3) shares have had a really impressive month, gaining 27% after a shaky period beforehand. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 28% in the last twelve months.

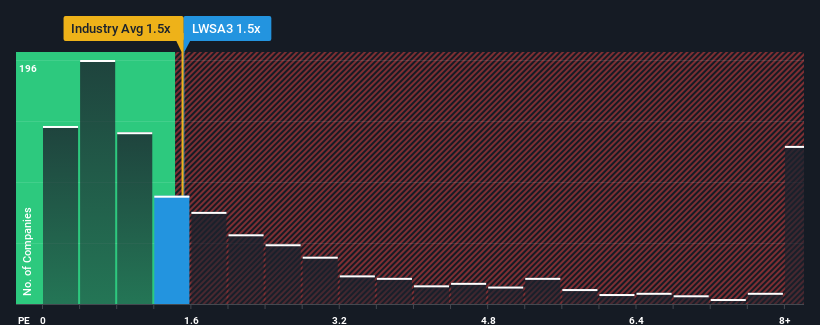

In spite of the firm bounce in price, it's still not a stretch to say that Locaweb Serviços de Internet's price-to-sales (or "P/S") ratio of 1.5x right now seems quite "middle-of-the-road" compared to the IT industry in Brazil, seeing as it matches the P/S ratio of the wider industry. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

See our latest analysis for Locaweb Serviços de Internet

How Locaweb Serviços de Internet Has Been Performing

Recent times haven't been great for Locaweb Serviços de Internet as its revenue has been rising slower than most other companies. It might be that many expect the uninspiring revenue performance to strengthen positively, which has kept the P/S ratio from falling. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Locaweb Serviços de Internet.How Is Locaweb Serviços de Internet's Revenue Growth Trending?

Locaweb Serviços de Internet's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Retrospectively, the last year delivered a decent 6.0% gain to the company's revenues. The latest three year period has also seen an excellent 71% overall rise in revenue, aided somewhat by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Shifting to the future, estimates from the six analysts covering the company suggest revenue should grow by 9.7% each year over the next three years. Meanwhile, the rest of the industry is forecast to expand by 9.7% each year, which is not materially different.

In light of this, it's understandable that Locaweb Serviços de Internet's P/S sits in line with the majority of other companies. Apparently shareholders are comfortable to simply hold on while the company is keeping a low profile.

The Key Takeaway

Locaweb Serviços de Internet's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our look at Locaweb Serviços de Internet's revenue growth estimates show that its P/S is about what we expect, as both metrics follow closely with the industry averages. Right now shareholders are comfortable with the P/S as they are quite confident future revenue won't throw up any surprises. Unless these conditions change, they will continue to support the share price at these levels.

Plus, you should also learn about these 2 warning signs we've spotted with Locaweb Serviços de Internet.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BOVESPA:LWSA3

Locaweb Serviços de Internet

Offers hosting, software licensing, and technical support services in Brazil.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

CEO: We are winners in the long term in the AI world

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.