- Brazil

- /

- Specialty Stores

- /

- BOVESPA:LREN3

Lojas Renner (BVMF:LREN3) Could Be Struggling To Allocate Capital

What trends should we look for it we want to identify stocks that can multiply in value over the long term? Firstly, we'll want to see a proven return on capital employed (ROCE) that is increasing, and secondly, an expanding base of capital employed. Ultimately, this demonstrates that it's a business that is reinvesting profits at increasing rates of return. In light of that, when we looked at Lojas Renner (BVMF:LREN3) and its ROCE trend, we weren't exactly thrilled.

What Is Return On Capital Employed (ROCE)?

For those that aren't sure what ROCE is, it measures the amount of pre-tax profits a company can generate from the capital employed in its business. The formula for this calculation on Lojas Renner is:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

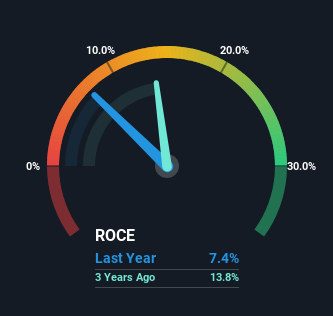

0.074 = R$964m ÷ (R$20b - R$6.9b) (Based on the trailing twelve months to September 2023).

So, Lojas Renner has an ROCE of 7.4%. In absolute terms, that's a low return but it's around the Specialty Retail industry average of 8.7%.

View our latest analysis for Lojas Renner

In the above chart we have measured Lojas Renner's prior ROCE against its prior performance, but the future is arguably more important. If you'd like to see what analysts are forecasting going forward, you should check out our free report for Lojas Renner.

What Does the ROCE Trend For Lojas Renner Tell Us?

In terms of Lojas Renner's historical ROCE movements, the trend isn't fantastic. Over the last five years, returns on capital have decreased to 7.4% from 30% five years ago. On the other hand, the company has been employing more capital without a corresponding improvement in sales in the last year, which could suggest these investments are longer term plays. It may take some time before the company starts to see any change in earnings from these investments.

Our Take On Lojas Renner's ROCE

Bringing it all together, while we're somewhat encouraged by Lojas Renner's reinvestment in its own business, we're aware that returns are shrinking. And investors appear hesitant that the trends will pick up because the stock has fallen 44% in the last five years. In any case, the stock doesn't have these traits of a multi-bagger discussed above, so if that's what you're looking for, we think you'd have more luck elsewhere.

If you'd like to know about the risks facing Lojas Renner, we've discovered 1 warning sign that you should be aware of.

While Lojas Renner may not currently earn the highest returns, we've compiled a list of companies that currently earn more than 25% return on equity. Check out this free list here.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BOVESPA:LREN3

Lojas Renner

Operates as a fashion and lifestyle company in Brazil, Argentina, and Uruguay.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives